Sales Invoice

After the sales order is created sales invoice are generated against the sales orders. Payment term discounts are applied for the selected customers. Invoices are printed in batches with the start and end number mentioned. Customer returns are followed by a credit memo for future proceedings.

Generate Invoice from Order

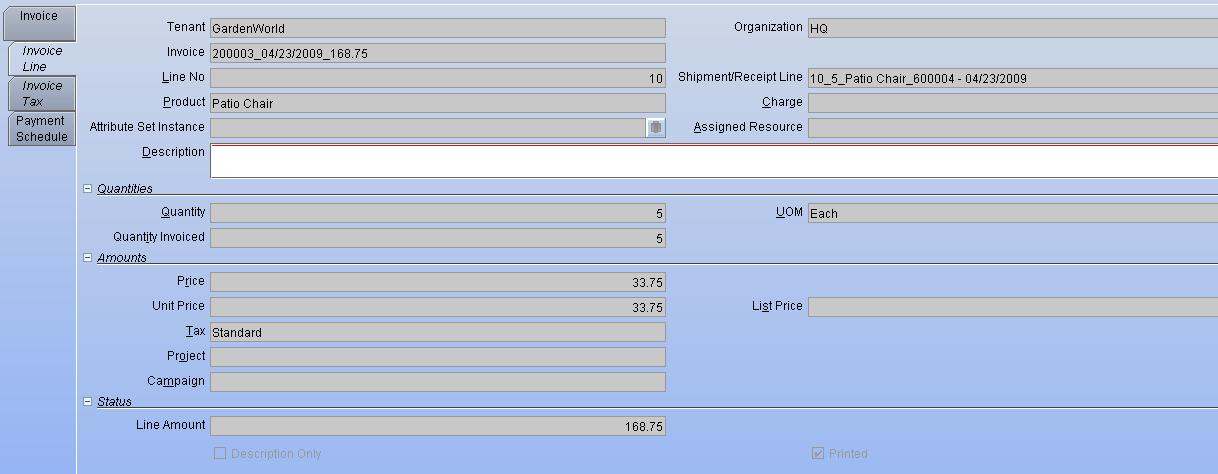

Customer Invoices are generated from Sales Order through the batch. One invoice will be created per Order. Maximum lines per invoice are 16. If the invoice line exceeds 16, then remaining lines will be created as new invoice with the same Order reference.

Business Rules:

- One Invoice Per Order.

- One invoice can accommodate a maximum of 16 lines.

- If an invoice exceeds 16 lines, then the remaining lines will be created as a new invoice with the same order reference.

- Tax will be created by default based on the tax code of the line.

- Tax screen will be a read-only screen.

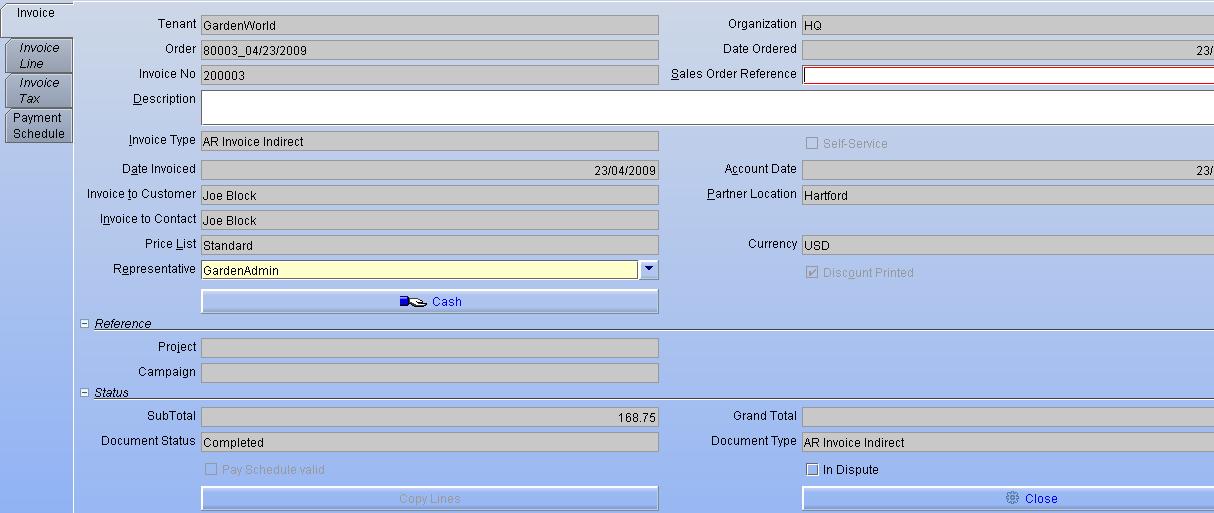

Invoice (Customer)

Customer Invoices are managed for each Sales Orders. Users can edit invoice till it is processed. Invoices can be voided, closed and reversed based on the business needs.

Business Rules:

- Invoice can be edited until it is processed.

- Invoice can be voided, closed and reversed if required.

- The currency will be VND.

- Payment term discount should be allowed one day ahead from the configured days. But Invoice should print the actual payment term.

- Price list zoom should be disabled.

- Tax zoom should be disabled.

UI /Report Layout

Invoice Header

Invoice Line

Invoice Tax

Apply Payment Term Discount

Payment Term discounts are applied in invoices based on the Payment Term chosen for the invoice. After the invoice is processed the payment term discounts can be seen from the related reports like Aging Report, Open Orders.

Business Rules:

- Payment term discounts are applied in invoices only for the General Trade Customers (This will be configured in the Price list and based on the price list, discount will be applied).

- For customers other than GT payment term discounts are availed in payment.

Invoice Tax

Invoice Taxes are applied based on the SKU available in the Invoice Line. Only VAT is applicable for 3A.

Business Rules:

- Invoice Print Template should have the taxes preconfigured as (0%, 5%, and 10%).

- Tax screen will be a Read Only screen.

UI /Report Layout

Process Invoice

The invoice is processed after it is reviewed. Once the invoice is processed, it is available for payment allocation.

Invoice Payment Schedule

Maintain Invoice Payment Schedule and maintain Payment Schedule of unpaid invoices

Select Invoice Select from invoices not fully paid.

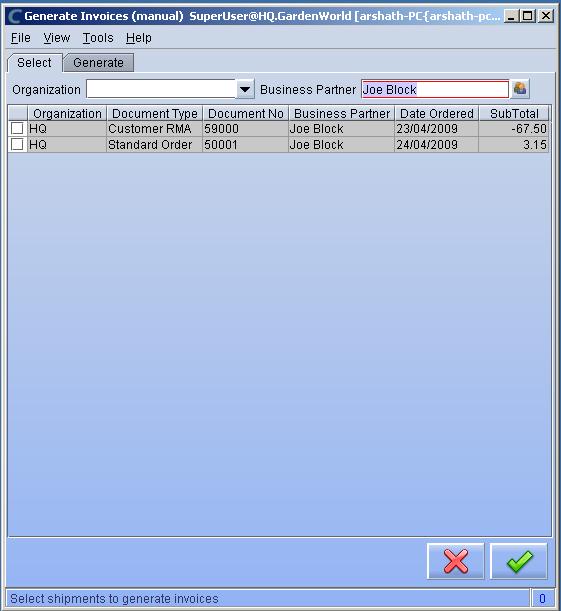

Generate Invoices

Invoices for open Orders are created based on the invoicing rule of the Order. If several Orders of a business partner have the same bill location, the orders can be consolidated into one Invoice.

Print Invoices

(Re)Print Invoices or send them as PDF attachments to the Business Partner Contact with a valid Email address.

Remark: If you only enter a Document No FROM value, all invoices greater or equal that document number are printed; you can alternatively use the % character as a wildcard.

Invoice document should be printed in batches with the sequence number mentioned. The log should be mentioned for the sequence printed. There should be a provision to mention the start number and end number to print the sequence.

Business Rules :

- There should be provisioned to mention the start number and end number to print the sequence.

- User will confirm once the printing is done.

- System will store the printing sequence number for the respective invoices.

- If there is any error during printing, user can again give the start date end date and can print the invoices.

- Print confirmed invoices will not be displayed again in the print batch screen.

- If any of the print confirmed invoices needs to be printed again, the user can manually open the invoice and print that.