Odoo Payroll

For generating Payroll, each employee should be defined with contracts with salary structure. This contract will define the Basic Pay, Working Schedules, duration and other related details. The salary structure is the record of set of rules.

It includes with one or more salary rules which helps to calculate salary during payroll generation process. Odoo Payroll management supports to generate pay slip individually or employee category wise or as employees batches. Mass creation of Pay slip for group of employees can be achieved in this way.

The Following are the list of Payroll Feature available in Odoo

- Supports payroll processing for companies operating in different countries

- Configure to show the Payslip PDF Display

- View and Manage all active employee contracts in one place

- Notify Contract Expiration & Work Permit Notice Period

- Easily view and manage all job offers in a structured list

- Part-Time Employee contract Support

- Automatic work entries created based on salary structure

- Visual overview of all employee work entries for easy monitoring

- Easily create new work entries for missing time or absences

- Identify and fix work entry issues before payroll with clear alerts on the dashboard

- Easily generate payslips through work entries

- Access individual payslips through work entries easily via the Payslips button

- Defer Individual or Multiple time off entries

- Create and Manage Salary Attachments

- Organized views for easy access and management of all payslips (To Pay, All Payslips, Batches)

- Track each payslip’s stage – Draft, Waiting, Done, Paid

- Worked Days and salary computation Auto-calculated based on attendance, contract, and structure

- Create and confirm payslips in batches by department

- Register payments and generate payment reports directly from batches

- Generate separate warrant payslips for bonuses or commissions

- Easily set up and manage customizable salary rules and structures for accurate payroll processing

- Multiple reports are available for tracking, including Payroll Report, Work Entry Analysis Report, and Salary Attachment Report

- Country-specific reports are listed, covering local tax laws and benefit details

Key Benefits

- Automates payroll calculations and salary processing

- Supports batch payslip generation and payment processing

- Simplifies contract and salary structure management

Payroll Management Workflow

Odoo Payroll Master Management

Following are the list of masters which support for Payroll process

- Contract Templates

- Employment Types

- Work Entry Types

- Working Schedules

- Salary Structure Types

- Salary Structures

- Salary Rules

- Salary Rule Parameters

- Salary Rule Categories

- Payslip Other Input Types

- Benefits

- Job Position

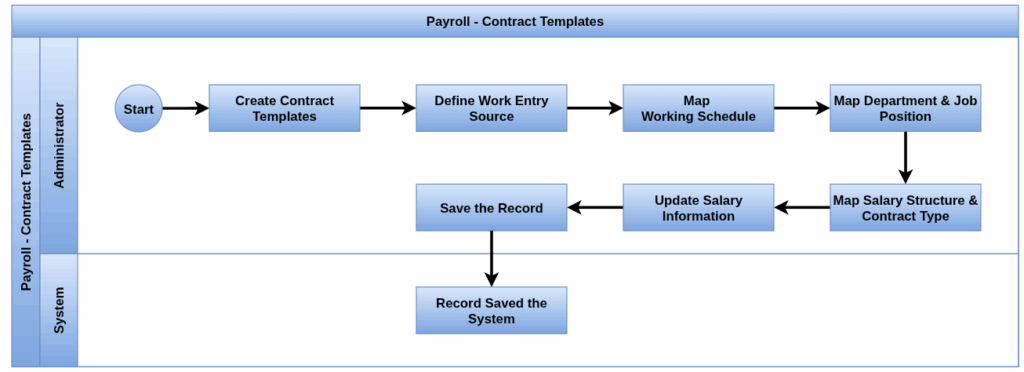

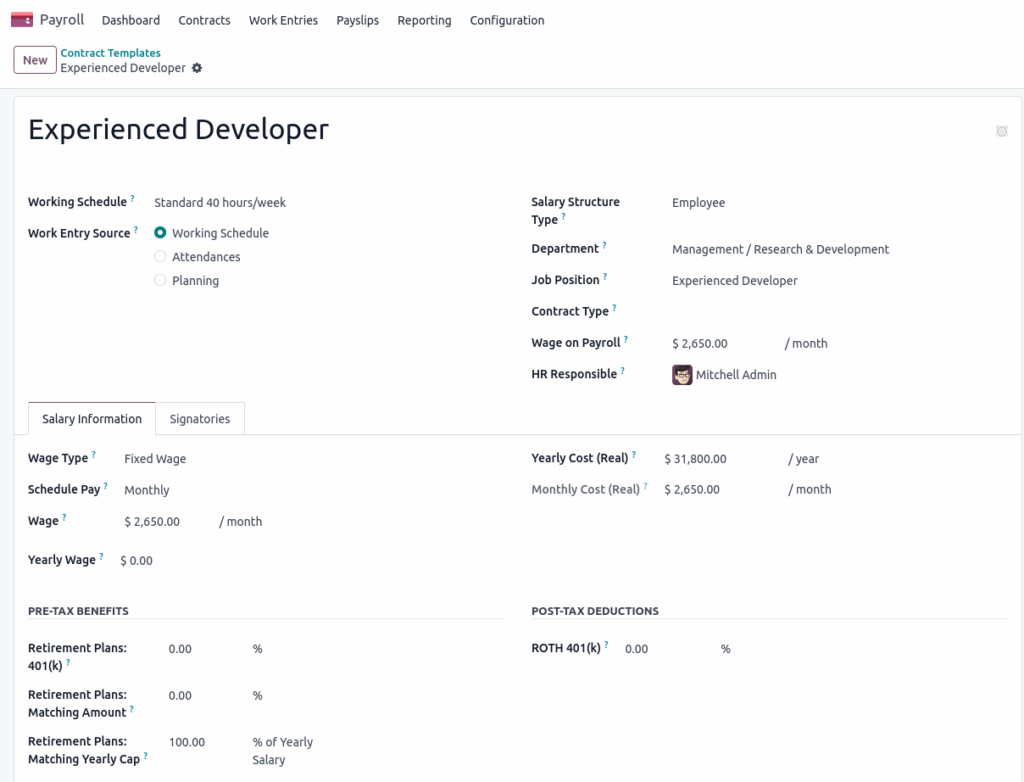

Contract Templates

Overview

Contract Templates in Odoo simplify employee contract creation by predefining key fields like job position, salary structure, working schedule, and benefits. This ensures consistency, speeds up onboarding, and reduces manual data entry errors in the payroll process.

Process Flow

Business Rules

- Each template should be tailored to a specific job position or role.

- Assign the correct salary structure to ensure accurate payslip computation.

- The contract template name is mandatory.

- The HR responsible must be assigned when creating the record.

- Templates must include a wage type (monthly, hourly, etc.) that matches the salary structure.

- Define the working hours per week (e.g., 40H/week, part-time, shifts).

Screenshot

Contract Templates Tree View

Contract Templates Form View

Employment Types

Overview

Employment types in Odoo define the nature of an employee’s work arrangement such as full-time, part-time, freelance, or temporary. They help determine payroll rules, working schedules, contract terms, and wage computation, ensuring accurate and compliant salary processing based on each employment category.

Process Flow

Business Rules

- The Employment types name is mandatory

Screenshots

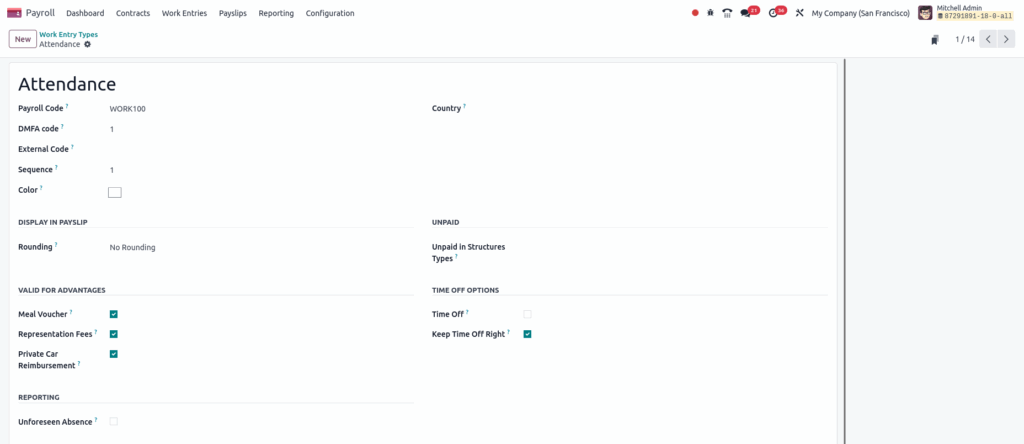

Work Entry Types

Overview

Work Entry Types in Odoo define the different types of time-based entries that affect payroll, such as attendance, paid time off, sick leave, overtime, or public holidays. They are essential for accurately tracking worked days and absences, and they directly impact payslip calculations.

Process Flow

Business Rules

- The work entry name is mandatory.

- Each work entry type must have a unique code to identify it in payroll

- The payroll impact of each work entry type must be properly configured

- The work duration unit (hours or days) must be specified for each entry type

- Leave-related work entry types must be linked to a corresponding Time Off Type

- Only active work entry types are used during payslip generation

Screenshots

Work Entry Types Tree View

Work Entry Types Form View

Working Schedules

Overview

Working Schedules define an employee’s regular working hours and days in Odoo. They are used to calculate attendance, leaves, overtime, and ensure accurate payroll processing based on the employee’s actual work time.

Process Flow

Business Rules

- Every schedule must have a clear and unique name

- A valid resource calendar specifying working days and hours must be linked

- Working Days and Hours Must Be Specified

- Only Active Schedules Can Be Assigned to Contracts

Screenshots

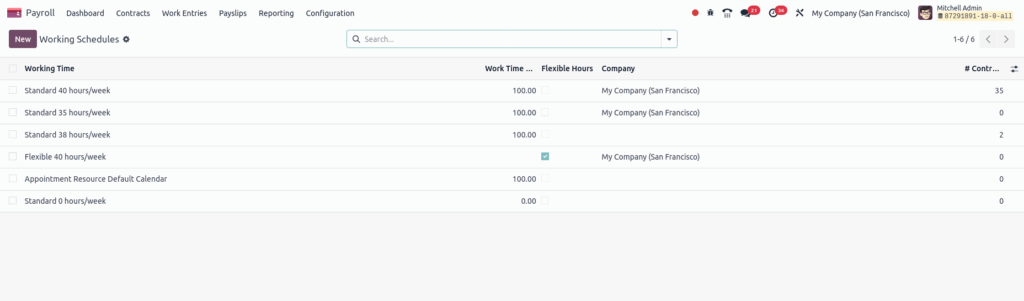

Working Schedules Tree View

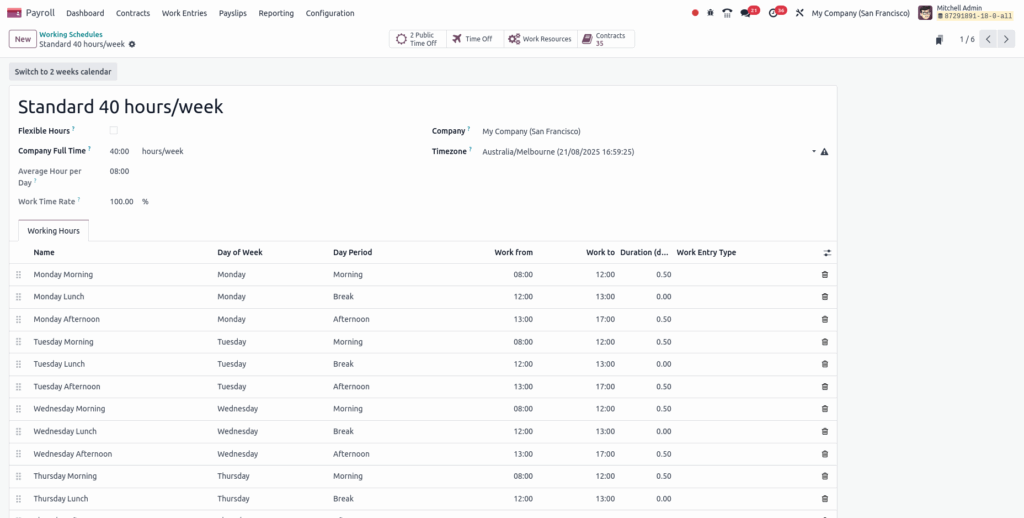

Working Schedules Form View

Salary Structure Types

Overview

Salary Structure Types categorize different payroll schemes (e.g., monthly, hourly) and define how salary rules are grouped and applied. They help organize payroll processing by specifying payment frequency, working hours, and the set of salary rules used for calculating employee compensation.

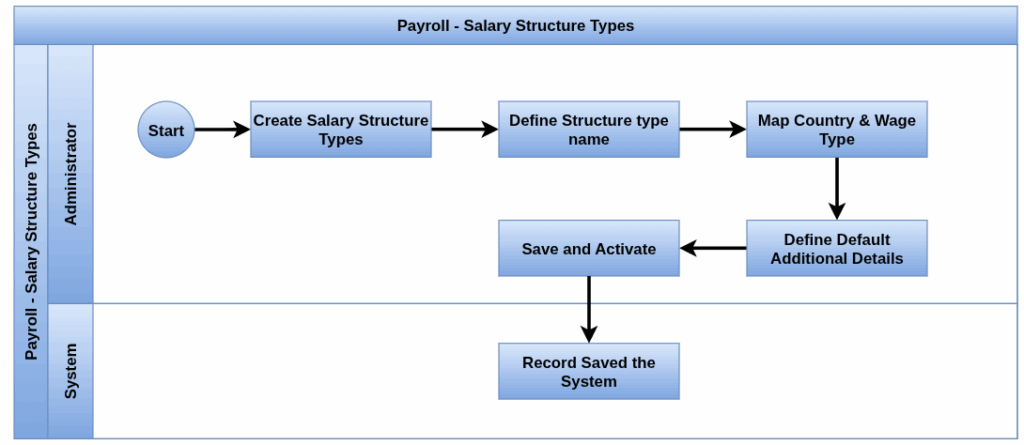

Process Flow

Business Rules

- The Salary structure type name is mandatory

- Default Working Hours Must Be Defined

- Only Active Structure Types Can Be Used

Screenshots

Salary structure types Tree View

Salary structure types Form View

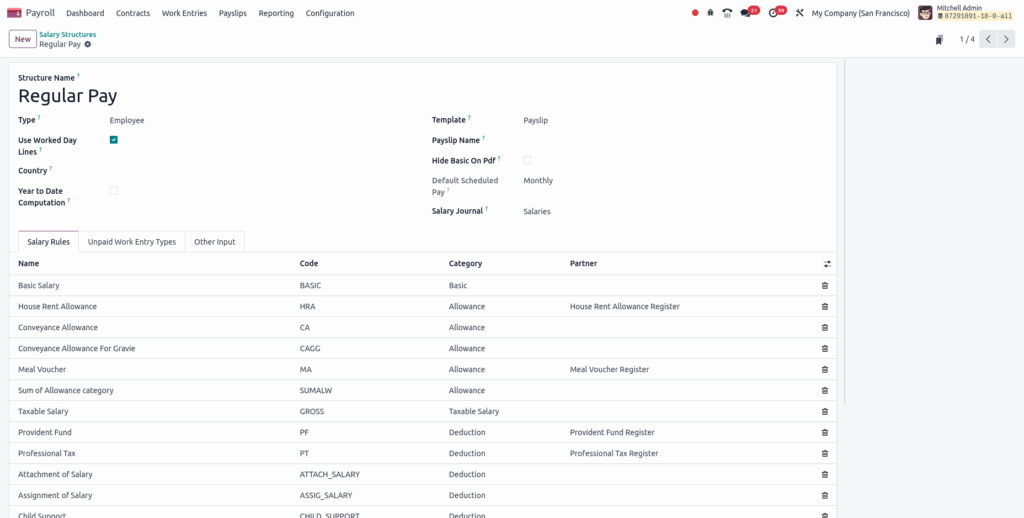

Salary Structures

Overview

Salary Structures define the set of salary rules, allowances, deductions, and benefits applied to employee payroll. They determine how salaries are calculated based on employee roles, contract types, and payment frequency, ensuring accurate and consistent payroll processing.

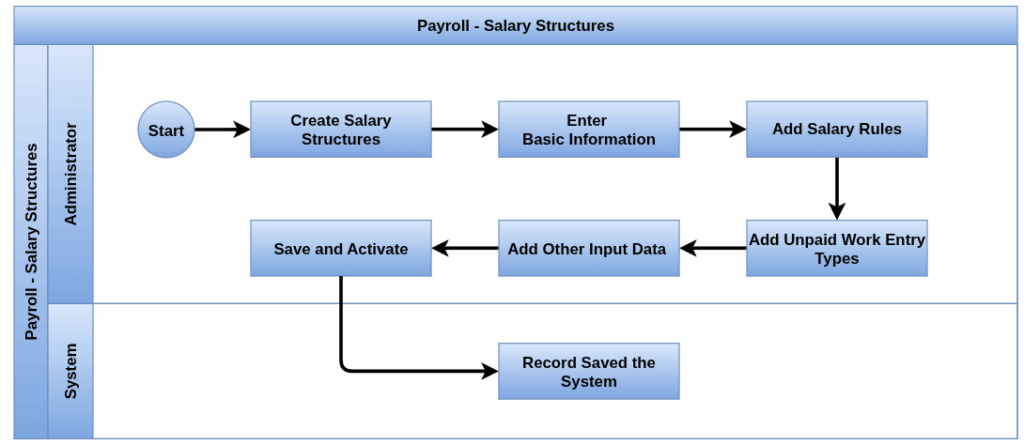

Process Flow

Business Rules

- The Salary structure name is mandatory

- A valid salary structure type (e.g., monthly, hourly) must be assigned

- Salary Rules Must Be Defined

- Only Active Structures Can Be Assigned

Screenshots

Salary Structures Tree View

Salary Structures Form View

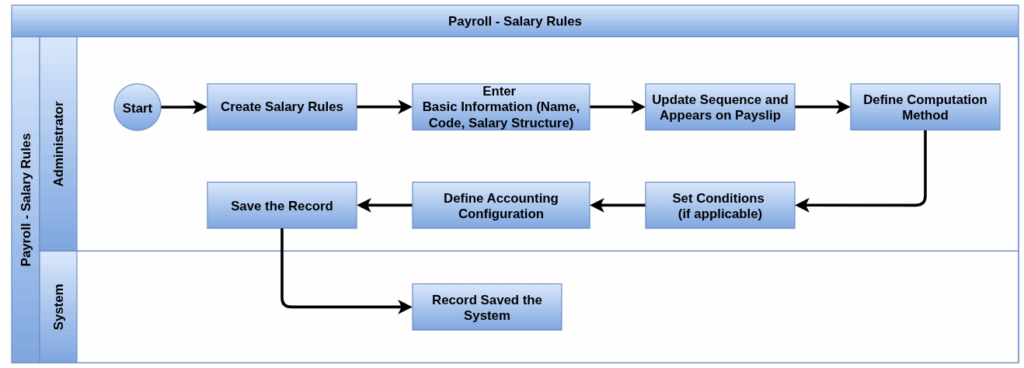

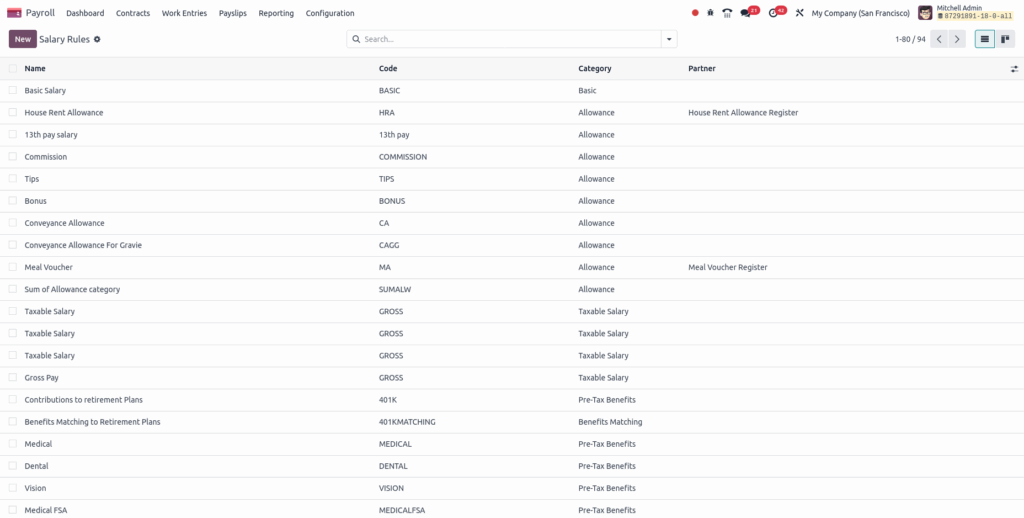

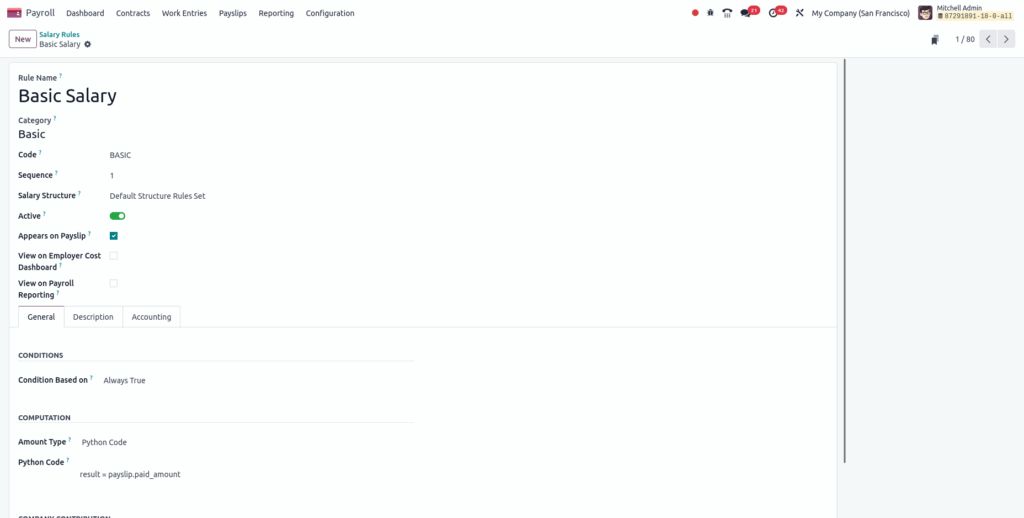

Salary Rules

Overview

Salary Rules define the individual components of an employee’s salary, such as basic pay, allowances, deductions, and taxes. They specify how each component is calculated and applied within a salary structure to ensure accurate payroll processing.

Process Flow

Business Rules

- The rule name is mandatory

- A unique code must be assigned to each salary rule

- A valid category must be selected for proper classification

- The computation method must be clearly defined

- Only active salary rules are used in payroll calculations

Screenshots

Salary Rules Tree View

Salary Rules Form View

Salary Rule Parameters

Overview

Salary Rule Parameters are customizable variables used within salary rules to standardize values like tax rates, allowances, or thresholds. They enable easy updates and consistent calculations across payroll without modifying individual salary rules.

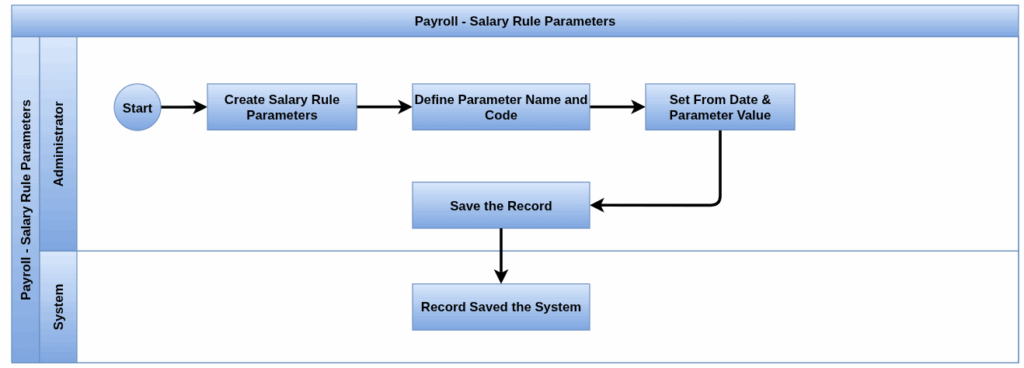

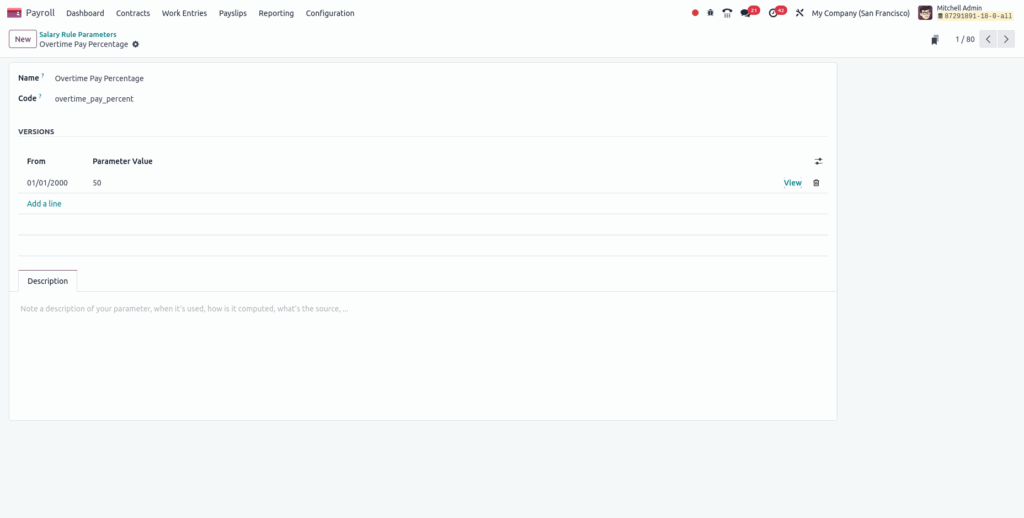

Process Flow

Business Rules

- The rule Parameter name and Code is mandatory

Screenshots

Salary Rule Parameter Tree View

Salary Rule Parameter Form View

Salary Rule Categories

Overview

Salary Rule Categories group salary rules into logical types such as allowances, deductions, or net pay. They help organize payroll components, control calculation order, and determine how each rule affects the overall salary computation and reporting.

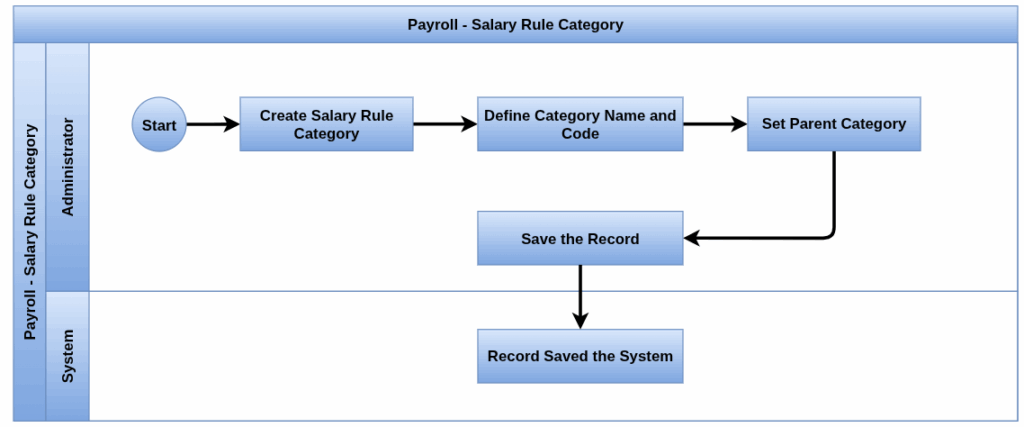

Process Flow

Business Rules

- The salary rule category name and Code is mandatory

Screenshots

Salary Rule Category Tree View

Salary Rule Category Form View

Payslip Other Input Types

Overview

Payslip Other Input Types allow manual inputs on employee payslips, such as bonuses, deductions, or adjustments that are not automatically calculated. They provide flexibility to include one-time or exceptional payments and corrections during payroll processing.

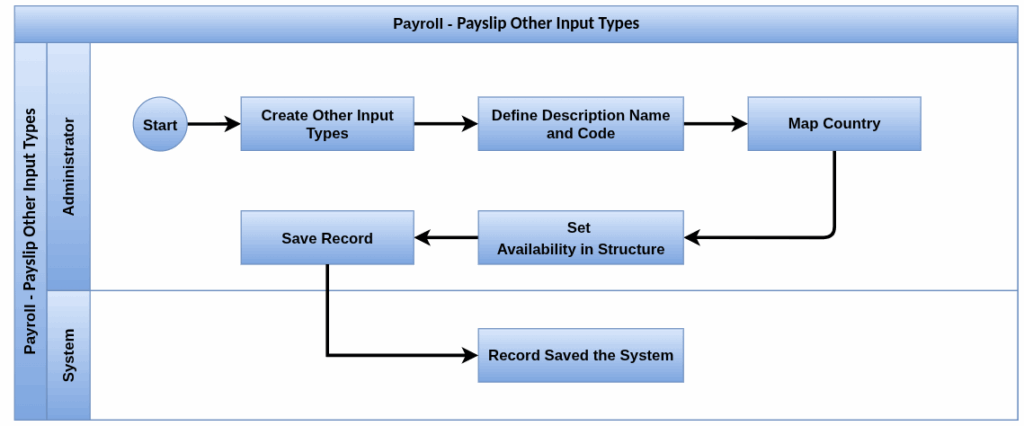

Process Flow

Business Rules

- The Other Input description name and Code is mandatory

- The Quantity and End Date fields are disabled by default and become visible only after the Available in Attachments field is enabled

Screenshots

Other Input Types Tree View

Other Input Types Form View

Benefits

Overview

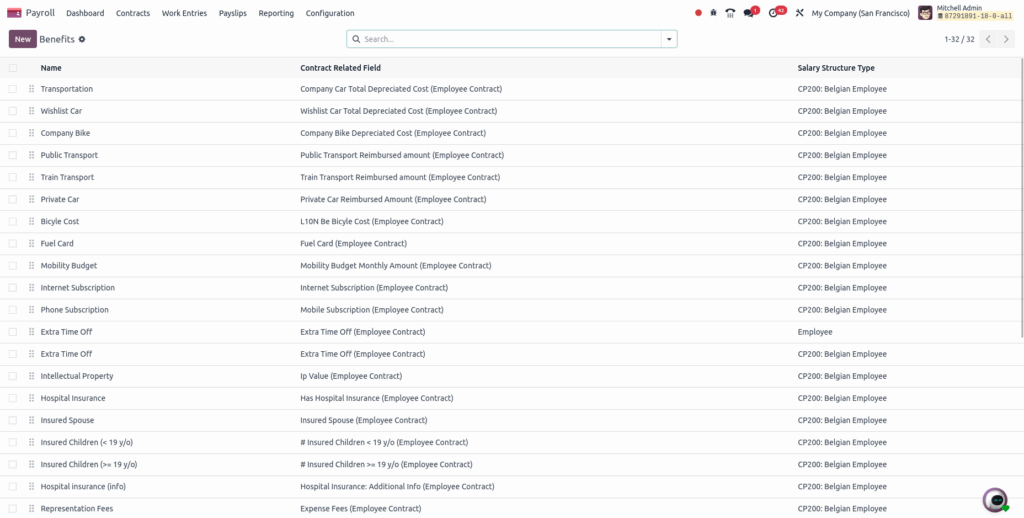

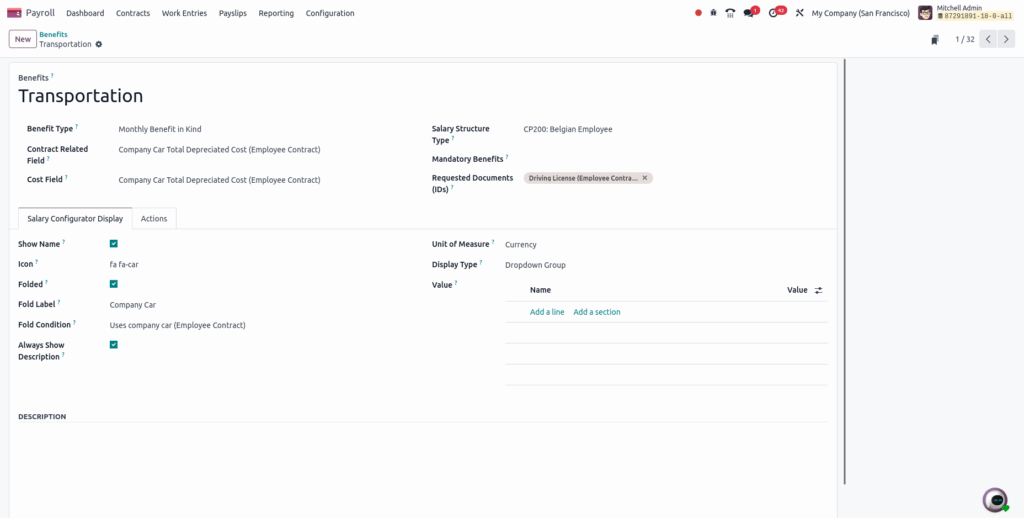

Benefits in the payroll module represent additional employee compensations such as health insurance, bonuses, or allowances. They are managed alongside salary components to ensure accurate and comprehensive payroll processing.

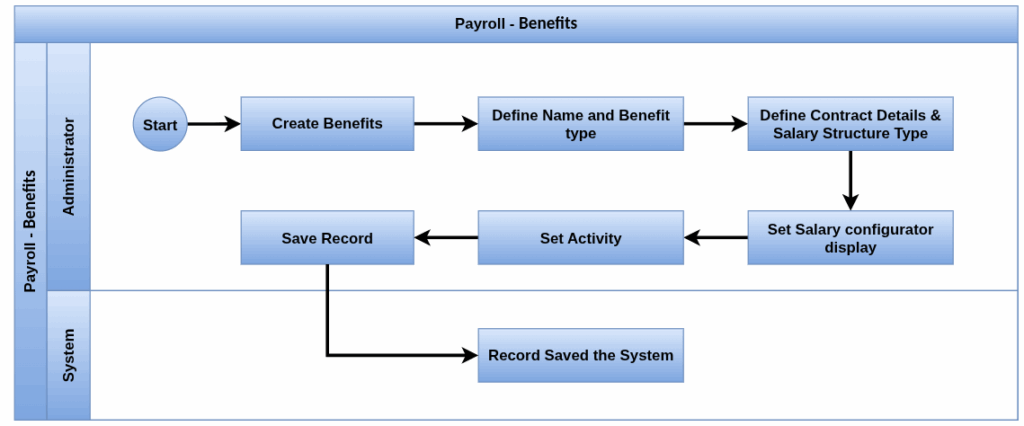

Process Flow

Business Rules

- The Benefit name is mandatory

- The salary structure type and display type is mandatory

Screenshots

Benefits Tree View

Benefits Form View

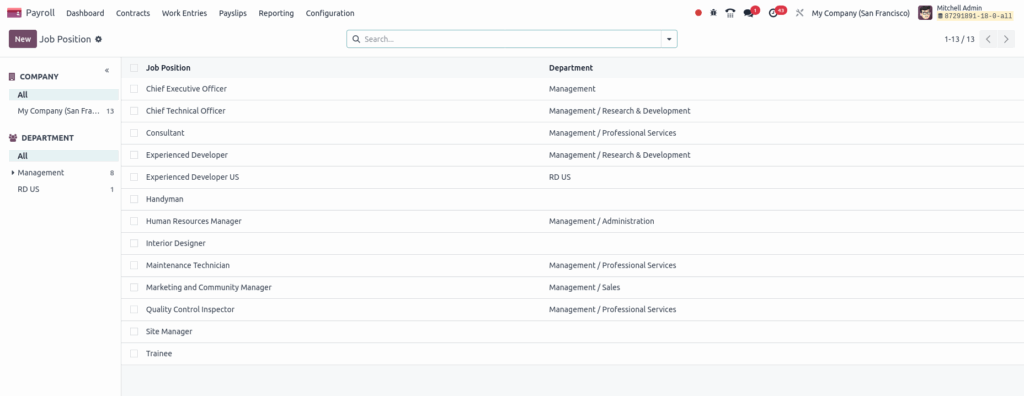

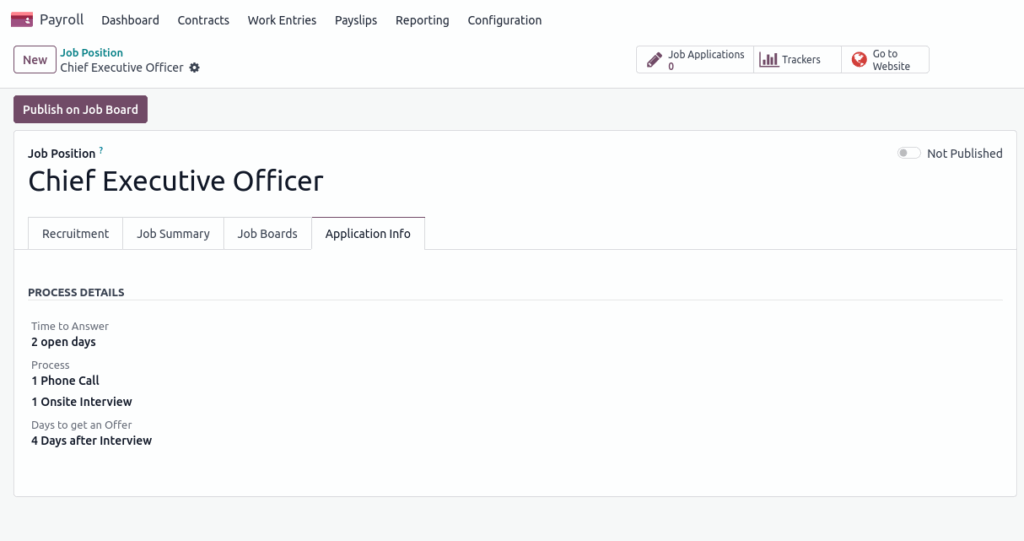

Job Positions

Overview

Job Positions define the roles and responsibilities of employees within the organization. In the payroll module, they help categorize employees, link salary structures, and manage compensation according to job-specific rules and policies.

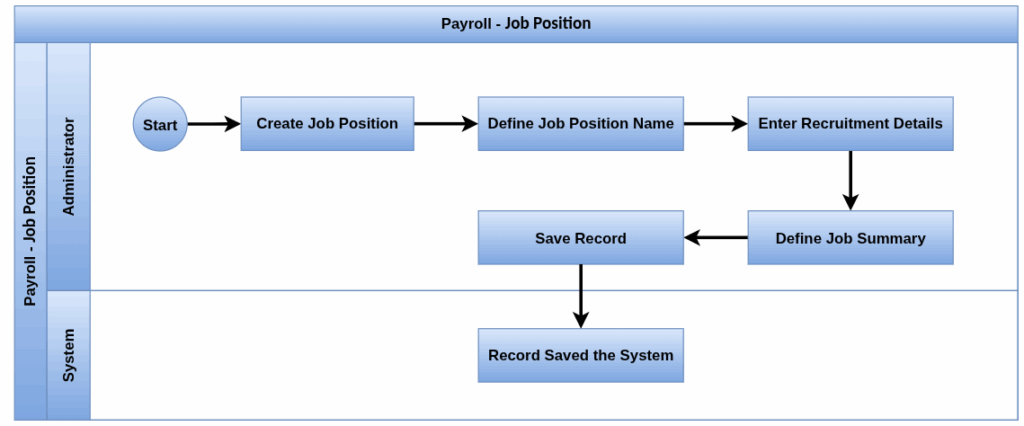

Process Flow

Business Rules

- Job Title, Department, and Recruitment Stages must be filled before saving

- Job titles must be unique within the same department

- At least one recruitment stage must be defined before publishing a position

- Every job position must have an assigned responsible recruiter or manager

Screenshots

Job Position Tree View

Job Position Form View

Payroll Management

Following are the list of Payroll features supported by Odoo,

- Contract Creation

- Work Entries

- Regenerate work entries

- Salary attachments

- Generating Batch payslips

- Generate warrant payslips

- Payslips to Pay View

- Payroll Dashboard

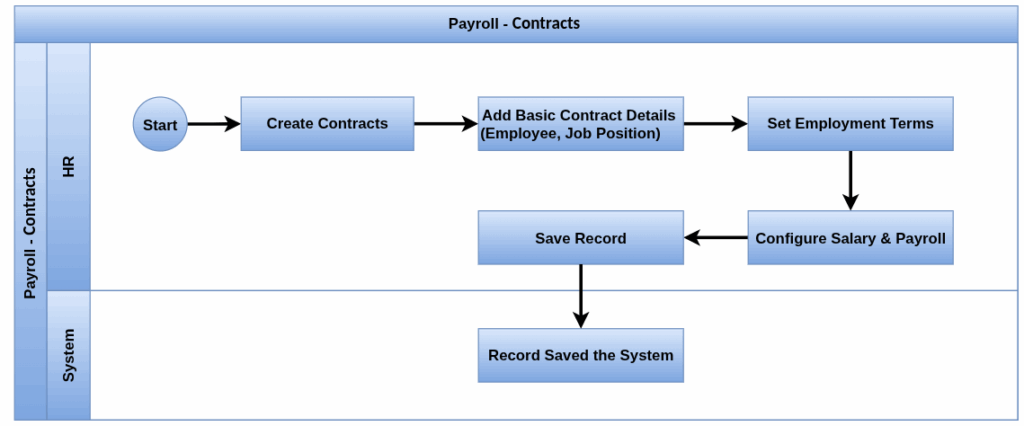

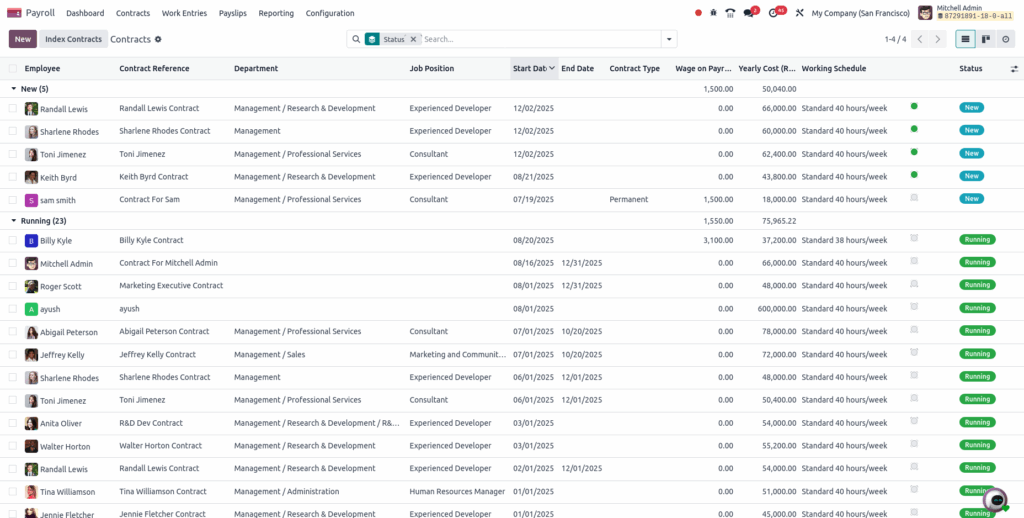

Contract Creation

Overview

Contracts formalize the employment terms between the company and the employee. In Odoo’s payroll module, contracts define salary structures, working schedules, and employment conditions to ensure accurate payroll processing and compliance with company policies.

Process Flow

Business Rules

- Every contract must be linked to a specific employee

- The start date of the contract must be specified

- A valid salary structure must be linked to ensure correct payroll calculations

- The employee’s working hours and days must be specified through a working schedule

- Define whether the contract is full-time, part-time, temporary, or internship

- Include an end date for temporary or fixed-term contracts

- Ensure the contract is linked to the correct company

- Prevent multiple overlapping active contracts for the same employee

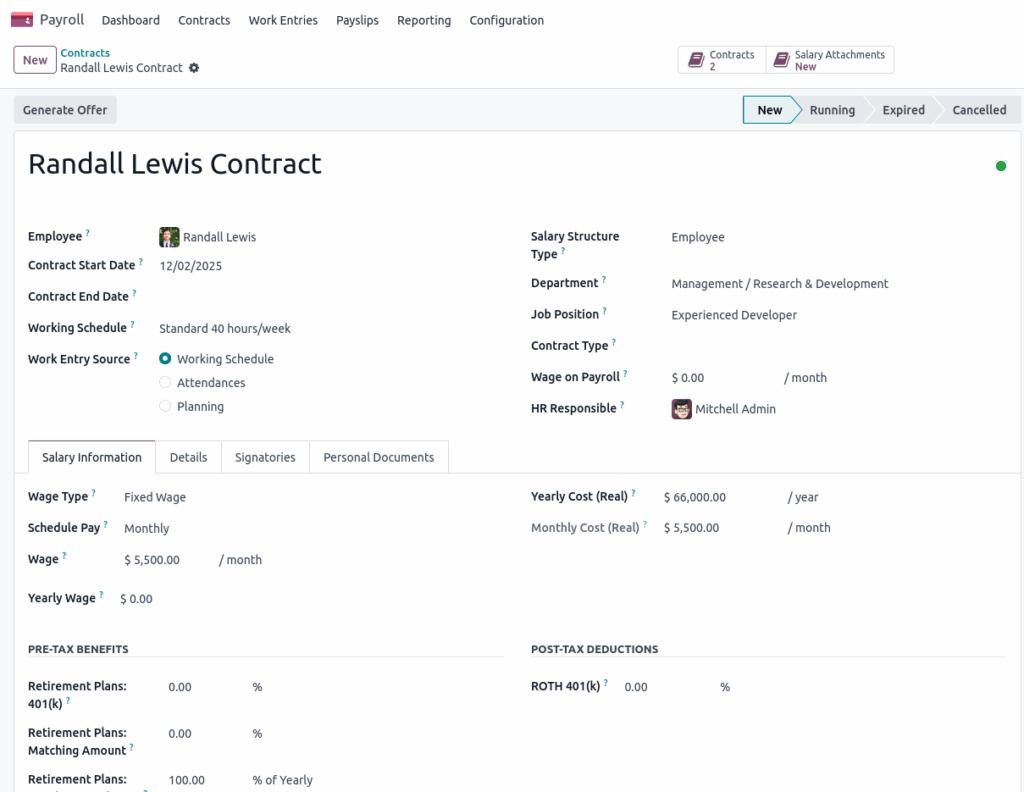

Screenshots

Contract Tree View

Contract Form View

Work Entries

Overview

Work Entries in Odoo represent the time-based records used for payroll calculations, including attendances, leaves, public holidays, and overtime. They are automatically generated based on contracts, working schedules, and time off, ensuring accurate and compliant payslip computation.

Process Flow

Business Rules

- Work entries are automatically created based on employee contracts, working schedules, and time off records

- The employee must have an active and validated contract for entries to be generated

- Two work entries cannot exist for the same employee on the same date and time range

- Each work entry must be linked to a valid work entry type (e.g., attendance, leave, public holiday)

- Once the payslip is validated or posted, related work entries are locked and cannot be edited

- Manually edited or added entries must not conflict with the employee’s contract terms or working hours

- All entries must be verified to ensure accurate payroll processing

- Entries related to sick leave, vacation, etc., are generated only from approved time off records

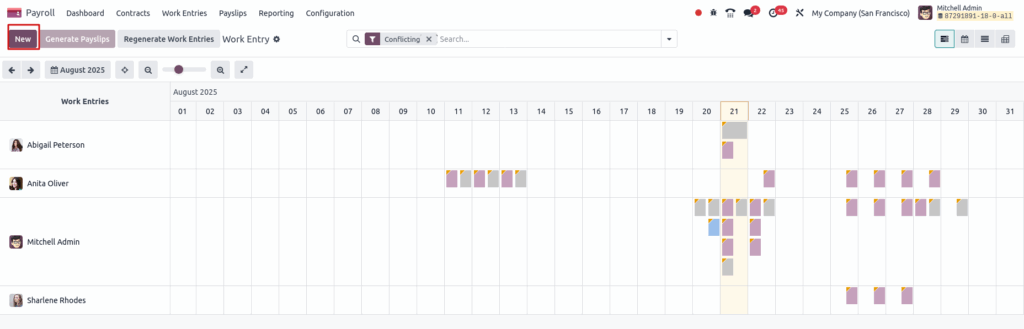

Screenshots

Work Entries Gantt View

Work Entries Creation View

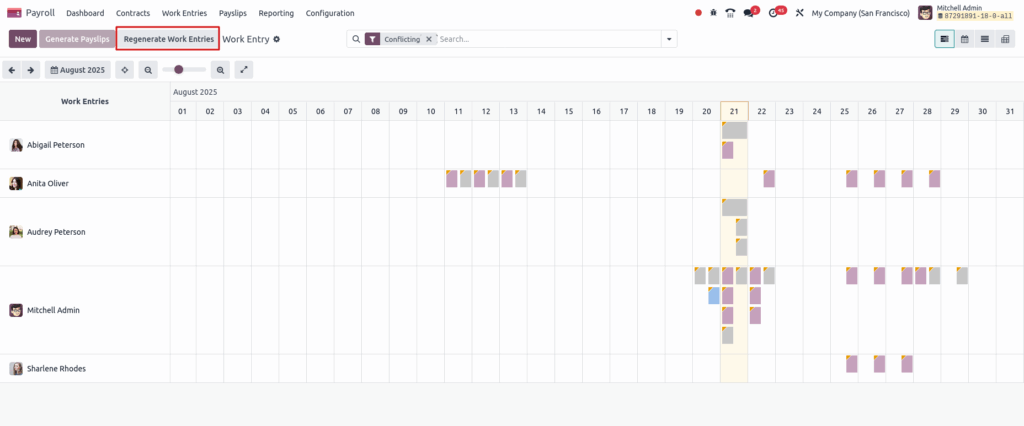

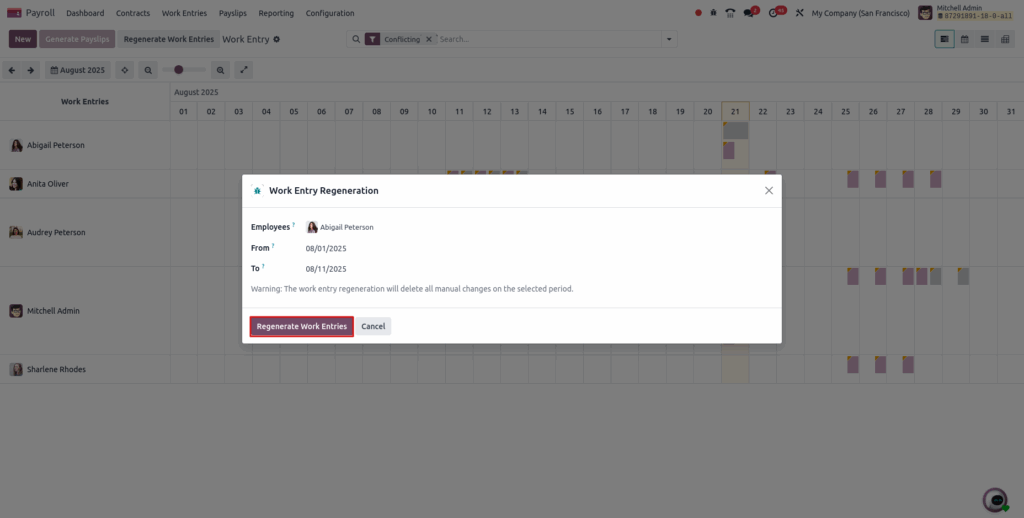

Regenerate Work Entries

Overview

The Regenerate Work Entries feature in Odoo allows users to refresh or recalculate work entries—such as attendances, leaves, and holidays based on updated employee contracts, working schedules, or time off. This ensures accurate and up-to-date data for payroll processing when any changes occur.

Process Flow

Business Rules

- Conflicts must be resolved at the source before regenerating work entries.

- Manual changes will be overwritten during the regeneration process.

- Regeneration should be used for efficient resolution of bulk conflicts.

- Unresolved issues in source applications will cause conflicts to reappear after regeneration.

- Employee selection is mandatory when initiating the regeneration process.

- A valid date range must be specified for the work entries to be regenerated..

- Regeneration must be performed from the Work Entries dashboard using the Regenerate Work Entries button

Screenshots

Regenerate Work Entries Button View

Regenerate Work Entries View

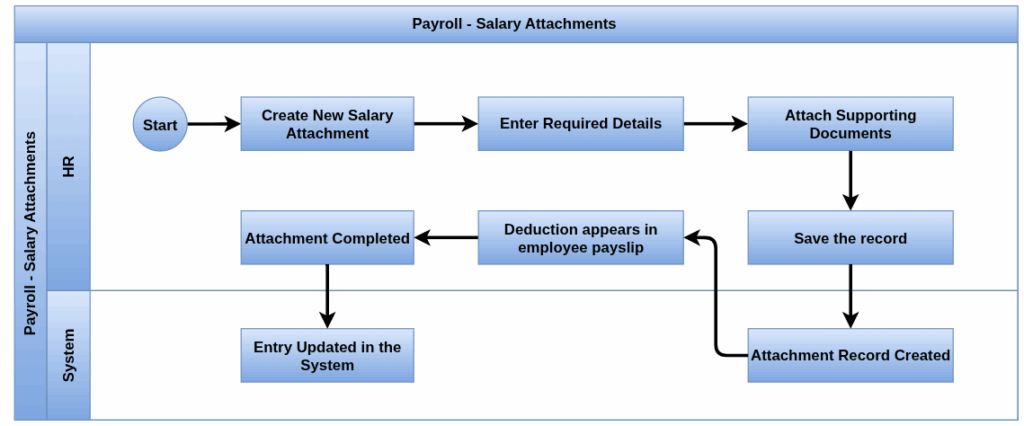

Salary Attachments

Overview

Salary Attachments in Odoo allow HR or payroll managers to record and manage legal or financial deductions from an employee’s salary such as loan repayments, court-ordered garnishments, or child support. These are linked to the employee’s payslip and automatically deducted during payroll processing.

Process Flow

Business Rules

- Each salary attachment must be linked to a specific employee

- The start date of the deduction is required to determine when it begins applying to payroll

- Define the nature of the attachment (e.g., loan, garnishment, fine)

- Specify the total amount, installment value, and frequency of deduction

- Include an end date to automatically stop the deduction after completion

- Inactive or expired attachments will not apply to payslips

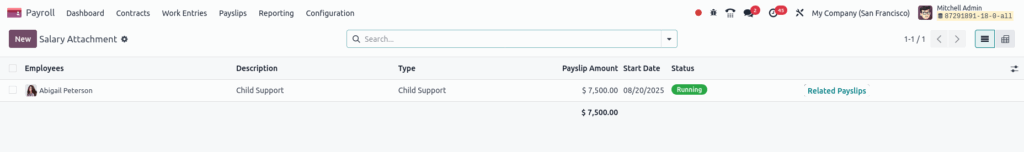

Screenshots

Salary Attachments Tree View

Salary Attachments Form View

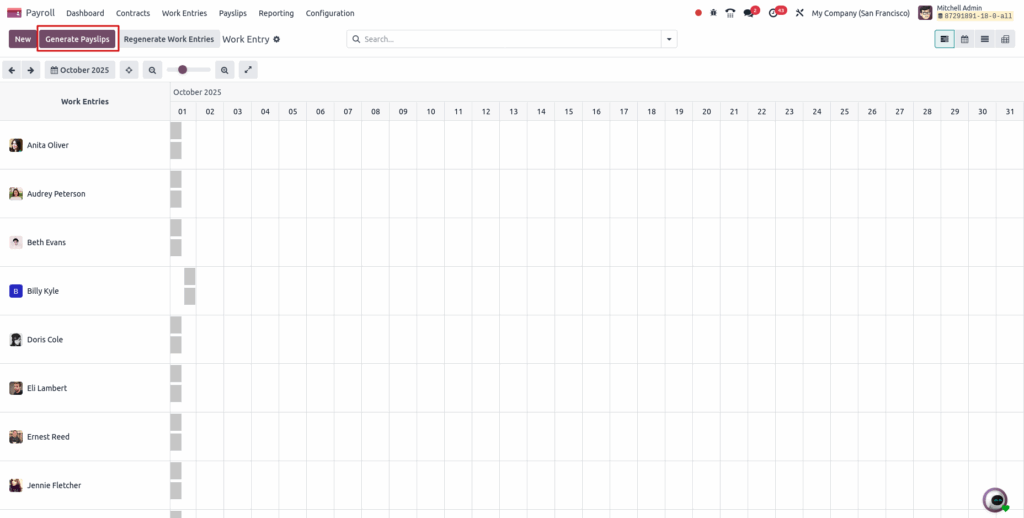

Generate Batch Payslips

Overview

The Generate Payslips feature automates the creation of employee payslips based on contracts, salary structures, and work entries. It streamlines payroll processing by calculating salaries, deductions, and benefits accurately for a specified period, ready for review and payment.

Process Flow

Business Rules

- To generate payslips, navigate to the desired payroll period and ensure the Conflicting filter is removed.

- The Generate Payslips button will only be active if there are no conflicts and the selected dates do not include future dates.

- All conflicts must be resolved before payslip generation can proceed.

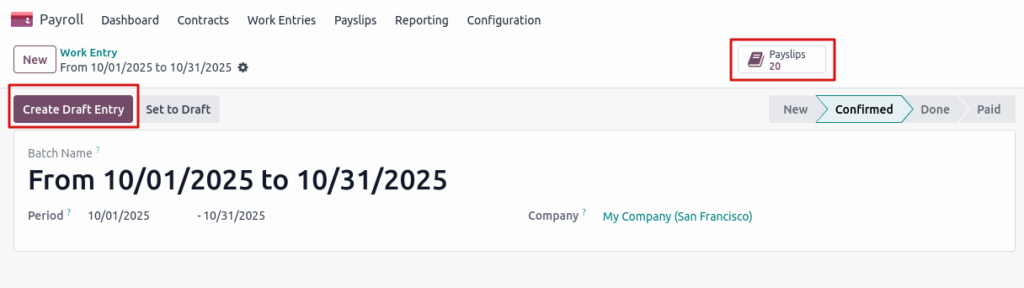

- When the Generate Payslips button is clicked, a batch entry is created automatically with a default batch name reflecting the date range.

- The payroll period and company fields in the batch entry form are fixed and cannot be edited.

- The user must click the Create Draft Entry button to generate payslips within the batch.

- Payslips for the batch can be accessed via the Payslips smart button at the top of the batch page.

Screenshots

Generate Pay slip Button View

Generate Batch Pay slip View

Generate warrant payslips

Overview

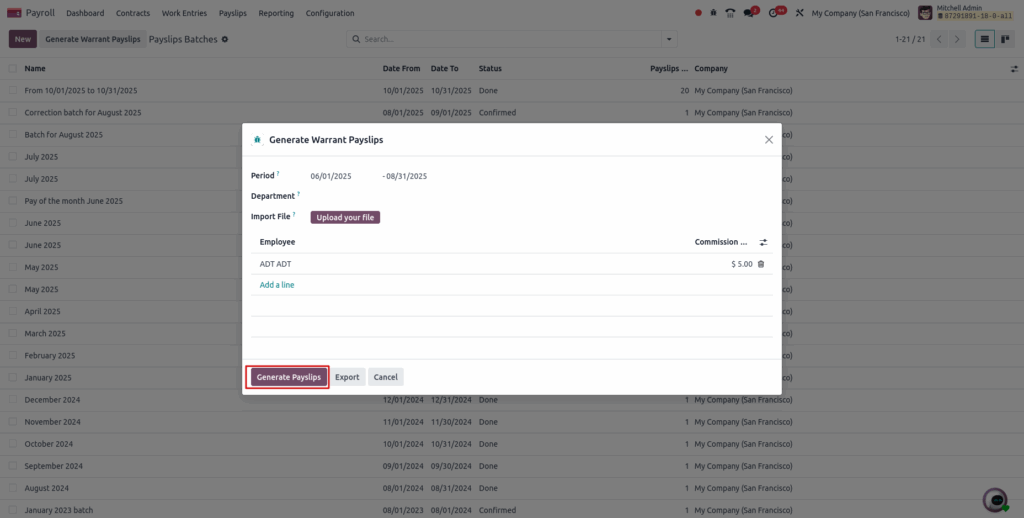

Warrant payslips in Odoo are used to process commission payments to employees. These payslips are generated from selected payslip batches by specifying the commission period, department, and commission amounts per employee. Additional employees can be added or removed, and supporting files can be uploaded. Once created, warrant payslips are processed like regular payslip batches to complete the payment.

Process Flow

Business Rules

- Warrant payslips can only be generated from existing payslip batches by selecting one or more batches

- The correct commission period must be selected using the calendar pop-up before generating payslips

- A department must be chosen to filter employees eligible for commission payslips

- Each employee listed under the selected department must have a commission amount specified

- Additional employees may be added manually, and employees can be removed before generating payslips

- Supporting files related to commissions can be uploaded in any file format

- Commissions are processed in batch mode, consistent with the standard payroll workflow

- After generation, warrant payslip batches must be processed like typical payslip batches to finalize payments

Screenshots

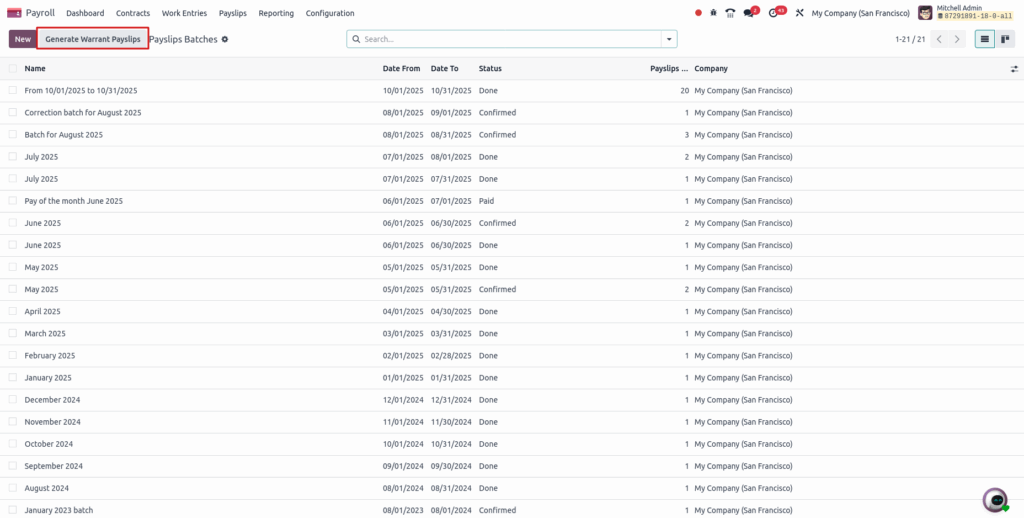

Generate warrant Payslip Button View

Generate warrant Payslip Create View

Payslips to Pay View

Overview

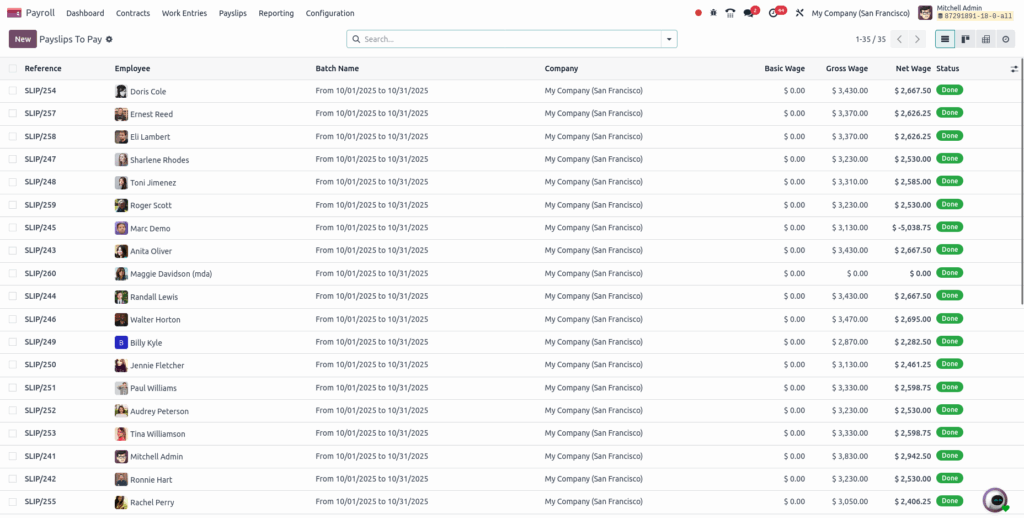

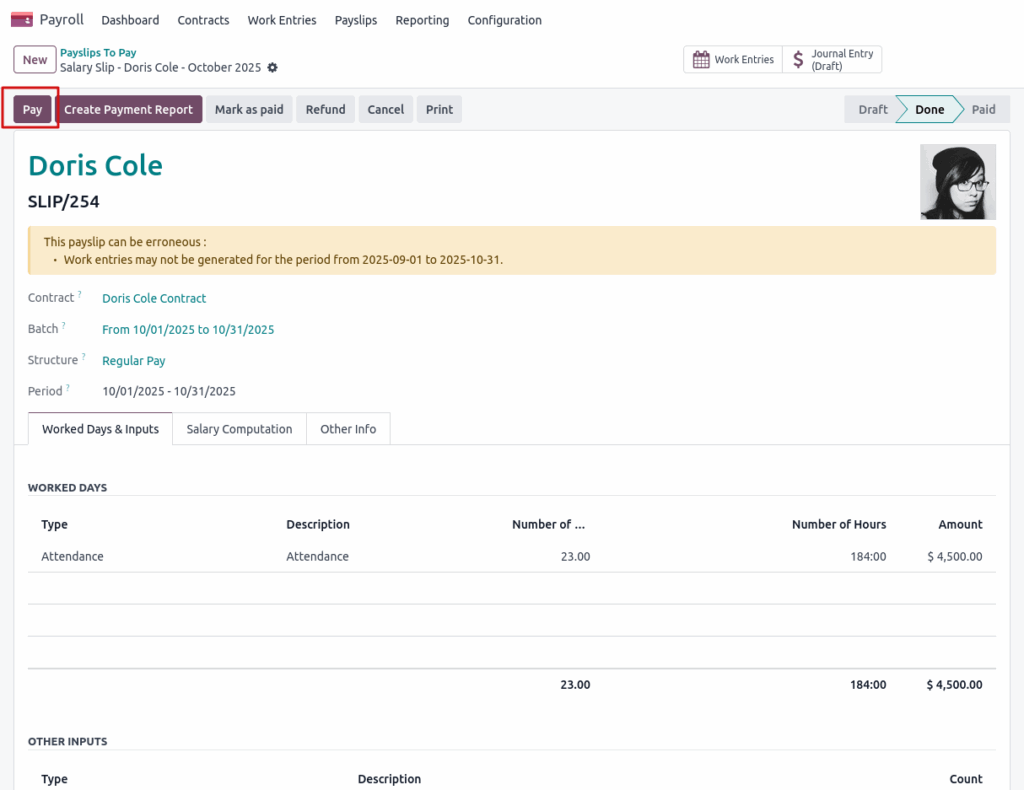

Payslips to Pay lists all validated payslips that are ready for payment. It helps payroll managers track pending salary payments, generate payment orders, and ensure timely and accurate salary disbursement to employees.

The following are the list of main features available in Payslips to Pay View,

- Displays only validated payslips that are pending payment, simplifying payment tracking.

- Allows bulk selection of payslips for efficient mass payment processing.

- Automatically posts salary payments to the accounting module, ensuring financial records are updated.

- Includes buttons for quick navigation to related journals, employees, or payment entries.

- Includes buttons for quick navigation to related journals, employees, or payment entries.

- Compatible with different salary payment methods like bank transfer, cash, or check.

Screenshots

Pay Slips to Pay Tree View

Pay Slips to Pay Form View

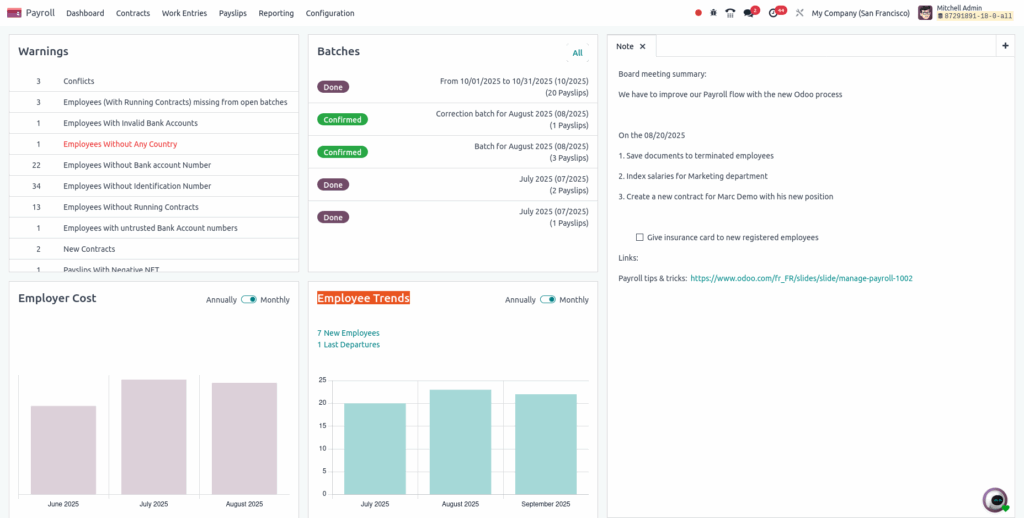

Payroll Dashboard

Overview

The Payroll Dashboard provides a centralized view of key payroll metrics and activities. It helps HR and payroll managers monitor payroll status, upcoming deadlines, Warnings, employee payslip summaries, Employee Cost, Employee Trends and work entry conflicts all in real time enabling efficient payroll management and decision-making.

The following are the list of main features available in Payroll Dashboard View,

- Displays critical alerts such as work entry conflicts, missing contracts, or unpaid payslips that require immediate attention.

- Shows a summary of payslip batches with their current status (draft, validated, paid) for quick batch management.

- Presents the total employer cost either monthly or annually, helping track payroll expenses and budgeting.

- Visualizes workforce trends over time (monthly or annually), including hires, terminations, and contract changes to support HR planning.

- All dashboard components update dynamically to reflect the latest payroll data.

- Allows toggling between monthly and annual views for Employer Cost and Employee Trends for flexible reporting.

Screenshots

Payroll Dashboard View

Payroll Report Management

Following are the list of Payroll report features supported by Odoo,

- Time off to report

- Work entry analysis

- Payroll Analysis

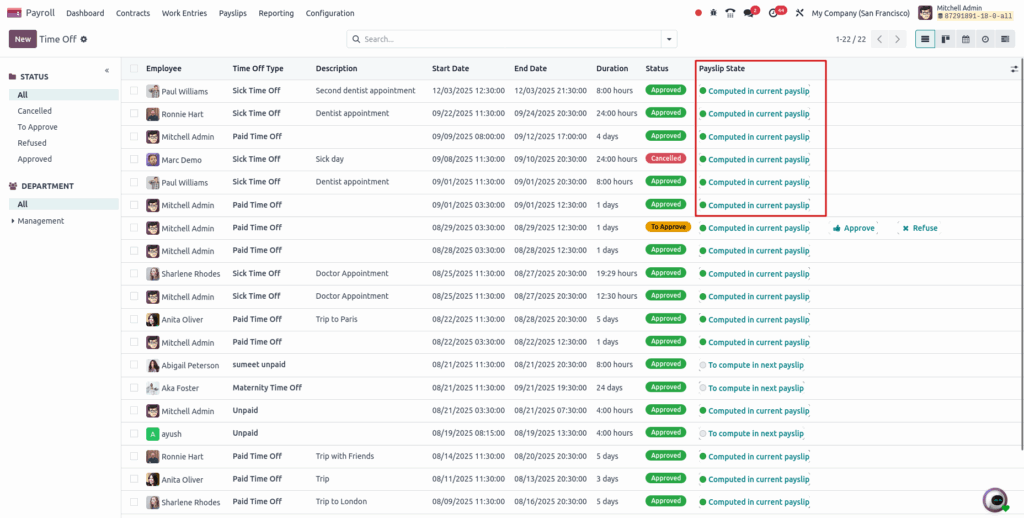

Time off to Report

Overview

Time Off to Report provides a consolidated view of employee leave and absence data that impacts payroll processing. It helps payroll managers track approved, pending, and rejected leaves, ensuring accurate salary calculations and compliance with company policies.

The following are the list of main features available in Time off to Report,

- Displays all types of employee leave (vacation, sick leave, etc.) relevant to payroll

- Shows leave requests with statuses such as approved, pending, or rejected

- Highlights leaves that affect salary computation and work entries

- Enables filtering by employee, leave type, date range, and approval status

- Automatically updates work entries based on approved time off

- Allows exporting leave data for audits or further analysis

Screenshots

Time off to Report View

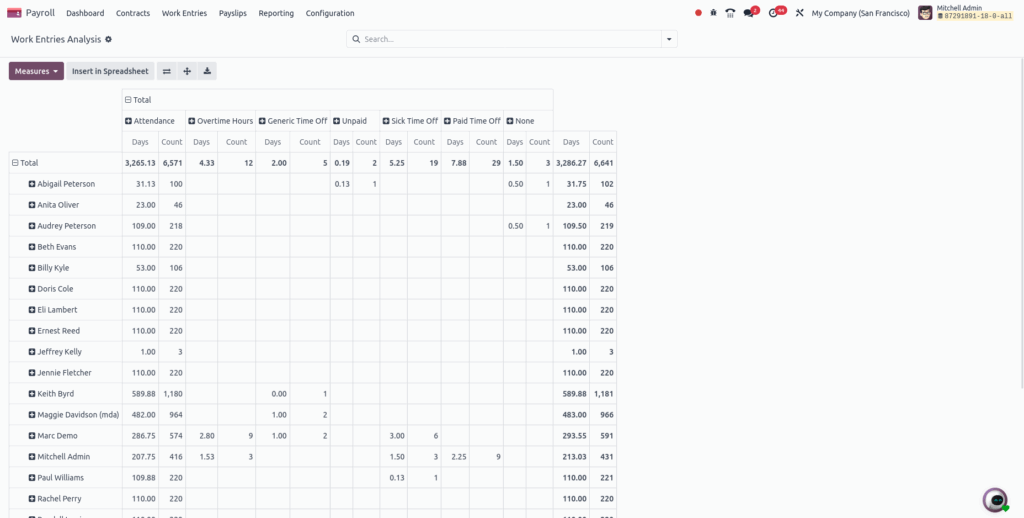

Work entry analysis

Overview

Work Entry Analysis provides detailed insights into employee work time records, including hours worked, leaves taken, and exceptions. It helps payroll and HR teams monitor attendance patterns, identify discrepancies, and ensure accurate payroll processing.

The following are the list of main features available in Work entry analysis,

- Shows breakdowns of worked hours, overtime, absences, and leave types

- Highlights overlapping or conflicting work entries that need resolution

- Allows filtering by employee, department, date range, or work entry type

- Includes charts and graphs for easier trend analysis

- Directly impacts payslip calculations based on validated work entries

- Supports exporting reports for management review or audits

Screenshots

Work entry analysis report View

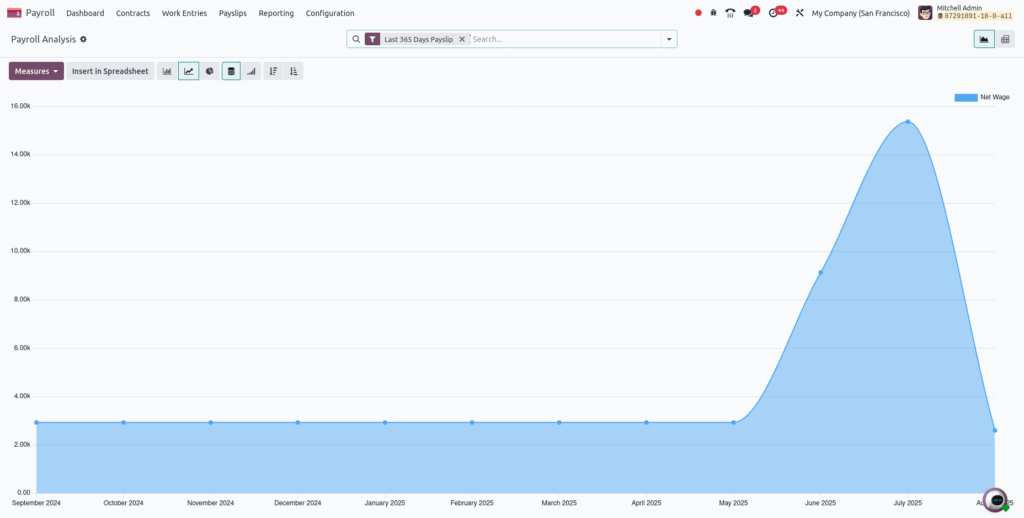

Payroll Analysis

Overview

Payroll Analysis offers comprehensive insights into payroll costs, trends, and employee compensation. It enables HR and finance teams to monitor payroll expenses, identify patterns, and make informed budgeting and strategic decisions.

The following are the list of main features available in Payroll Analysis,

- Summarizes total payroll costs by employee, department, or company

- Tracks payroll expenses over time (monthly, quarterly, annually)

- Details salary components like basic pay, bonuses, deductions, and benefits

- Allows filtering by date range, department, job position, and employee

- Includes charts and graphs for quick understanding of payroll data

- Enables exporting payroll reports for financial audits and presentations

Screenshots

Payroll Analysis View