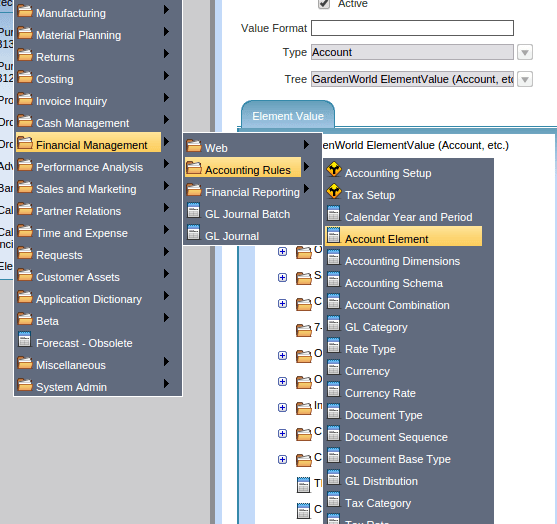

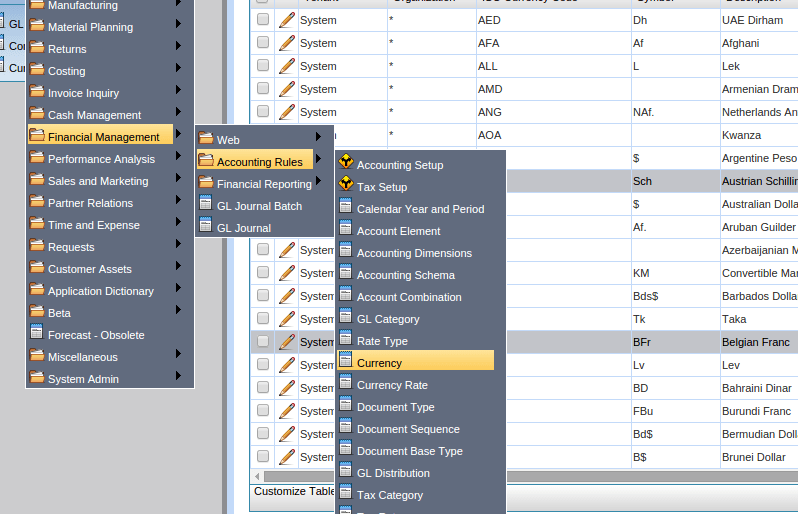

Compiere Financial Management

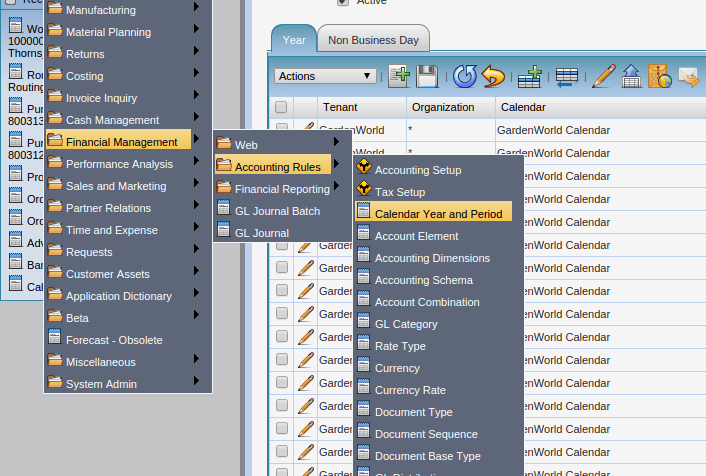

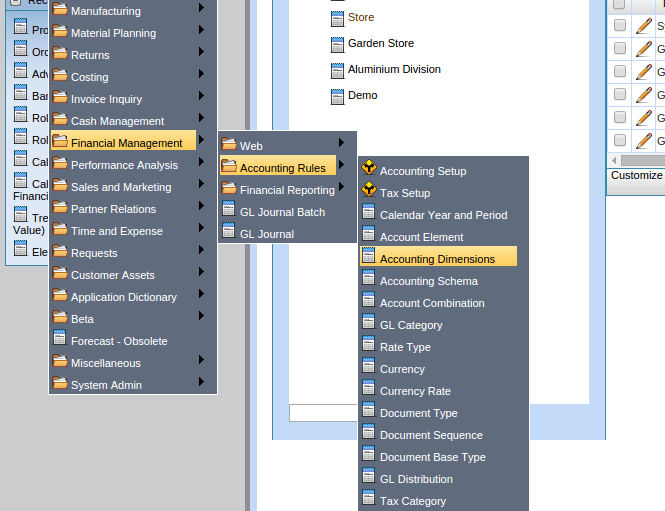

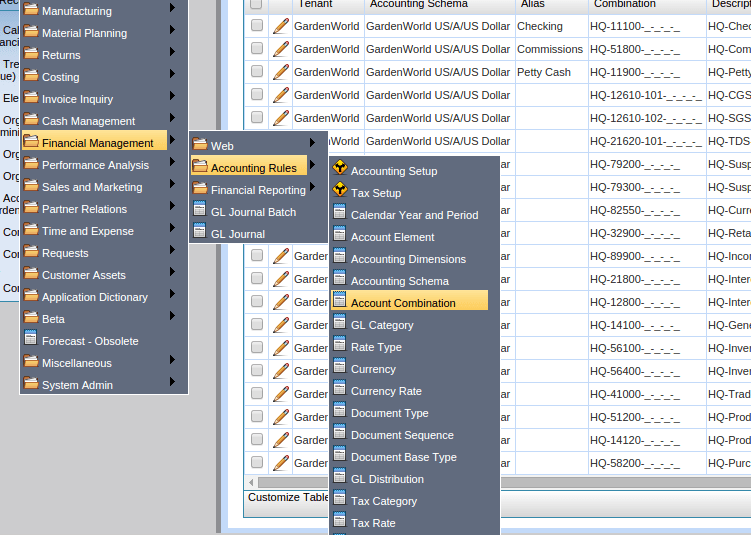

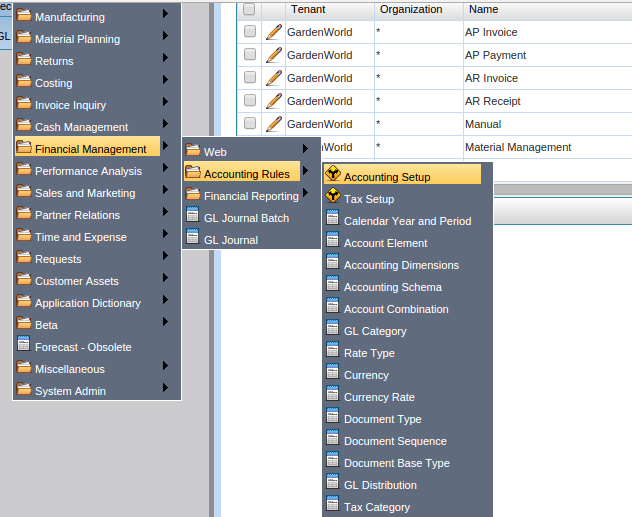

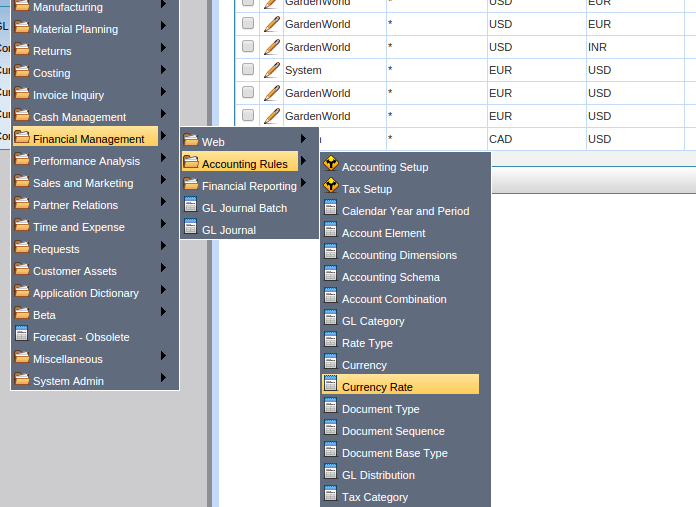

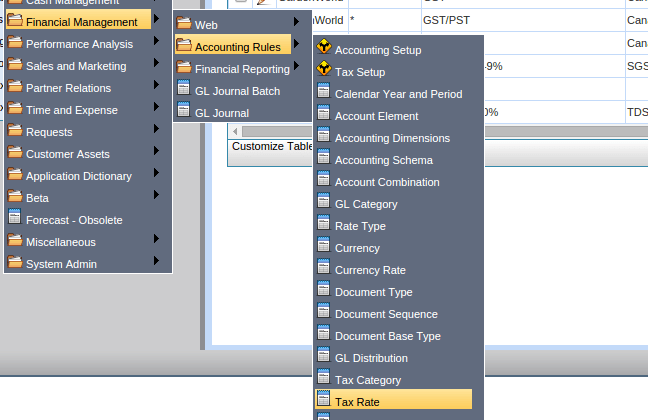

Compiere Financial Management includes Web, Accounting Rules, Financial Reporting, GL Journel Batch and GL Journel

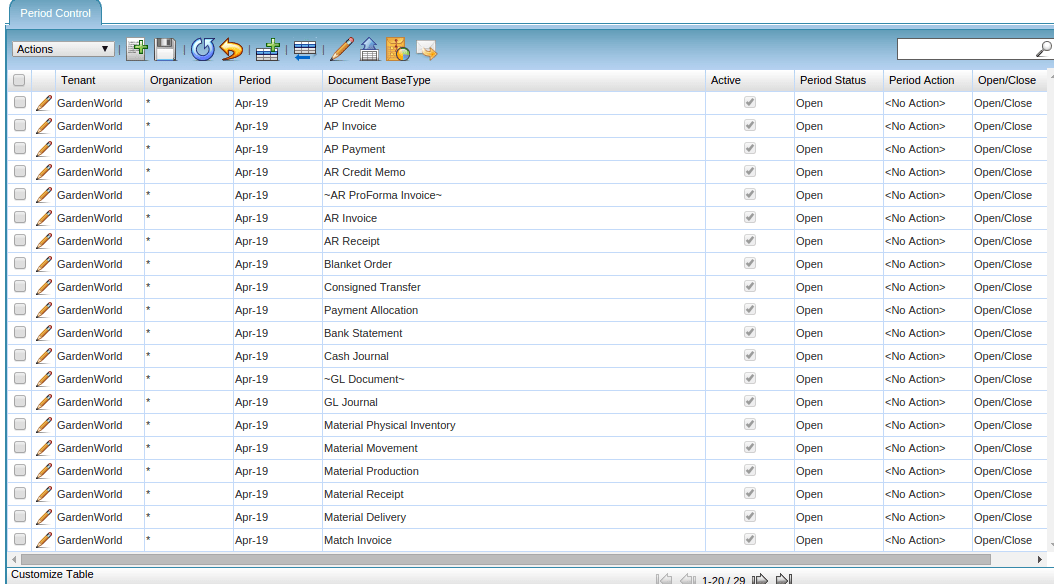

Calendar Period

The Calendar Year and Periods define the calendars that will be used for period control and reporting. You can also define non-standard calendars (e.g. business year from April to March)

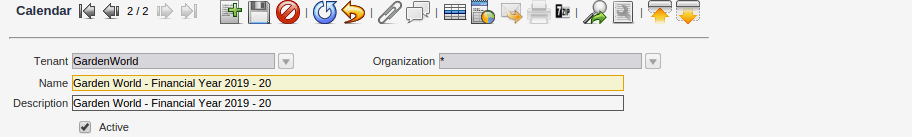

To Click on Create a new Calendar Period we need to define with a Name for the Organisation & Tenant

For ex: For Garden world we can define as “Garden World – Financial Year 2019 – 20” for Name & Description

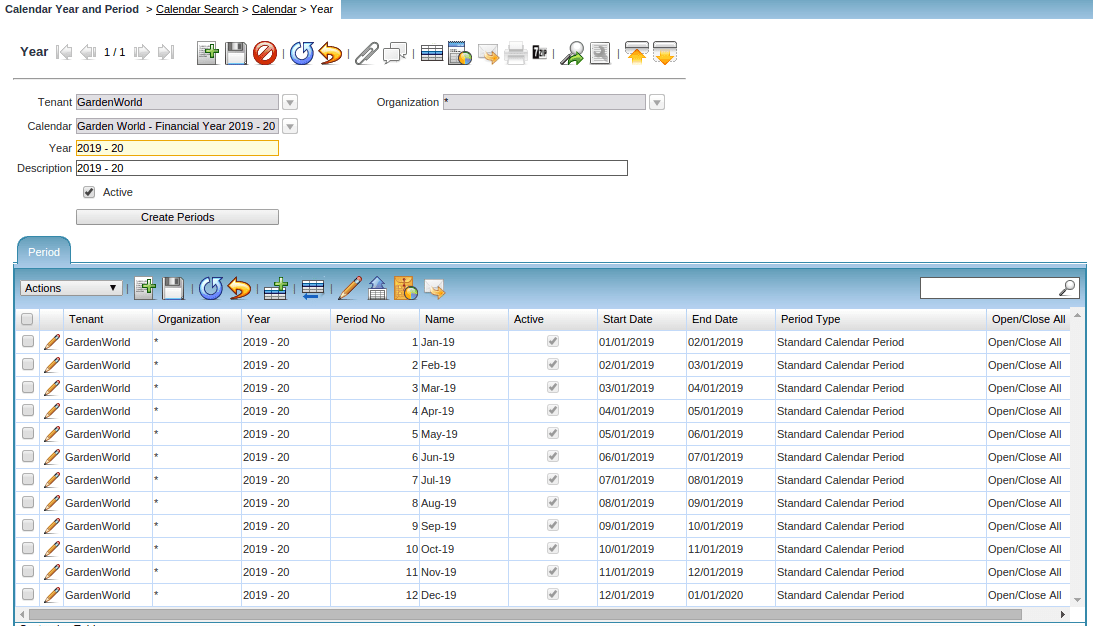

The Organisation selected needs to * & Year defined as 2019 – 20 & we need to click on Create Period Buttons

For each period the Start & End Date needs to be defined (From 1st to Last date of each month)

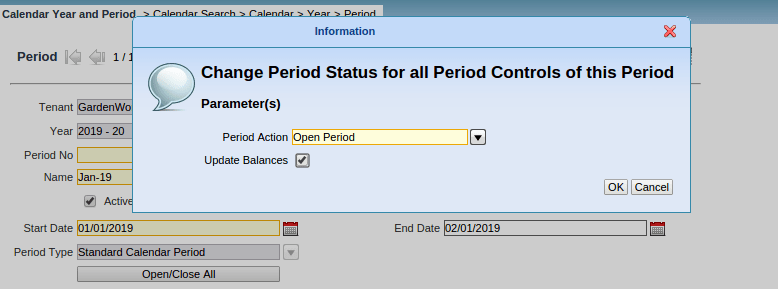

Then for each month, all the respective document types (for ex: AP Invoice, AR Invoice, G/L Journal, etc can be opened both individually as well as combined) by clicking “Open/Close all Buttons”

“The Update balance check box” helps in carrying for the previous month closing balances as current month Opening Balances

Note: As and when the Accounting entries for the respective month gets completed, the Admin needs to close the accounting period in order to maintain the sanctity of numbers and also to make sure Accountants

do not go and post any back dated accounting entries

Note: The same process needs to be followed for every month for the calendar year

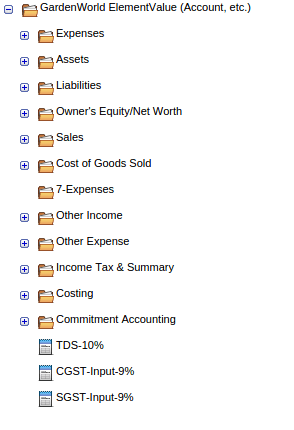

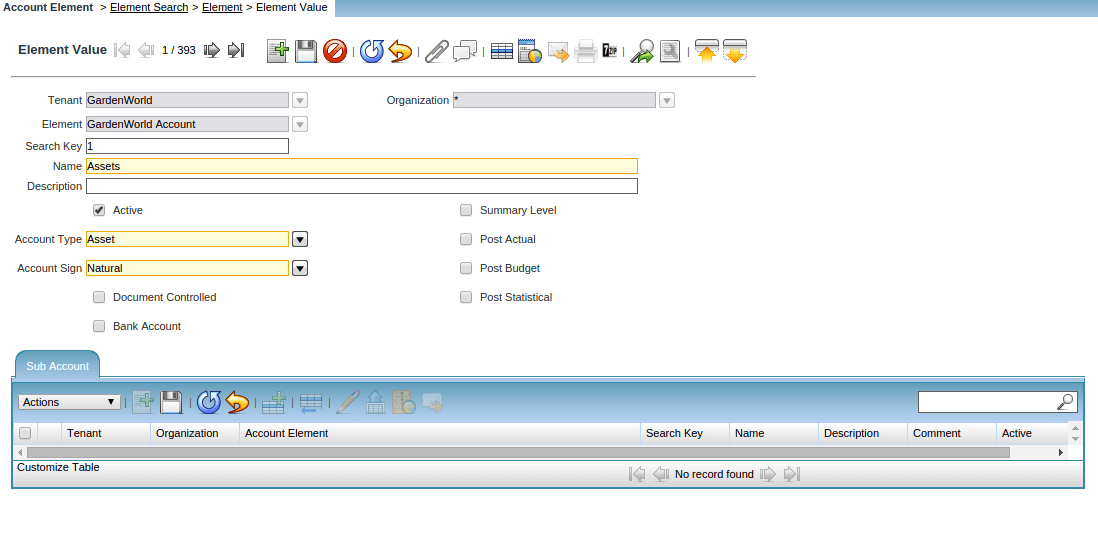

Account Element

The Account Element Window is used to define and maintain the Accounting Element also popularly called as Chart of Accounts of Any Organisation

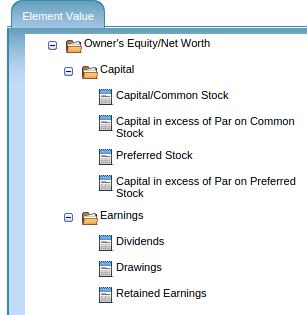

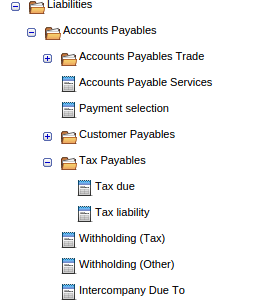

For any Organisation the 5 Key headings under the Chart of Accounts are (Owner’s Equity, Liabilities, Assets, Revenue & Expenses)

For ex:

Owner’s Equity: Garden World the amount of money bought in to form the company by the promoters are as Capital/Equity Share Capital etc. Other parts of Share Capital includes Stock Options, Preference Share Capital

Earnings: Carry forward of the previous year profit + or – the current year’s Profit is called as Earnings

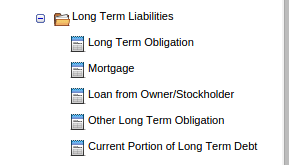

Liabilities: Garden world liabilities can be classified as Long Term Liabilities (Long Term Debt, Long Term Mortgage from Wells Fargo Bank), Short Term Liabilities (Current Short term portion of long-time Debt Wells Fargo Bank), Tax Payables (GST, Any other deducted Tax)

Vendor Payables (for Goods purchased like seeds, flower pots & services availed like Tax Consultants)

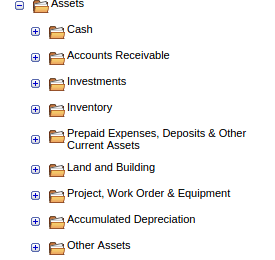

For ex: Garden world: Assets can be classified ask Fixed Assets (Plant & Machinery used for processing seeds, Furniture in offices including Chairs, Tables, Computers & Laptops used in offices, Office Buildings, office vehicles including cars, Current Assets (Stocks or inventory which can be classified as Raw Materials, Work in Progress or semi-processed goods, & finished products, Accounts Receivables (payments we need to receive from our customers), (Softwares used in Office premises for Accounting, Inventory, Payroll), Prepaid Expenses (expenses like Internet bills which the company would have paid for a full calendar period), Cash & Bank Balances of Garden World

Note: The Element needs to be created at the * Organisation

Search Key: The Accounting Codes are called as Search Key: In any Organisation there will 4 levels of classification Header, Breakdown, Account, Sub Account

For Garden World: Headers are called as Owner’s Equity, Liabilities, Assets, Revenue & Expenses)

Breakdowns are 1 level below the Headers: For ex: Under Owner’s Equity: Share Capital & Retained Earnings

Liabilities: Long Term Liabilities & Short Term Liabilities

Revenue: Revenue from Operation & Other Income

Expenses: Cost of Goods Sold, Sales & Admin Expenses, Employee Expenses etc

Accounts: Under Breakdowns, the Accounts are the next level drill down

Owner’s Equity: Equity Share Capital & Reserves & Surplus are called as Accounts

Liabilities: Long Term Debt, Long Term Mortgages are Account Heads under Long Term Liabilities, Current Period of Long Term Debt, Cash Credit, Bank Overdraft are called as Accounts under Short Term Liabilities

Revenue: Revenue from Goods Sold, Revenue from Services are account heads under Revenue from Operation\

Expenses: Product COGS, Inventory COGS are account heads under Expenses

SUB ACCOUNT:

Owner’s Equity: Paid Up Capital is a Sub Account

Liabilities: Long Term Debt: Individual Debt from Banks (Wells Fargo) are Sub Accounts

Revenue: Revenue from Sale of flower pots are Sub Accounts

Expenses: Cost of Purchases of seeds, fertilizers, Salary, Rent, Electricity, Telephone Bills are all sub-accounts

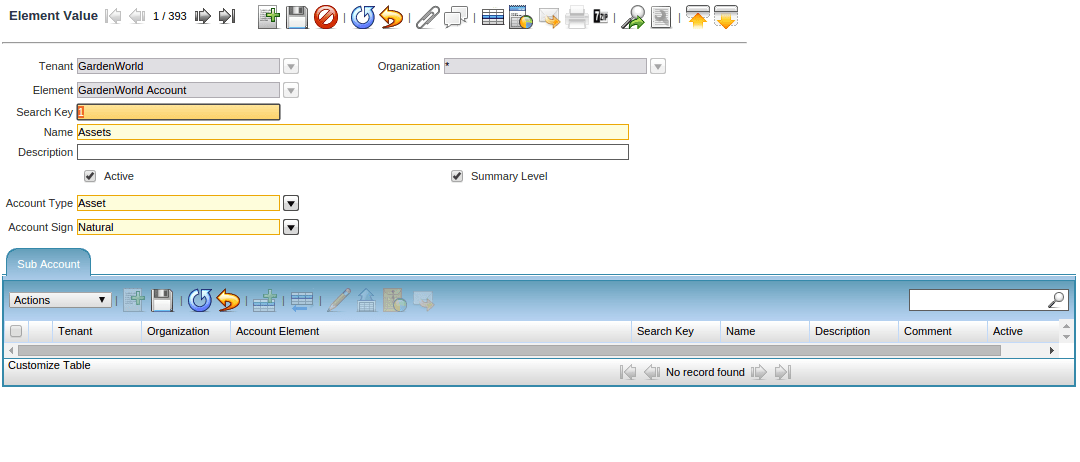

Element Value Creation

Search Key: The Header/Breakdown/Account/Sub Account Code defined for each element value created

For Ex: for Garden World

Header: Owner’s Equity Search Key: 1

Breakdown: Share Capital Search Key: 100

Account: Equity Share Capital: 1001

Sub Account: Paid Up Capital 100101

Summary Level: For Header, Breakdown, Accounts alone, the Summary Level check box needs to be clicked in order to total the values under Each

For Sub Accounts: The Account Type either has to be Asset, Liability, Expense, Revenue or Owner’s Equity

Account Sig: Has to be natural only

Post Actual: Check box needs to be selected for Sub Accounts, Budgets can also be defined

Document Controlled mechanism helps in maintaining number sequence

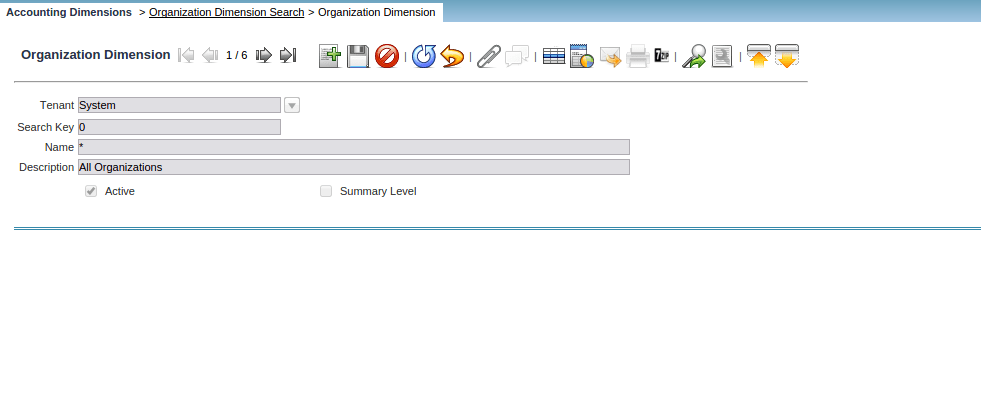

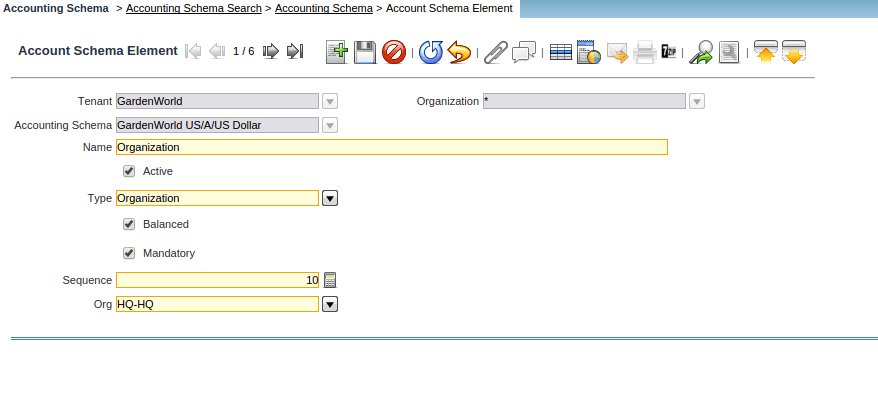

Accounting Dimensions

Accounting Dimensions refers to the number of Companies which can be created under Organisational Structure

The Search Key, Name of the Organization and whether to define it at Summary Level can be defined in this window

**Note: There can be only 1 Account Tree in Compiere.

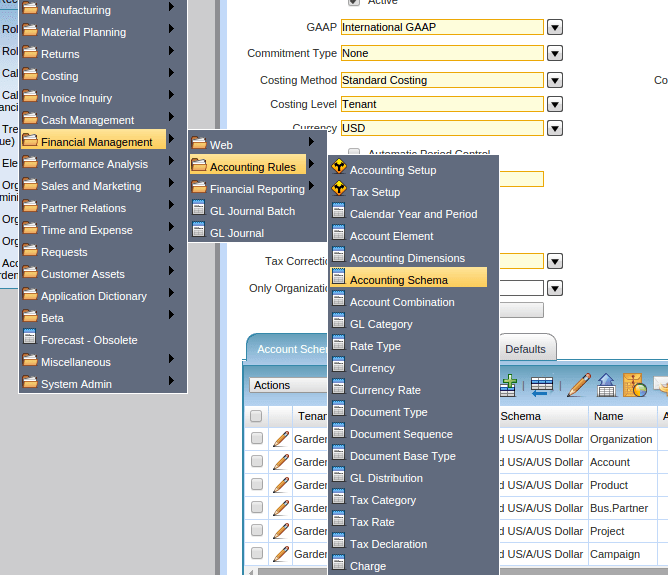

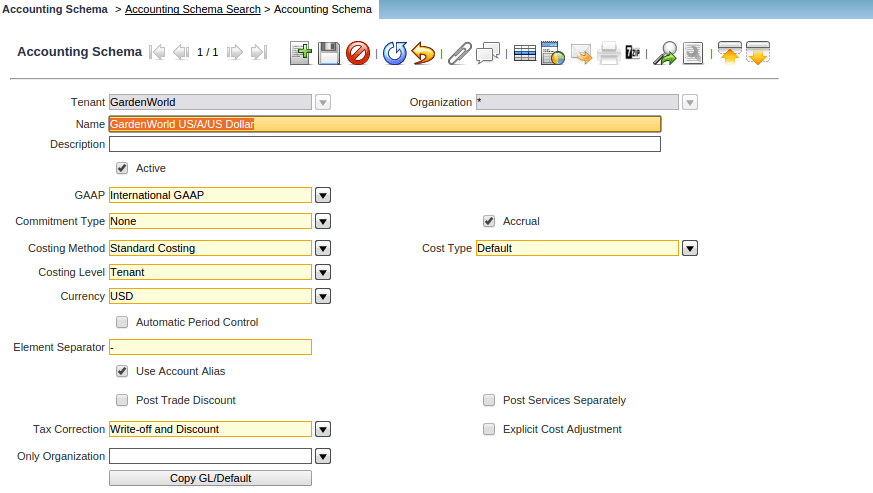

Accounting Schema

Accounting Schema will help in defining the Accounting Practice (US GAAP, IND AS), the costing methodology (Standard, FIFO, LIFO, Average), the Currency of the transaction at Organisational level, (USD) & tax corrections

(in case of any write-off, discounts or any other standard methodology needs to be practiced across Organisation)

The following are the Account Tree structure places to be effected. Organization, Account, Product, Business Partner and any other which can be added

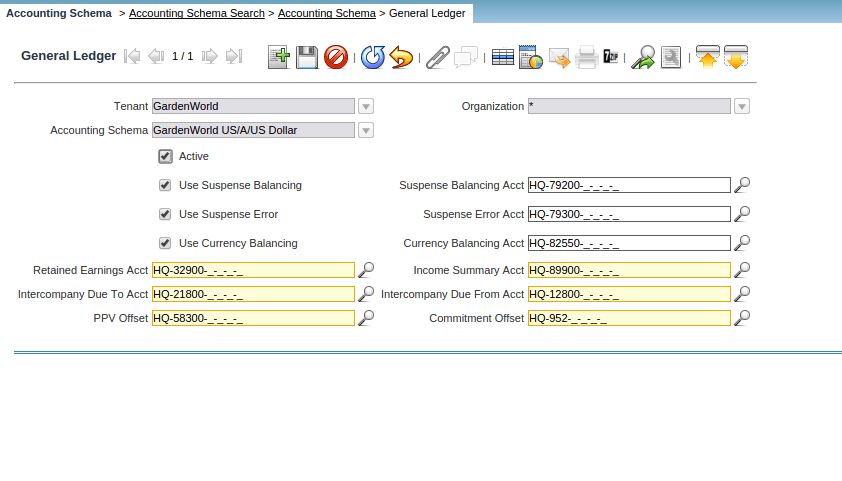

Accounting Schema General Ledger

use Currency Balancing, Use Suspense Error & Use Suspense Balancing check boxes need to be clicked

Currency Balancing: The Currency Balancing Account indicates the account to use when a currency is out of balance (generally due to rounding)

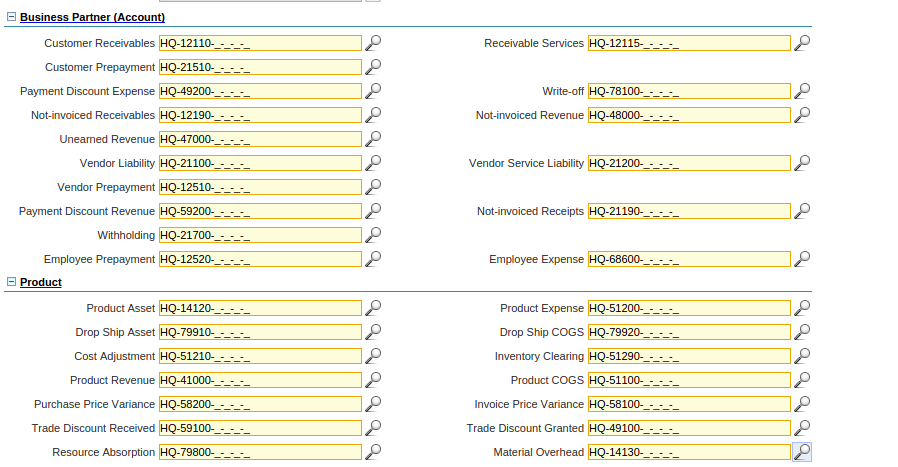

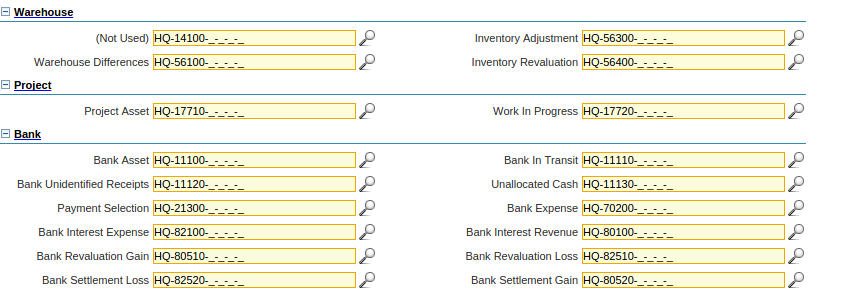

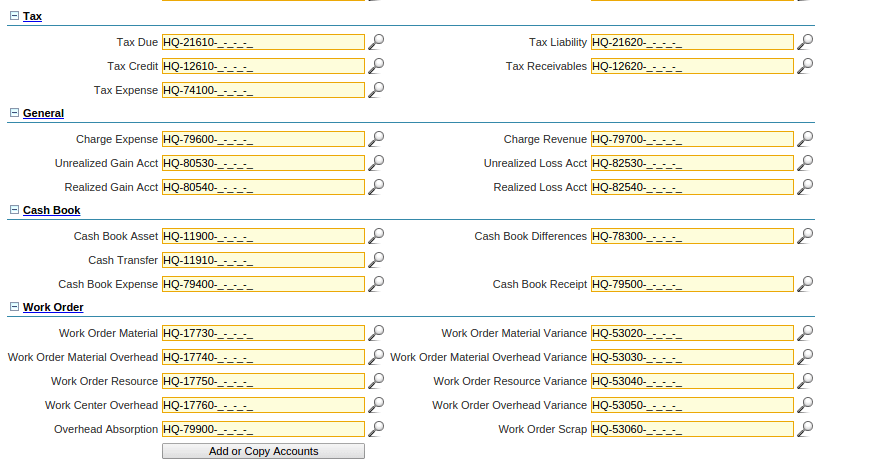

Defaults Sub Tab

The default accounting configurations for Business Partner, Product, Warehouse, Bank, Tax, Cash Book, Work Order can be defined here

Based on this the same, once configured, the accounting codes can be replicated to all the above across Compiere

**Note: The definition of the account codes have been individually captured in the modules above Business Partner, Product, Warehouse, Bank, Tax, Cash Book, Work Order

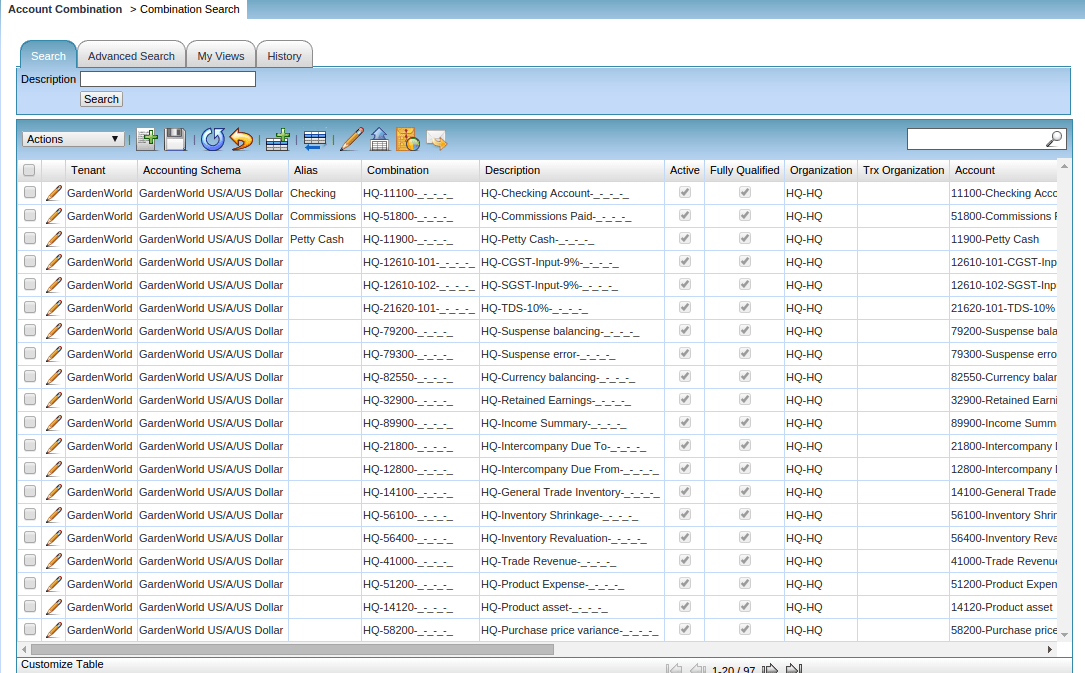

Account Combination

The Account Combination Window defines and displays valid account combinations.

Through this window, the process can be used to pre-define and configure for Each Organisation the accounting

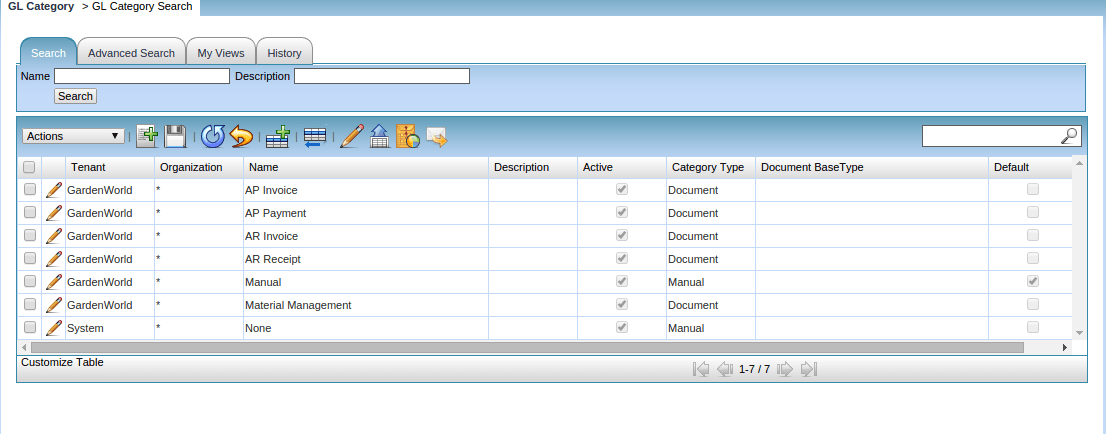

GL Category

The GL Category Window allows you to define categories to be used in journals. These categories provide a method of optional grouping and reporting on journals

Some of the examples of GL Category for include AP Invoices, AR Invoices, Material Management, AP Payment, AR Receipt for the purpose of defining the Document Type

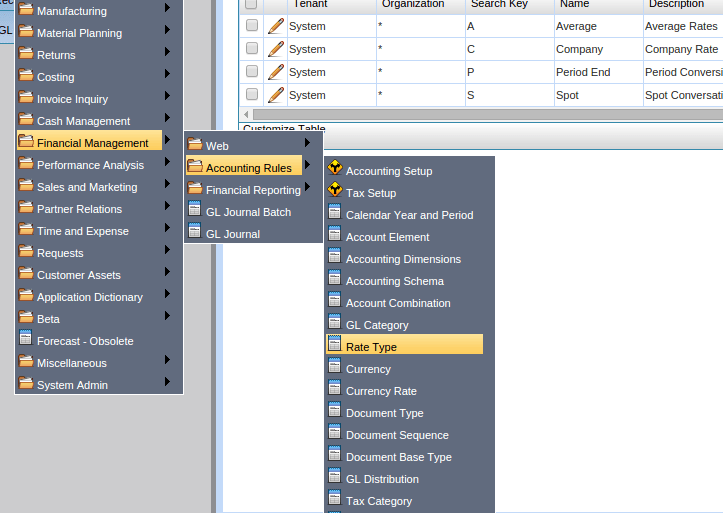

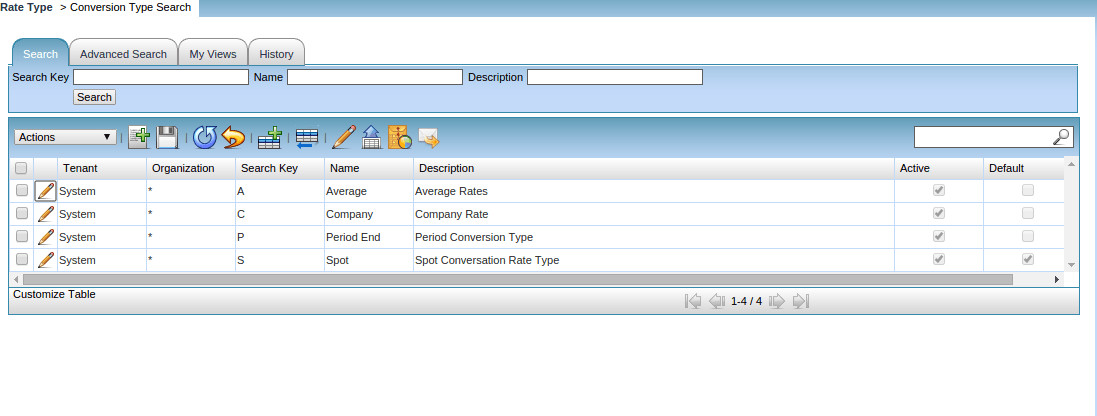

Rate Type

The Currency Conversion Rate Type lets you define different type of rates, e.g. Spot, Corporate and/or Sell/Buy rates.

For ex: This can be used for Buying/Selling Garden World commodities into the Stock/Commodities market through Spot/Future/Average Rates

This will help at the time of defining the exchange rates for the individual currencies with which Garden World does transactional activities

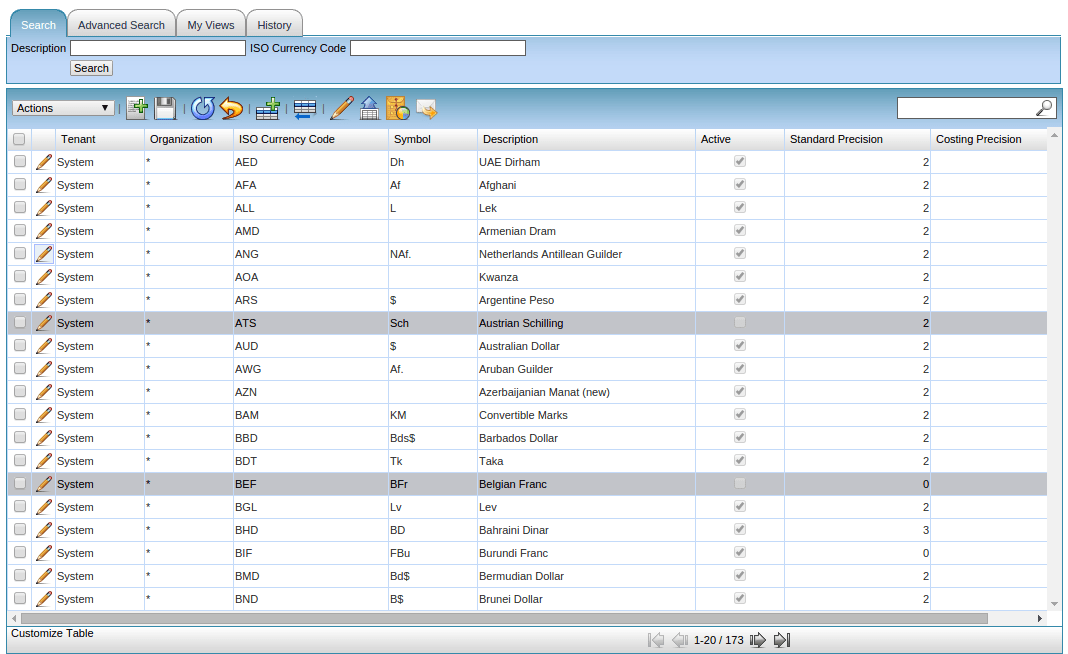

Currency

The Currency Window defines any currency which will be used in documents or reporting

For Garden world , the currencies used for Purchase/Sale of Garden products can happen in any currency including USD, GBP,Euro, SGD (Singapore Dollars), Australian Dollars, Canadian Dollars etc

Hence the default system provides the Currency, their short form & the full name terminology

Defining the exchange rate

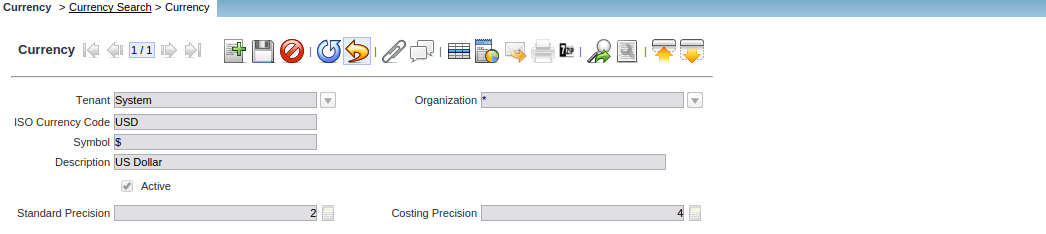

Creation of New Currency

Tenant: Garden World, Organisation: *, ISO Code : Currency Code (Ex: USD for American Dollar), Symbol (of USD $) & Description: US Dollar

Standard Precision: The number of places of decimal for rounding off for accounting purpose

Costing Precision: The number of places of decimal for rounding off for costing purpose

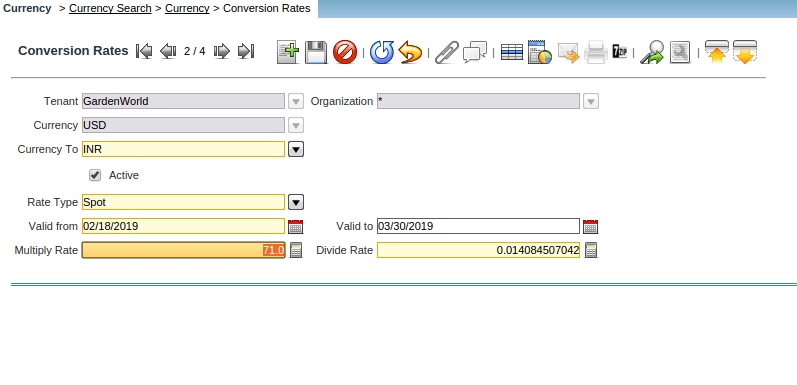

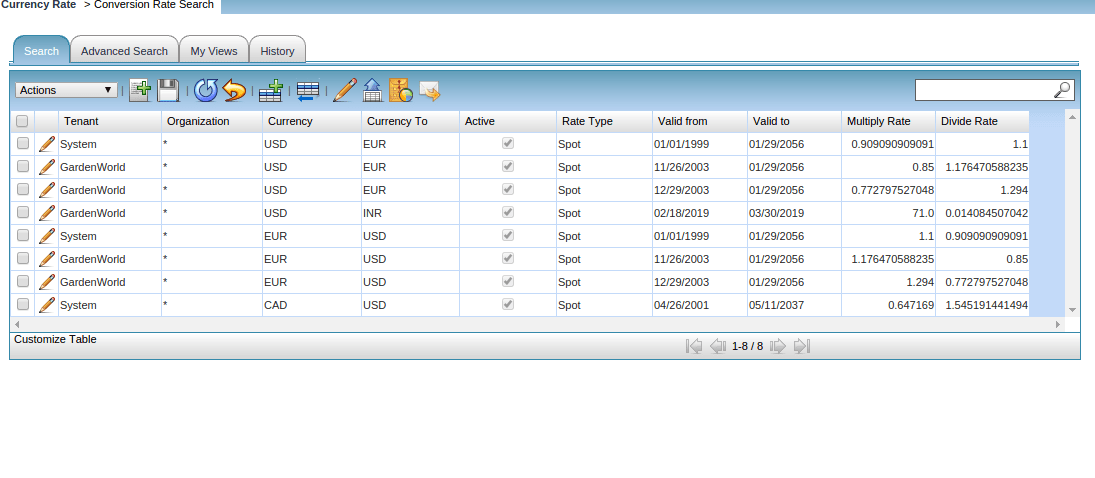

Conversion Rates

The Conversion Rate Tab defines the rates to use when converting a source currency to an accounting or reporting currency. Note that only the multiply rate is used; the divide rate is for visualization only

The exchange rate can be defined on a daily basis, weekly basis, monthly basis, quarterly basis based on Garden World’s Financial Advisors approval

For ex: Garden world can get into a contract with a Purchase Vendor in Euro Currency for a quarter (January 2019 – March 2019) and agree that the exchange rate between the parties will remain the same irrespective of

International Spot Markets fluctuation

Tenant: Garden World; Organisation: *; From Currency (always USD as Organisational Currency is USD); To Currency (Any other Currency); valid From & To Date: Need to be defined, Multiply Rate: As per Exchange Rate

The divide by automatically gets calculated

Currency Rate

The exchange rates defined against individual currencies will be displayed in this window

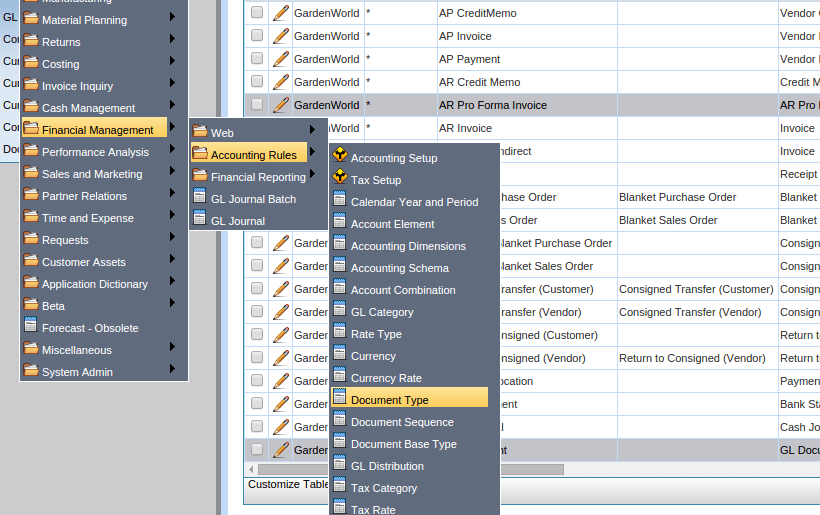

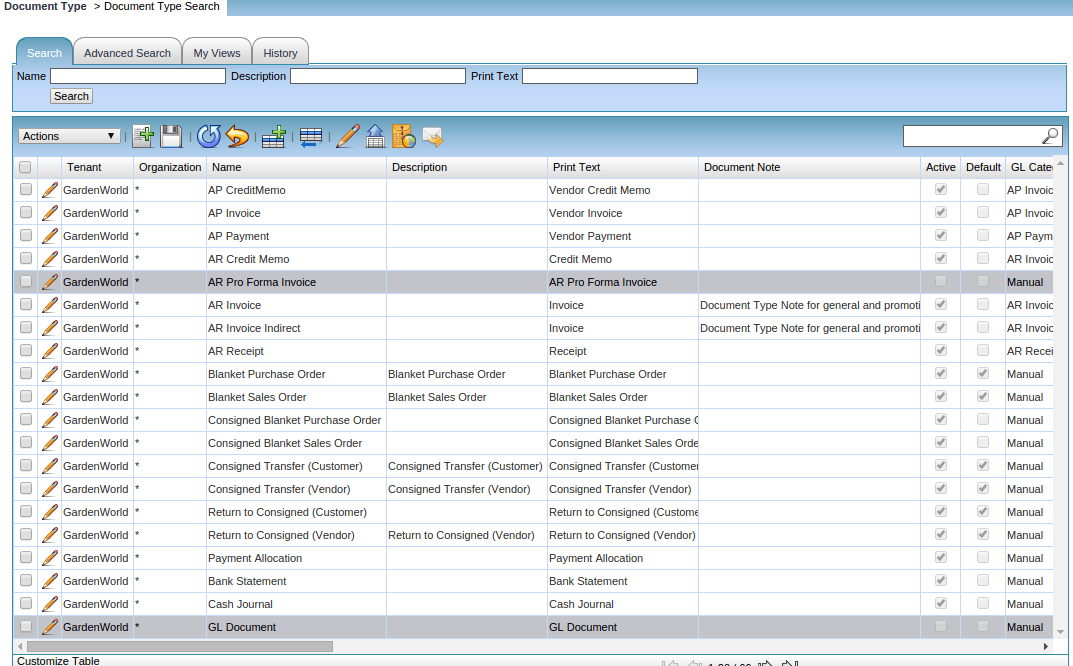

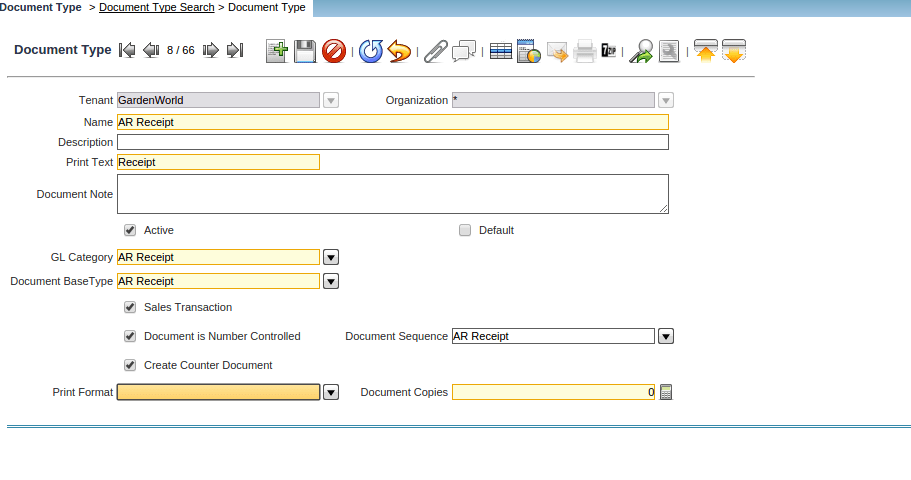

Document Type

The Document Type Window defines any document to be used in the system. Each document type provides the basis for processing of each document and controls the printed name and document sequence used

For Garden World Document Type will include Vendor Invoice, Vendor Payment, AR Receipt, Return to Consigned (Customer )etc

- Tenant: Garden World; Organisation: *; Name: AR Receipt/AP Payment etc; GL Category needs to be defined as AR Receipt (from GL Category window, the Document Base Type is a dropdown from where Multiple Documents can share the same base Document Type (For Garden world ex: All Foreign Receipts, local receipts, Inter-Country State receipts of from customers can all have base document type as AR Receipt

- Sales Transaction: Checkbox to be selected if related to Sales alone

- The document is Number Controlled: Will have a Document Sequence number automated if checkbox selected

- Document Sequence: Based on the above checkbox selected, the Document Sequence for AR Receipt can be defined

- Any Default or System configured AR Receipt format can be linked through Print Format

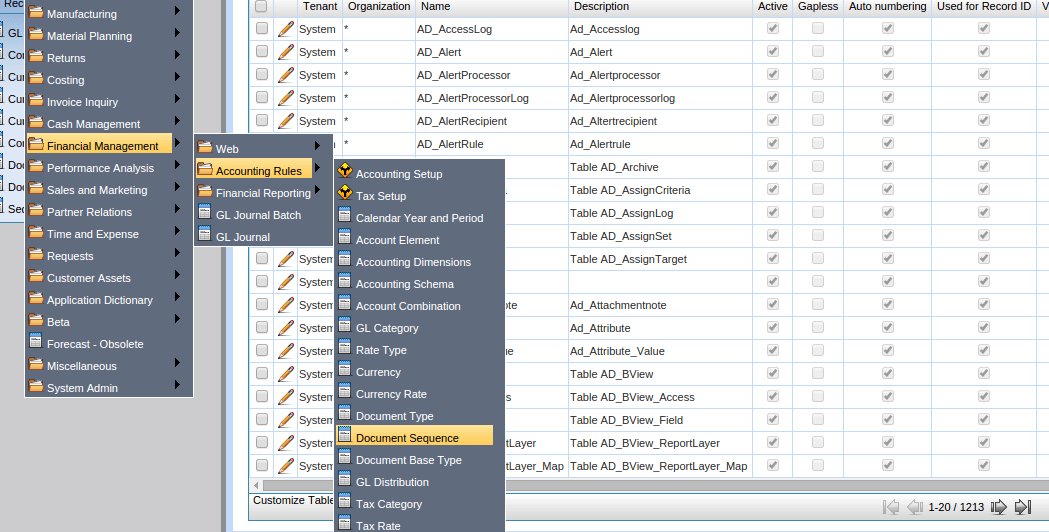

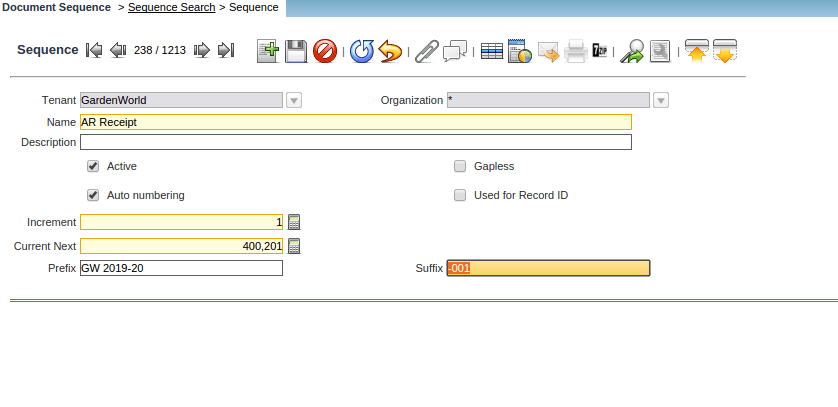

Document Sequence

The Sequence Window defines how document numbers will be sequenced. For Each Document Type, Prefix & Suffix can be added for various tables

For Ex: For Garden World for AR Receipt can be with Prefix – GW 2019 – 20 & Suffix can – 001 Hence the Document will have auto-numbering with GW2019 – 20 – 001

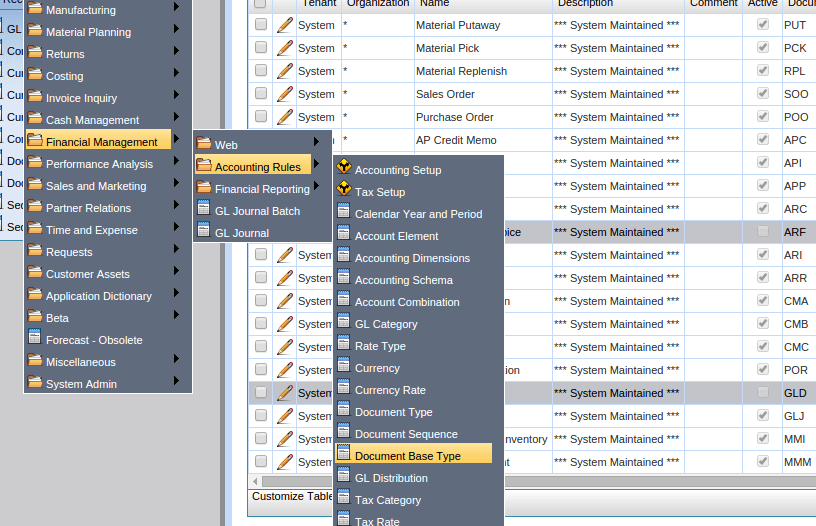

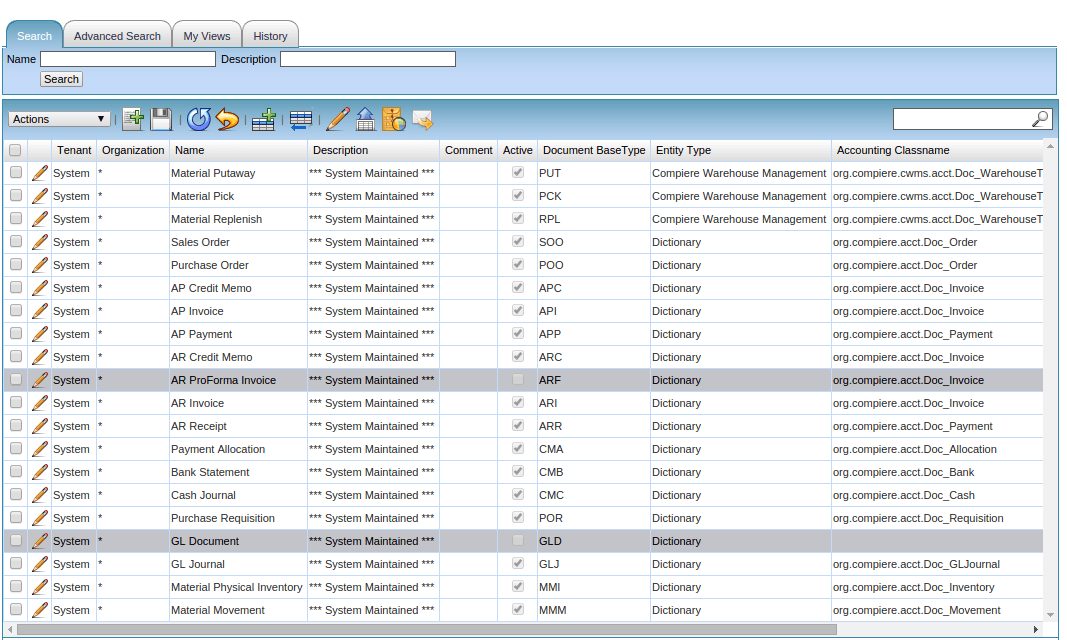

Document base Type

The accounting document base type determines how the transaction records are accounted for. This allows users to create custom documents and accounting rules

Different Document Types can have same Document Base Types

For ex:

Tenant: System;Organisation*; Name: AR Receipt, Description: ***System Maintained*** (always), Document Base Type: ARR, Entity Type: Dictionary, Accounting Classname:

This will be configured by the technical consultant

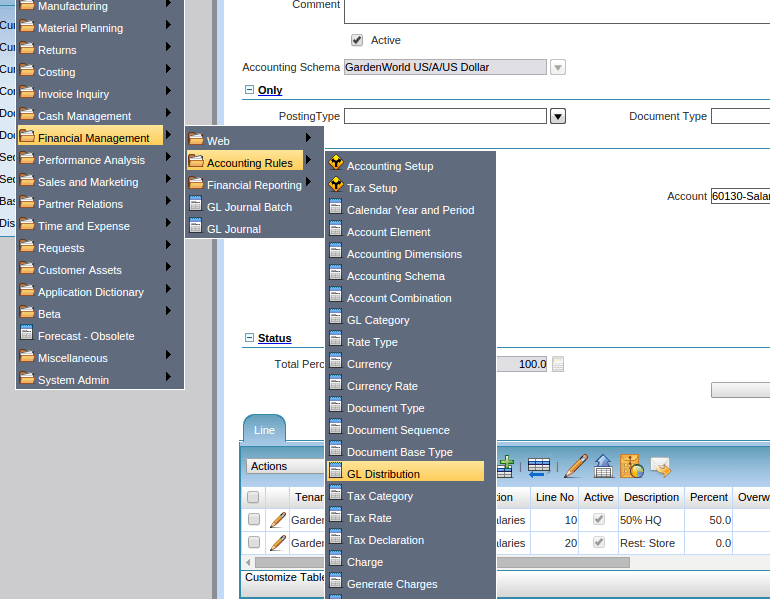

GL Distribution

This process helps in the allocation or transfer of costs from 1 Organisation to Another Organisation for want of finding the Actual Profit & Loss of individual Organisations

For ex: For Garden world, there are 3 Organisations (HQ, Stores, & Garden Stores)

Certain costs like Rent, Electricity, etc and their vouchers are all handled by HQ and booking happens in HQ only. But the actual costs need to be apportioned to Stores & Garden stores

Hence this process can be used for the same

Tenant: Garden World; Organisation:*; Name: Distribute Salaries; Accounting Schema: Garden World (General Ledger); Posting Type: Actual/Budget can be defined; The necessary document types

like AP Invoice, AR Invoice; The Account Code: 60130 – Salaries, 61100 – Rent, etc can be defined here; The Business Partner, Product, Project, and any other parameters can be selected for apportionment

The Lines are created in order to define the % of apportionment of expenses

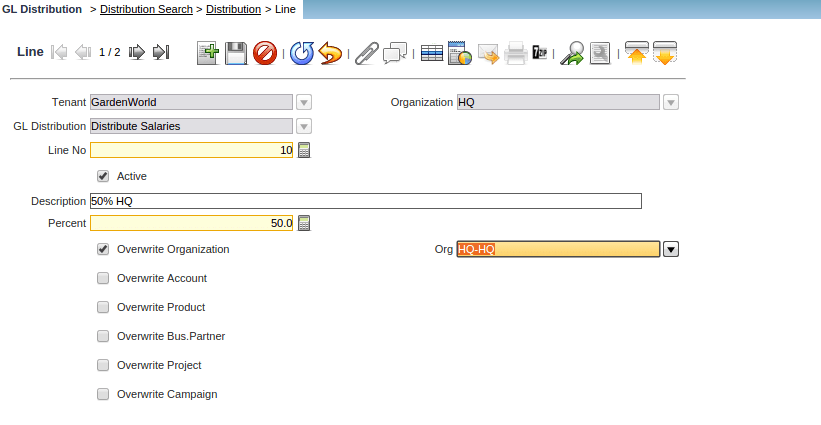

Tenant: Garden World, Organisation: HQ (in order to select from & to Organisation); GL Distribution selected in the header will get carried forward; the Percentage needs to be defined

(limited maximum of 100% anything in excess will be not allowed); Organisation will have to be From & TO with Over right Organisation checkbox to be selected in order to over right the Initial Organisation which was

selected for Transactions

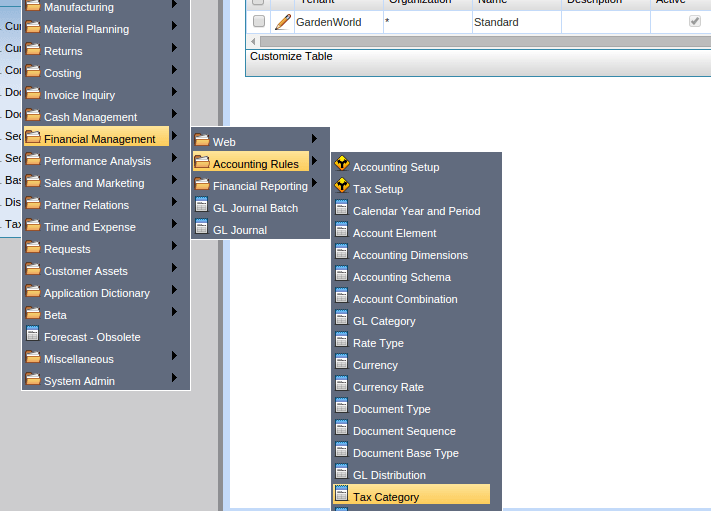

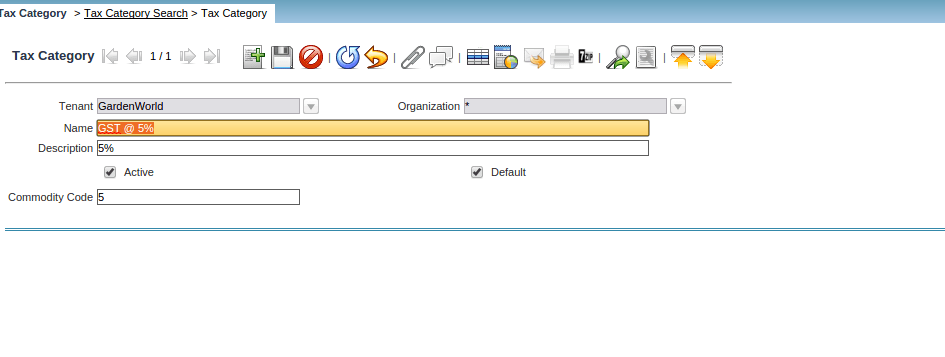

Tax Category

The Tax Category Window is used to enter and maintain Tax Categories. Each product is associated with a tax category which facilitates reacting changing tax rates

For ex: for Garden world, seeds can be taxed at GST of 5% whereas the Cars Purchased can be taxed at GST 10%

Hence GST with multiple Rates can be defined in this window

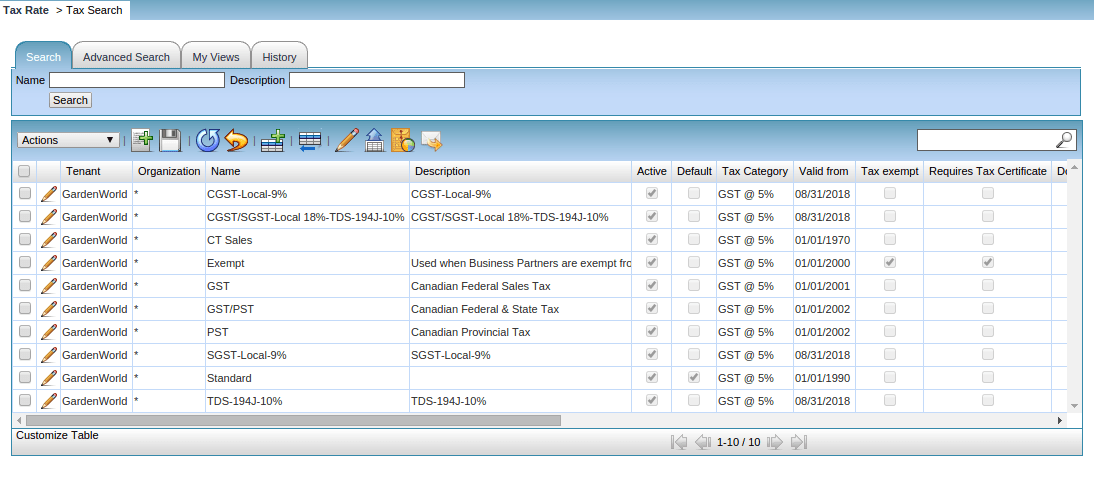

Tax Rate

The Tax Rate Window defines the different taxes used for each tax category. For example, Seeds will have different taxes, clusters will have different tax rates in each state

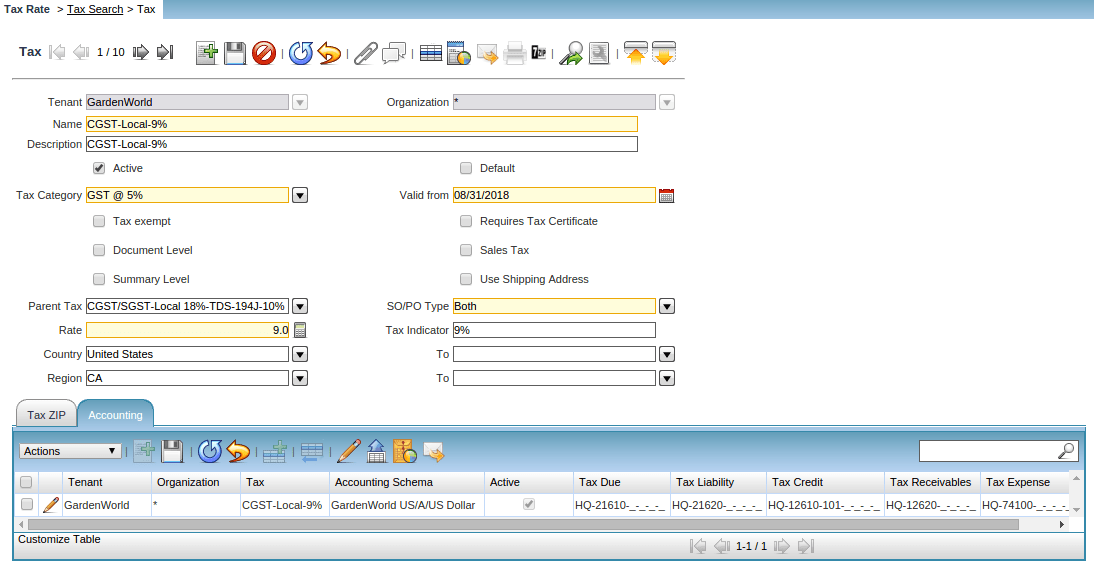

Tenant : Garden World; Organisation: *; Name & Description: CGST @ 9%, Tax Category: GST @ 5%; Valid From Date: Date field; Parent Tax (in case there are cascading taxes); Rate in %,

whether applicable for both Sales & Purchases need to be defined

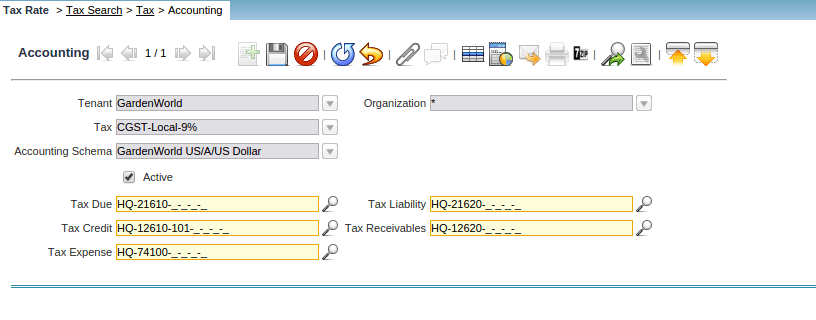

Configuration of Taxes with G/L Codes

- Tax Due & Tax Liability: Taxes which are part of Vendor Payables need to be configured under these G/L Codes

- Tax Credit & Tax Receivables: Taxes which are part of Customer Receivables need to be configured under these G/L Codes

- Tax Expense: Those Taxes for which Tax Credit cannot be taken and need to write off to Profit & Loss Accounts are classified under these G/L Codes

For ex: For Garden, if the seeds clusters which are procured from Ohio contain taxes, which cannot be claimed by Nevada state, these taxes need to be written off as expenses