Product Pricing

Choosing the Right Pricing Strategy for a Retail Product

Pricing is a critical factor in retail success. Choosing the right pricing model can maximize profits, attract customers, and ensure competitiveness.

Indian retail pricing is a mix of cost structures, taxes, and competitive strategies. Whether you run a small store, an e-commerce business, or a large retail chain, understanding these components helps in optimizing profits while staying compliant. Below is a breakdown of key retail pricing models, their advantages, disadvantages, and best use cases.

1. Key Components of Retail Pricing in India

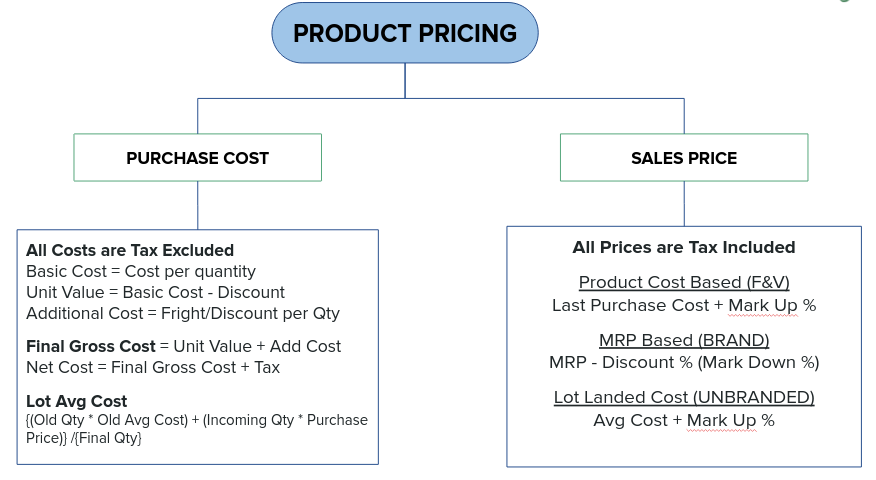

A. Cost Price (CP)

- The price at which a retailer purchases the product from the manufacturer or wholesaler.

- Includes:

- Purchase Cost (with/without discount)

- Transportation & Logistics

- Import Duties (if applicable)

B. Wholesale Price (WP)

- The price at which distributors sell to retailers.

- Typically includes a 10-30% markup over the cost price.

C. Maximum Retail Price (MRP)

- The highest price a retailer can charge, as per Indian law.

- Must be printed on all packaged products.

- Includes:

- Manufacturer’s Cost + Profit

- Distributor/Wholesaler Margin

- Retailer Margin

- Goods & Services Tax (GST)

D. Selling Price (SP)

- The final price at which the product is sold to customers.

- Can be equal to or lower than MRP (but never higher).

- Retailers may offer discounts below MRP.

2. Pricing Strategies Used by Odoo Retail (Indian Retailers)

A. Cost -Plus Pricing (Markup Pricing)

- Formula: Selling Price = Cost Price + Profit Margin (%)

- Common in Grocery stores & small retailers.

B. Discount Pricing (Markdown Pricing)

- Prices are set based on discounts below MRP.

- Used for Branded products (Hamam, Gold Winner) in supermarkets.

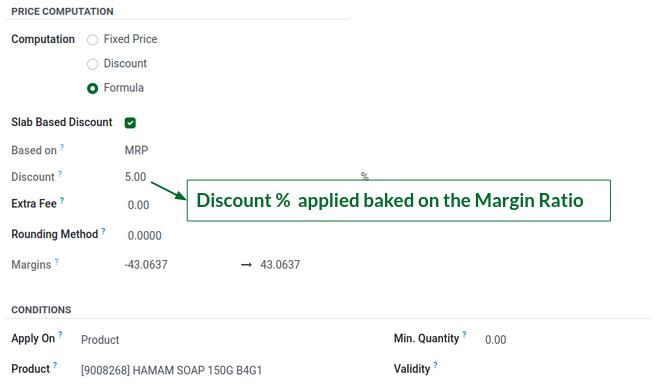

C. Dynamic Pricing (Margin Based)

- Prices change based on common margin slabs

- Discount applied on MRP

- Example: 1%-10% margin gets 2% Discount on MRP. 20%-40% margin gets 10% Discount on MRP.

D. Psychological Pricing

- Prices like ₹99, ₹499 to make products seem cheaper.

- Common in fashion, FMCG, and electronics.

E. Promotional Pricing

- Festival Sales (Diwali, Big Billion Days)

- Buy 1 Get 1 Free (B1G1), Cashback Offers

- Example: 50 % off on Specific Category/Brands/Products

F. Bill Value-Based Pricing

- Promotional strategy where a discount is applied automatically if the total bill value crosses a certain threshold.

- Example: Get 5% off on orders above ₹2,000

3. Taxes Impacting Retail Pricing in India

A.Taxes in Retail Pricing

- GST slabs:

- 0% – Essentials (milk, fresh food)

- 5% – Branded food items

- 12% – Processed food, cosmetics

- 18% – Electronics, furniture

- 28% – Luxury goods (with additional cess if applicable)

- GST is included in the MRP, not added separately at the counter.

Pricing Challenges

✔ Price Sensitivity – Indian consumers prefer discounts & low-cost options.

✔ GST Compliance – Different tax slabs affect final pricing.

✔ Competition from E-commerce – Online discounts pressure offline retailers.

4. Odoo Retail Price list

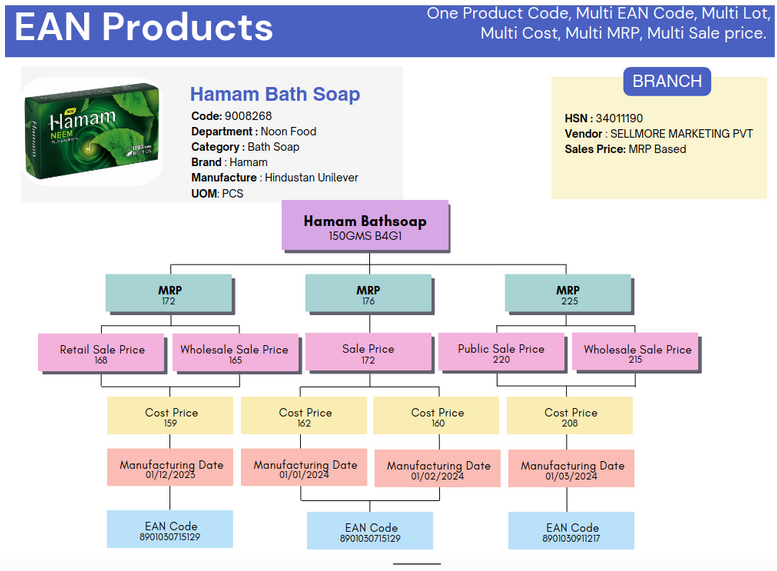

A. Multiple Prices per product

Assign different set of prices to each Companies and assign to Customers.

Example: Public Pricelist, WholeSale Pricelist, Membership Pricelist

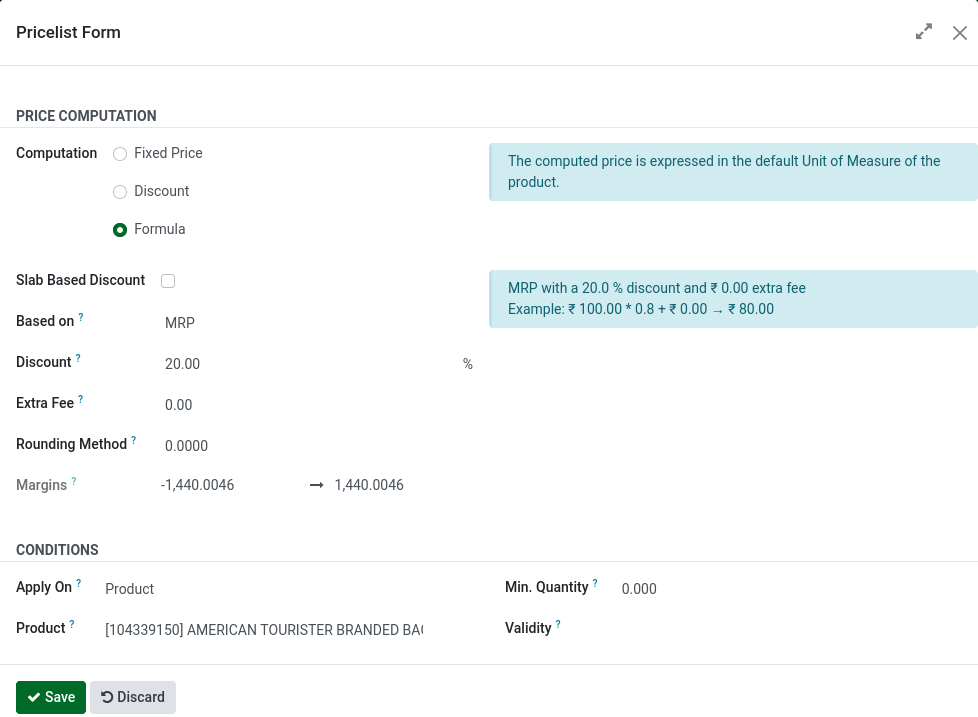

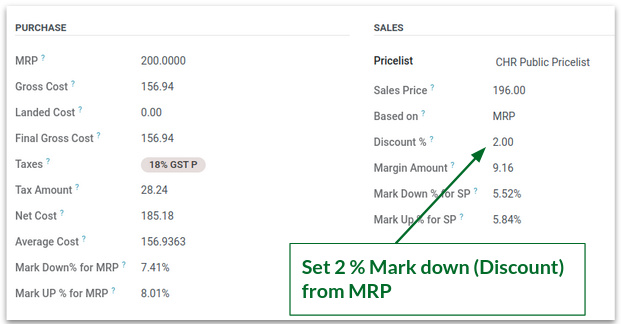

B. Advanced Price rules (discounts, formulas)

Price rules and apply discounts, margins, and roundings

Example: 2 % Discount from MRP, 10% Markup from Cost

C. POS Terminal / Company Based

Set different price lists specific to company or branch in POS terminal.

5. Screenshots

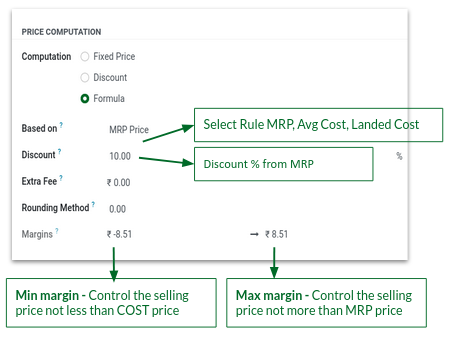

A. Selling Price – MRP Based (Branded Products)

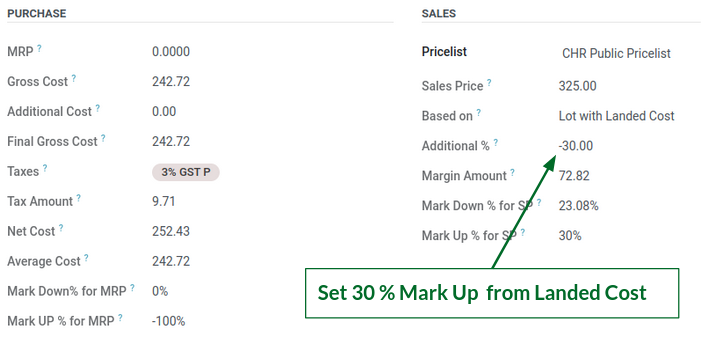

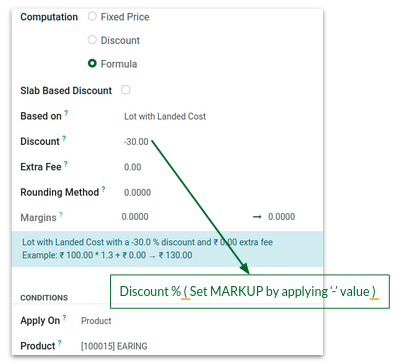

B. Selling Price – Lot Cost Based (Unbranded Products)

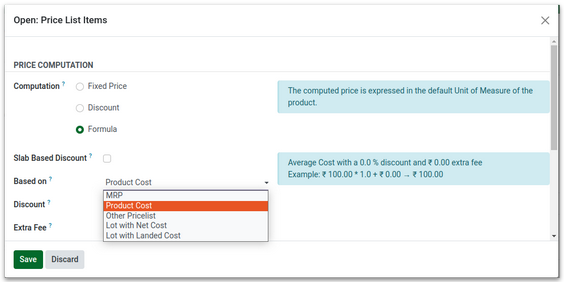

C.Selling Price – Product Cost (F&V)

D.Selling Price – Slab Based (Margin Ratio)

6.Price Info – Example

Set 2% Mark Down from MRP

Set 30% Mark up from Landed Cost