Odoo 18 Accounting EE

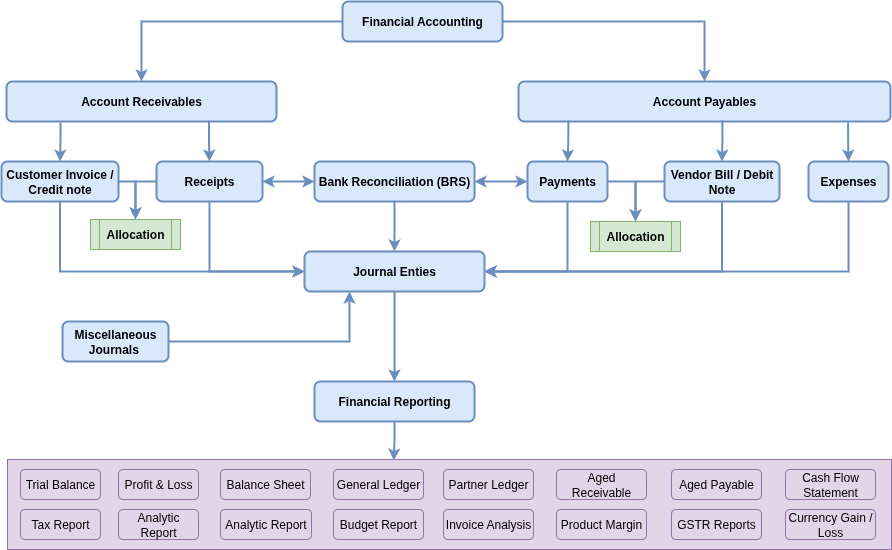

The Accounting module in Odoo, fully integrated financial management system designed to streamline and automate all accounting processes. It caters to businesses of all sizes, enabling accurate financial tracking, compliance and reporting.

Accounting module supports multi-currency, multi-company and multi-chart of accounts configurations. It automates journal entries, reconciliations, tax calculations, and financial consolidations, providing real-time financial insights and ensuring regulatory compliance. Seamless integration with Sales, Purchase, Inventory, Manufacturing, Payroll and other Odoo modules guarantees consistency and efficiency across all business operations.

Advanced features such as automated bank Integration and synchronization, payment follow-ups, budgeting, and audit trails empower organizations to improve cash flow management, optimize tax filings.

Workflow

Accounting Key Features/ Business Rules

- Location based Chart of Accounts Master Configuration with Single or Multiple Companies

- Allow to make the Transaction in different Currencies

- Multi-Currency Transaction with Exchange rate Conversion

- Exchange Rate Sync on Daily Basis

- Forex Gain/Loss Entry while making reconciliation export Invoices, Import Bills, Debit Notes, Credit Notes with Payments and Receipts received other than Company’s currencies

- Manage the different type of Payment Terms

- Due Date Calculation Based on Payment Terms

- Manage customer credit Limits

- Based on Due date Sales person will follow-up the pending Payments

- Invoices, Bill, Credit Notes, Debit Notes and Payments, Receipts will pass Journal Entries automatically

- Odoo Accounting based on Dual Account Posting system with Debits and Credits

- All Stock moves will pass Journal Entry for Inventory Valuation purpose

- Bank Reconciliation Statement(BRS) process through auto Synch or through manual import of bank statements

- Auto Matching Payment reference and with BRS statement reference

- Taxes (GST, IGST, TCS, TDS…etc) calculation based on tax master configuration and tax grouping

- Financial reports (Trial Balance, Balance Sheet, Profit & Loss, Cash Flow, General Ledger, Payable, Receivable…etc) with Accounting Standards

- Audit trails track all changes to financial entries, user actions, and approvals for compliance and security

- Invoices, Bills, Credit Notes, Debit Notes, Payments Posting with an Manager Confirmation to avoid the financial security and risks

- Cost Centers and Analytic Accounts enable detailed accounting posting tracking for profitability analysis purpose

- Consolidated report to view simple and easy report across all the companies

- E-Invoicing and Eway bill Integration with Customer Invoices based customer GST type Odoo 18 Accounting EE

- E-Invoice and Eway bill Cancellation process handled in case of any mistakes

- E-Invoice and Eway Bill Error handling for the user Mistakes

- Cash Rounding based on Line level and Header Level

- Discount Based on each Line level to Provide the different discounts based on the products

- Invoice print with Total Amount in words

- QR Code Based Payment Using Invoice Print

- Provision to Print the Bank cheques

- PDF Document Digitization to review it easily

- Import your bank statements with different type of files (CSV, XLS, and XLSX)

- Product Level Margin Analysis

- Configurable Fiscal years based on start and end dates

- Easy GSTR reports and Directly Submit it

- Lock dates period wise based Customer Invoice level, vendor Bill level and Company Level to Make the Old data security

- Capture the Payment methods in Invoice/Bill Level

- Customer Invoice, Vendor Bill, Debit, Credit Notes, Payments and receipts mark as to check, for the future Identification

- We can able to generate Single Invoice with Multiple Sale Orders with same customer

- We can able to generate Single Bill with Multiple Purchase Orders with same Vendor

- Different Type of Taxes configuration

- Fiscal Position Configuration with Auto detect based on Country and state

- Fiscal Position Configuration with manual mapping in Customer and Vendor

- Prepare the Custom template to Export the Data for Reporting Purpose

- Easy to Maintain the Favourites and Filter for the future references

- Easy to Filter and group the Transactions

- Easy to make the default Values for required fields

Accounting Master Management

- Chart of Accounts (COA)

- Taxes

- Fiscal Positions

- Payment Terms

- Payment Methods

- Incoterms

- Bank Accounts

- Journals

- Analytical Plans

- Analytic Accounts

- Currencies

- Tax Groups

- Account Groups

- Account Tags

- Fiscal Years

- Cash Rounding

- Customers

- Vendors

- Products

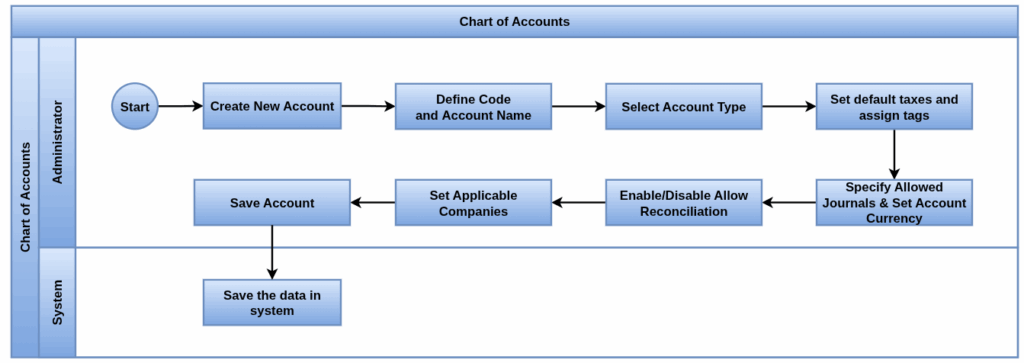

Chart of Accounts

Overview

The Ledger Master is a simple list of all the accounts that required to a business uses to make its debit and credit balances. It helps organize finances, making it easy to track income, expenses, assets and liabilities for reporting and Financial Team make the better decision based on balances.

Process Flow

Business Rules / Features

- Country Based Predefined Accounts

- Parent and Child Hierarchy wise account groups

- Hierarchy mapping is based on Account Code and it’s Group code

- Different Account Types (Asset, Expenses Liability, Income, etc.,)

- Multi-currency support for accounts handling foreign transactions

- Ability to import/export account lists for integration with other systems and update the bulk data at a time

- Ledger/Account Level default Tax Mapping is allowed

- Tags Mapping for the Better reporting and Cash flow purpose

- Account wise Allow Reconciliation Mapping

- Single Account with Multiple accounts sharing

- Account Code is Unique, to avoid the duplicates

- Account balance View easily

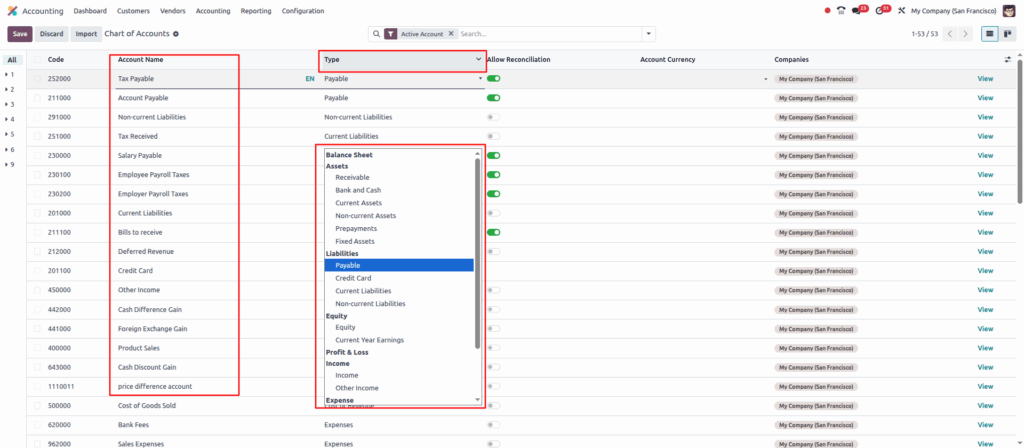

Screenshot

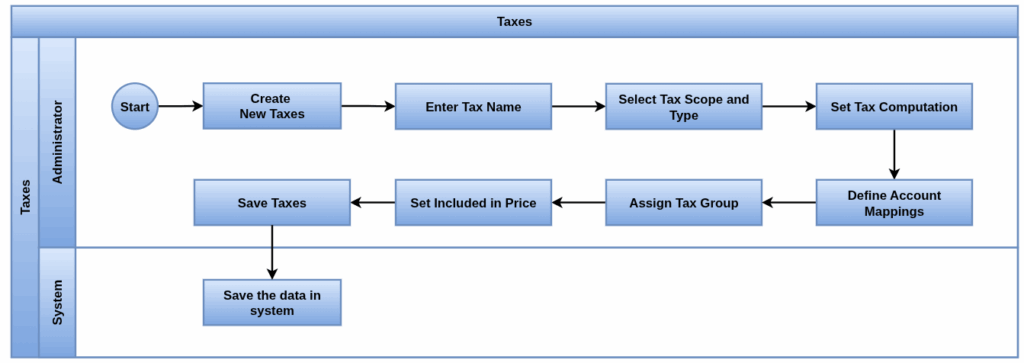

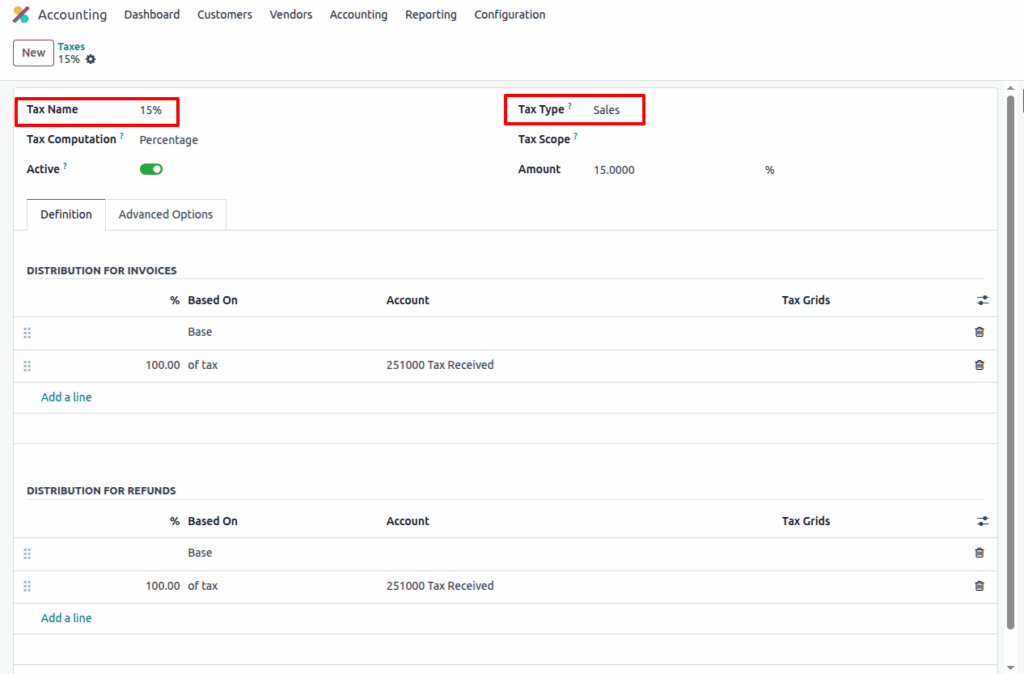

Tax Master

Overview

The Tax Master is the place where a company keeps all its tax details. It defines what type of tax (like GST, VAT), the percentage or amount, and where it should apply (sales, purchase) with group of taxes. This makes billing easier, ensures correct tax calculation, and helps in filing government returns on time.

Process Flow

Business Rules / Features

- Name of the Tax to Identify while selecting it in the Transactions

- Type of the Tax Sales/Purchase, to avoid the conflicts in between Receivable and Payable

- Scope of Taxes Goods or Service Taxes

- Different Type of Tax Computations Fixed, Percentage, group of taxes, etc.,

- Tax Rate or Percentage of tax to apply in the transactions

- Include Tax and Exclude tax provision to Apply tax computation

- Tax grouping to know the which tax is applied and Print it in PDF reports

- Tax Display Name in PDF reports

- Auto Tax Apply in transactions Based on mapping in product Master

- Company Wise Tax Mapping to maintain the Security

Screenshot

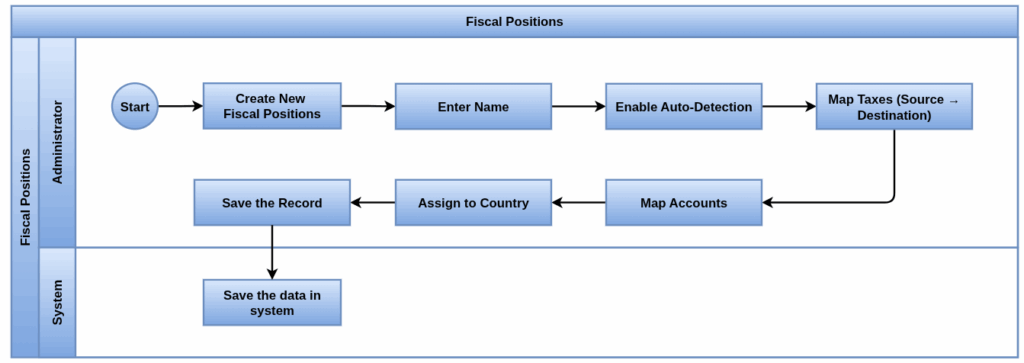

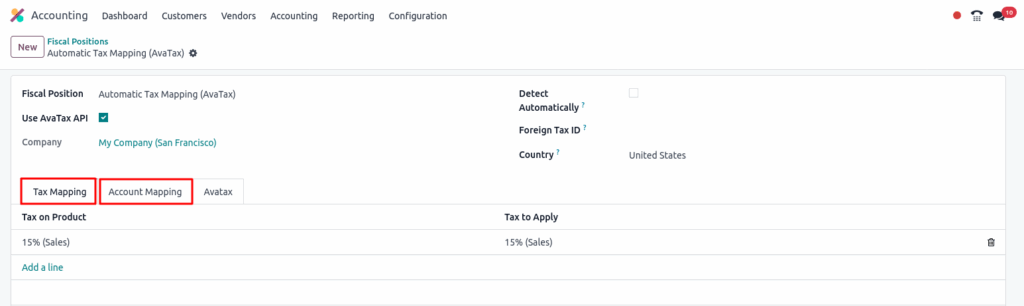

Fiscal Positions

Overview

The Fiscal Position is used to automatically map taxes and accounts in transactions based on customer or supplier requirements. It helps businesses handle cases like domestic vs. export sales, interstate vs. intrastate GST, or special exemptions. This ensures the correct tax and ledger accounts are applied without manual changes during invoicing or billing.

Process Flow

Business Rules / Features

- Name of the Fiscal Position to Identify while Mapping the Customer/Vendor Master

- Replace one tax with another (e.g., GST 18% → IGST 18% for interstate sales) using Tax Mapping

- Replace one Account with another (e.g., Ledger1 → Ledger2) using Account Mapping

- Provision to detect Automatically while making Transactions based on State/Country Mapped in Customer/Vendor Master

- Country Group Based Tax Mapping

- Company Wise Fiscal position mapping due the security

Screenshot

Payment Terms

Overview

The Payment Terms defines the Payment due days agreed with customer and Supplier from the date of invoices raised. It specifies the due days, installments, discounts, and credit period for payments. This ensures clarity between customer, suppliers and Company, smooth cash flow management, and avoids the late delay payments from customers.

Process Flow

Business Rules / Features

- Name of the Payment term to easily identify it in transactions

- We can Maintain Company wise common to all Companies

- Early Payments with Discount Option

- Due terms, Due days calculation based on it

- Easily view on next Installment date

- Easily Mapping in Customer and vendor Master to Apply default Terms in Transactions

- Easy to Payment Follow-up

Screenshot

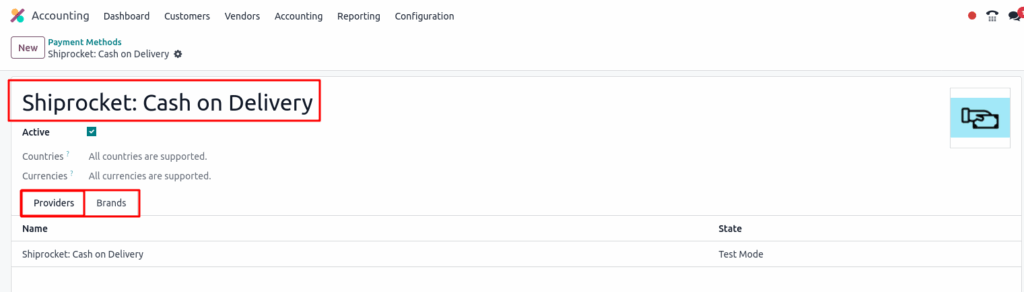

Payment Methods

Overview

The Payment Methods define the different ways a company can receive or make payments, such as Cash, Bank Transfer, UPI, Cheque, Credit/Debit Card, or Online Gateway. They help in tracking how money moves in and out of the business and ensure proper accounting entries.

Process Flow

Business Rules / Features

- Name of the Payment method to Easily Identify it (e.g., Cash, Bank, UPI, and Card).

- Payment Method Code to unique Identification

- Online Payment Integration with gateways like Razor pay, PayPal, etc

- Apply Payment Method Based on Allowed Countries

- We can map the Payment method with required currency

- Company wise mapping to maintain the own set of methods

Screenshot

Bank Accounts

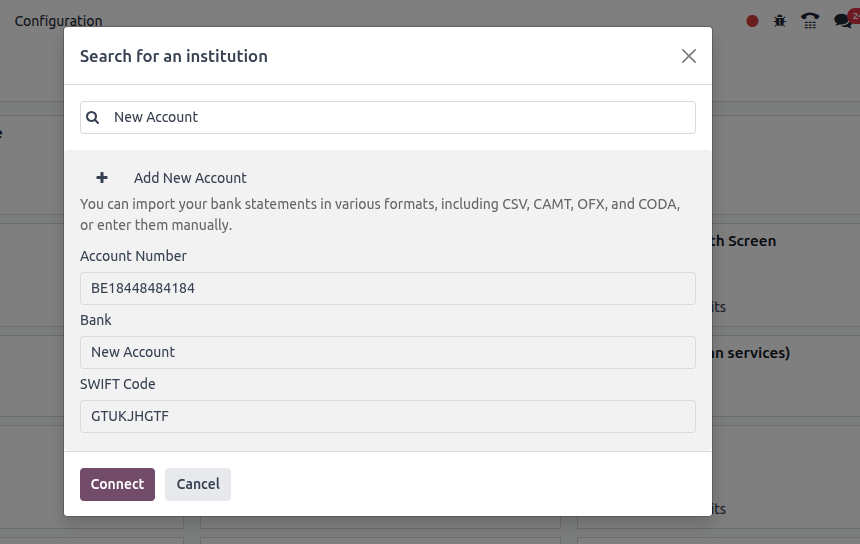

Overview

The Bank Accounts section in the system stores details of all company bank accounts used for business transactions. It allows linking payments and receipts directly with the correct account, making bank reconciliation, balance tracking and financial reporting purpose.

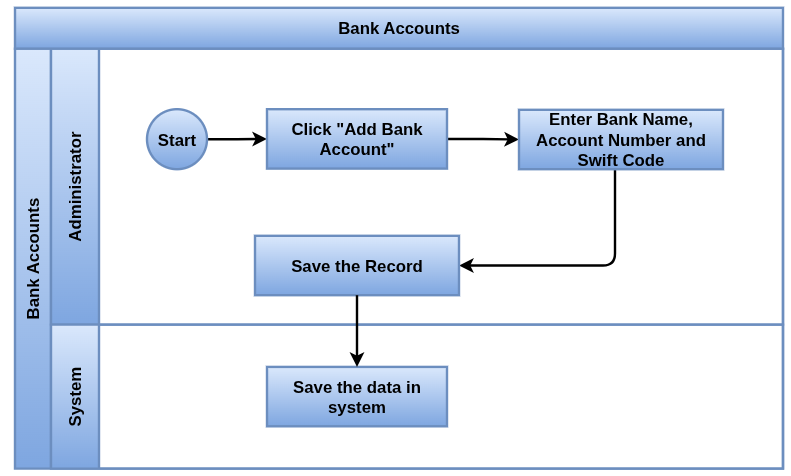

Process Flow

Business Rules / Features

- Name of the Bank Account to Maintain Unique Names and easily Identify it

- Account Mapped to Bank

- Phone Number of bank contact person

- Email Id of Bank Contact Person

- Bank Account Mapped with Journal and Customer, vendors

- Address Of the Bank to Identify where it is located

- Currency Mapping to the Bank Account

- Company Mapping to Bank Account to own set of accounts

- Mapping with Account Holder

Screenshot

Journals

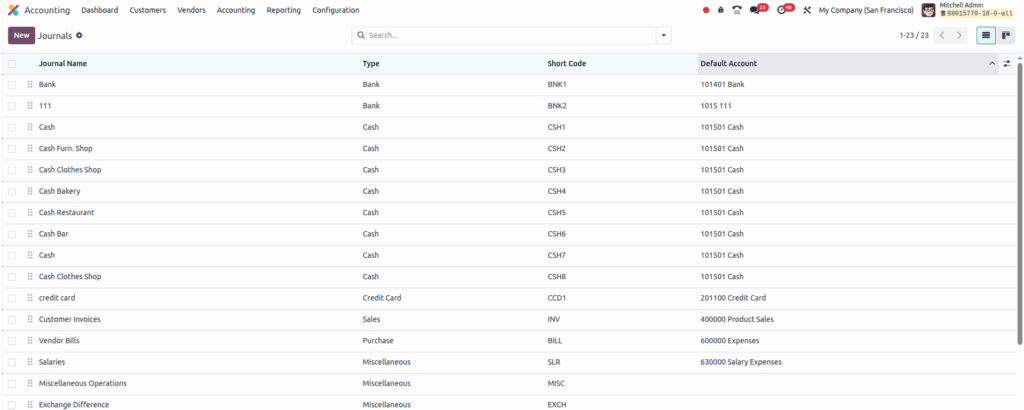

Overview

A Journal is a book of original entry where every financial transaction is first recorded before posting to ledgers. In an Odoo ERP/accounting system, journals define how transactions are grouped and tracked, like Sales, Purchase, Bank, Cash and Miscellaneous. They ensure transactions are properly classified and form the backbone of accurate account posting.

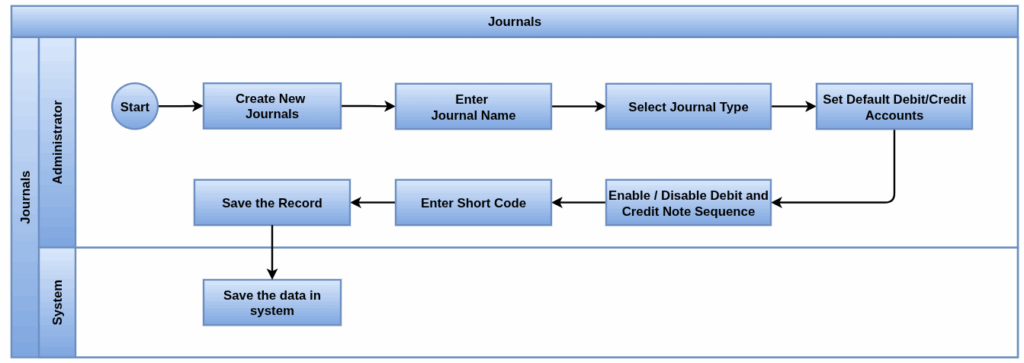

Process Flow

Business Rules / Features

- Name of the Journal to Identify easily

- Type of Journal to Identify and apply filters for reporting purpose (Sales, Bank, Misc, Cash, Purchase)

- Journal Based Separate Sequence Number to maintain the Record Numbers

- To make proper Accounting Posting Default Debit and Credit Accounts mapping

- Common to all companies or Company wise Mapping to maintain the separate sequences

- Journal Wise Currency Mapping if required

- Allowed Accounts mapping to provide the security

- Payment Communication Based on Customer or Invoice

- Payment Methods Linked to Journal

- Outstanding Receipts/Payments Accounts mapping

Screenshot

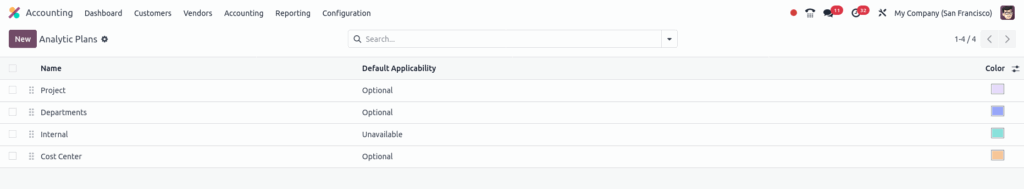

Analytical Plans

Overview

An Analytical Plan in Odoo is a framework to track costs and revenues across different dimensions of the business, such as projects, departments, regions. Instead of just looking at overall accounts, companies can create multiple plans to analyse financial data in detail. Each transaction can be split and assigned to one or more analytic accounts under different plans, helping management get a clear picture of performance and profitability.

Process Flow

Business Rules / Features

- Unique Name of Plan to Identify it easily

- A cost center was created as part of the analytical plan

- Hierarchy Level mapping is allowed using parent mapping

- Default Applicability have three Options Optional, Mandatory, unavailability

- Applicability is mandatory the system will allow to enter before confirm or Validate the record

- Colour Coding is available to quick identification in Reporting and Transactions

- Each Company can define its own set of plans to own reporting purpose

- Domain Applicability, Define where the plan applies (Invoices, Vendor Bills, Purchase Orders, etc.)

- Financial Account Prefixes, Restrict plan usage to specific account ranges

- Product Category Mapping, Apply plans automatically based on product categories

- Reporting, Provides detailed profitability and cost reports by dimension

Screenshot

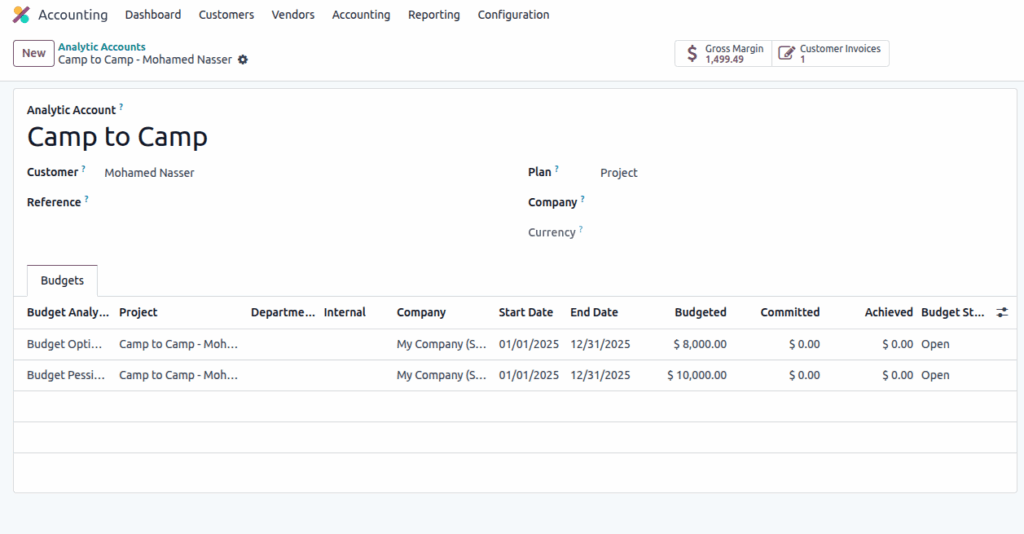

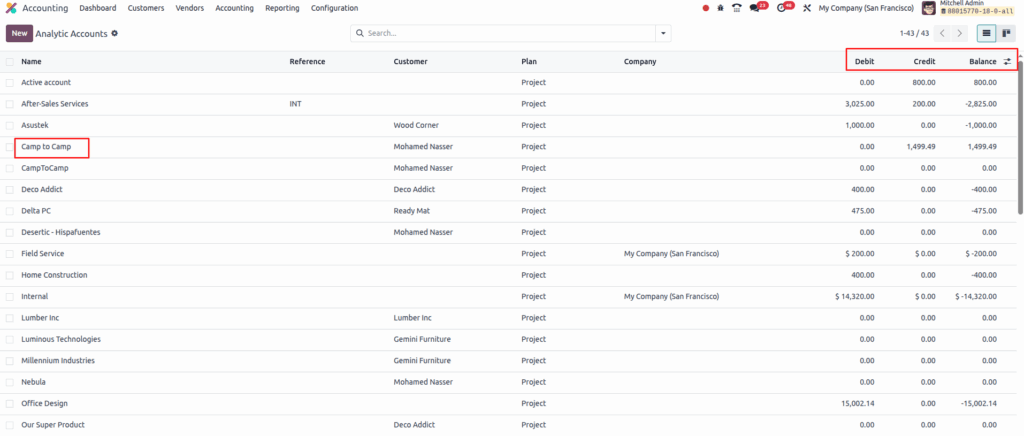

Analytic Accounts

Overview

Analytic Accounts are tools to track income and expenses beyond the standard Chart of Accounts. While normal accounts show what the debit and credit is spent on, cost centers/analytic accounts show where or which purpose it is spent, such as by department, project, product line or branch. This helps in deeper analysis of profitability and to make the better decision of accounting team for the business improvement.

Process Flow

Business Rules / Features

- Name of the Analytical Account to Identify it easily

- Plan Mapping to the Analytical account to Identify it belongs to which department or project

- Company based or Common to all companies mapping

- Customer Wise Analytical Account mapping

- Activate or Deactivate at any point of time

- Easy to filter in reports

- Helps management monitor spending and optimise resource allocation

Screenshot

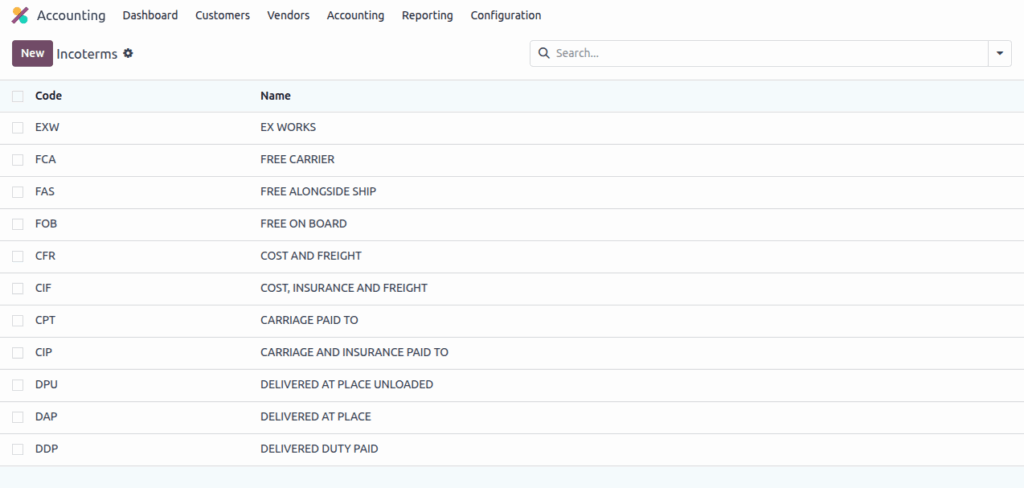

Incoterms

Overview

Incoterms (International Commercial Terms) are globally accepted trade terms published by the International Chamber of Commerce. They define the responsibilities of buyers and sellers in international and domestic trade, mainly who arranges transport, insurance, customs clearance, and who bears the cost and risk at each stage of delivery. Using Incoterms avoids confusion and ensures smooth cross border transactions.

Process Flow

Business Rules / Features

- Name of the Incoterm with short name to Easily Identify it

- Code of the Incoterm to maintain the Unique data

- Incoterms are common to across all companies

- Incoterm mapping in Sale order while make an customer Order

Screenshot

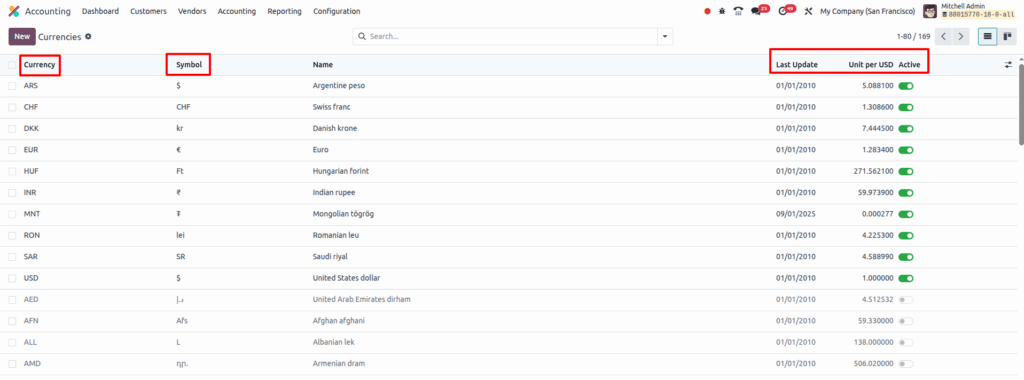

Currencies

Overview

The Currencies setup allows a company to manage transactions in multiple currencies apart from its base currency (e.g., INR, USD, EUR). It enables businesses to handle international trade, record foreign transactions, apply exchange rates and generate accurate financial reports in both local and foreign currency.

Process Flow

Business Rules / Features

- Name of the Currency

- Symbol of the Currency to Identify it and Print in PDF Reports

- Rounding Factor to maintain the Price accuracy

- Decimal Rounding to view in screen and reports for price accuracy

- Currency Symbol display option (Before and after the amount)

- Currency Master is common for all companies

- Currency rates are managed with company wise

- Base Currency Mapping in Company Master

- Currency Mapping in Pricelist to map the customer/vendors

- Exchange gains/losses posted automatically in accounting based rate differs

Screenshot

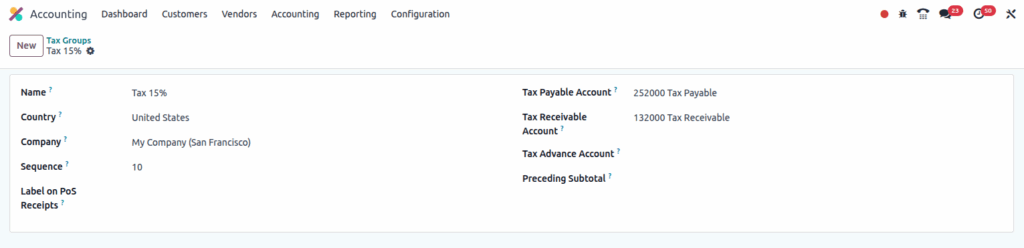

Tax Groups

Overview

A Tax Group is a collection of one or more individual taxes combined together to apply as a single tax rate on transactions. It is mainly used when a tax is made up of multiple components, such as GST (CGST + SGST for intrastate sales, or IGST for interstate sales). Tax groups ensure that the correct tax split is applied automatically while still showing the total tax on invoices and reports.

Process Flow

Business Rules / Features

- Name of the Tax Group to identify it easily

- Country that Allow the tax group

- Company wise Tax group to maintain their own set of names

- Sequence of Tax group to make the sorting order

- Print Label on POS print while Receipt Print

- Maintained Receivable and Payable Accounts for counterpart tax closing entry

Screenshot

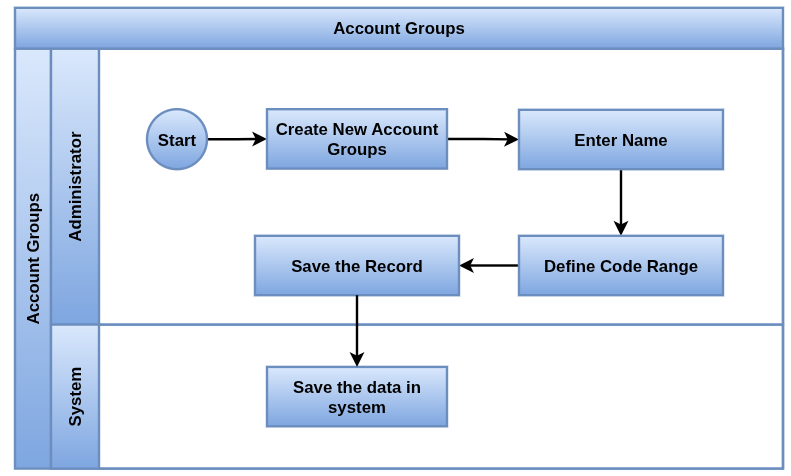

Account Groups

Overview

The Account Groups are used to organise the Chart of Accounts into logical categories, such as Assets, Liabilities, Income, and Expenses. They make it easier to structure financial data, prepare balance sheets and profit & loss statements, and ensure compliance with accounting standards. Grouping also helps management quickly understand where money is coming from and where it is going and also parent child hierarchy easy view in Trial balance and other reports.

Process Flow

Business Rules / Features

- Name of the Account Group to Easily Identify it

- Parent and Child Hierarchy structure

- Allows to add subgroups under parent group for detailed classification

- Group Code configuration based on start and end codes

- Company wise Account groups to maintain their own set of hierarchy

Screenshot

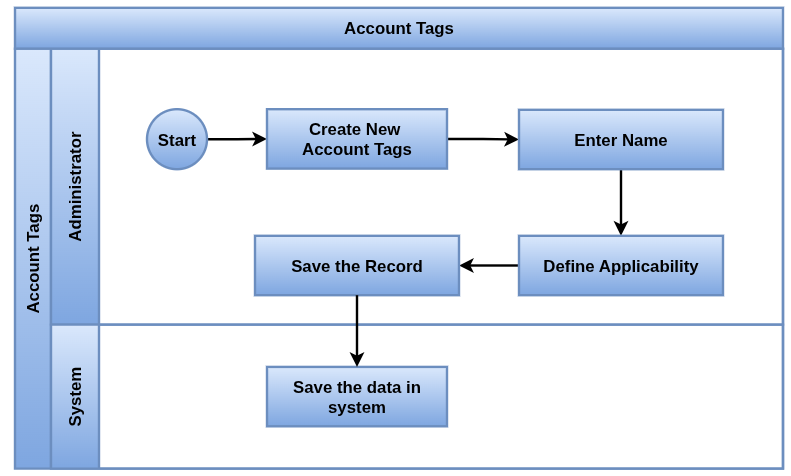

Account Tags

Overview

The Account Tags are labels that can be attached to accounting entries or accounts for extra classification and reporting. Unlike Account Groups these are fixed structures, tags are flexible and multi-purpose, allowing businesses to track transactions by category, project, region, or any custom dimension without changing the Chart of Accounts. The main purpose is Cash flow purpose.

Process Flow

Business Rules / Features

- Name of the Account Tag to Identify it easily

- Tags are allowed to mapped in the Accounts master, allowed to add multiple

- Tags are allowed to mapped in the Tax master, allowed to add multiple

- Tags are allowed to mapped in the Product master, allowed to add multiple

- Each Tag we can map separate Colour to identify it easily

- Country wise Tag mapping is allowed

- Account Tags are common for across all companies

- Filter and generate reports based on tags

Screenshot

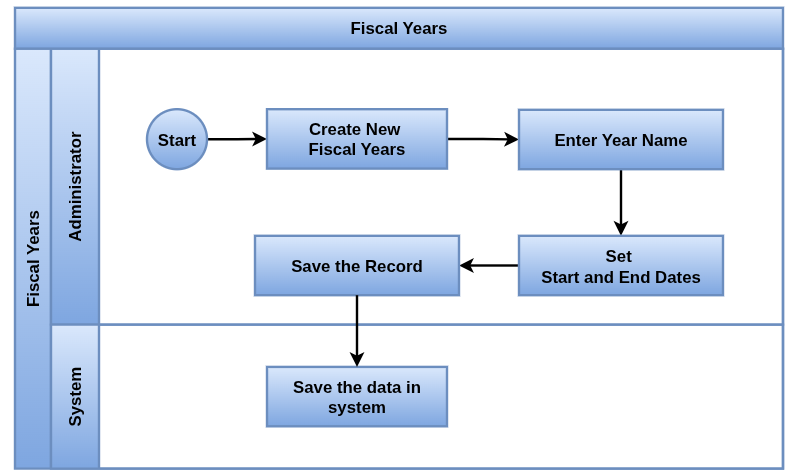

Fiscal Years

Overview

A Fiscal Year is the official accounting period of a company uses to prepare its financial statements and file taxes. In India, the fiscal year normally starts from 1st April to 31st March of the next year. All financial transactions, reports, audits, and compliance activities are tied to this period.

Process Flow

Business Rules / Features

- Name of Fiscal Year to Identify it easily

- Fiscal year setup is based on start and end dates (Ex: Apr to Mar in India)

- Each company can maintain its own set of start and end dates for fiscal year

- Due to the Configurable dates it’s flexible to for Other countries also

- Break the fiscal Year into quarters and months for the easy view in reports and transactions

- Automatic control on entry posting restriction for Future and out of dates

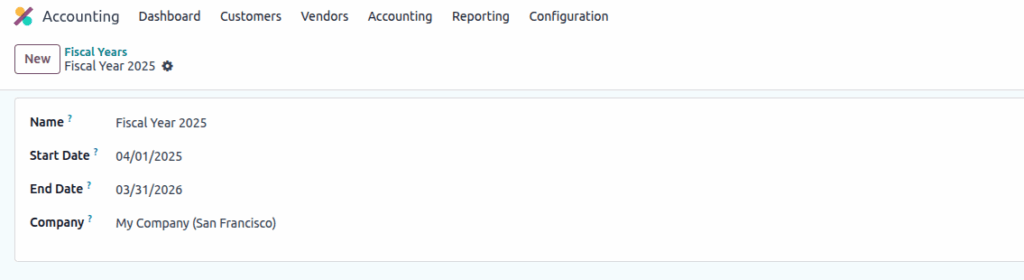

Screenshot

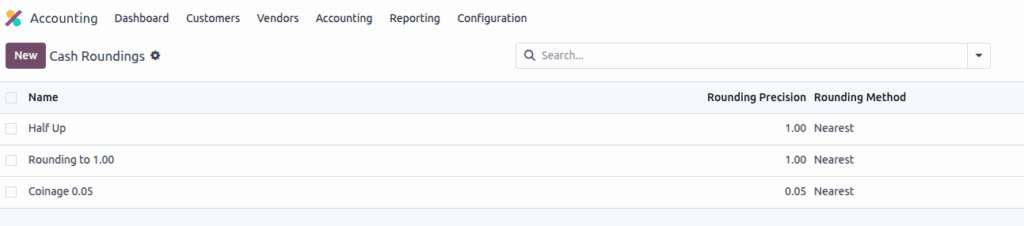

Cash Rounding

Overview

Cash Rounding is the process of adjusting the final total of an invoice or bill to the nearest rounding unit (like 1, 5, or 10). This is mainly used in cash transactions, where dealing with small paisa amounts is inconvenient. The system automatically adds or subtracts a tiny difference to make the total easy to pay in cash.

Process Flow

Business Rules / Features

- Name of the cash rounding to identify it easily

- Allows three types of Rounding methods i.e, UP, DOWN, HALF-UP

- Two Type of Rounding Strategies are allowed, add a new line and modify the tax amount

- Rounding Profit and Loss account Mapping for Posting Entries

- Rounding is common to across all companies

- Profit and Loss account mapping is company based to maintain their own set accounts

- Define the rounding precision to next nearest value like 0.5, 1 as per the business need

- The Rounding Amount will display in PDF reports

Screenshot

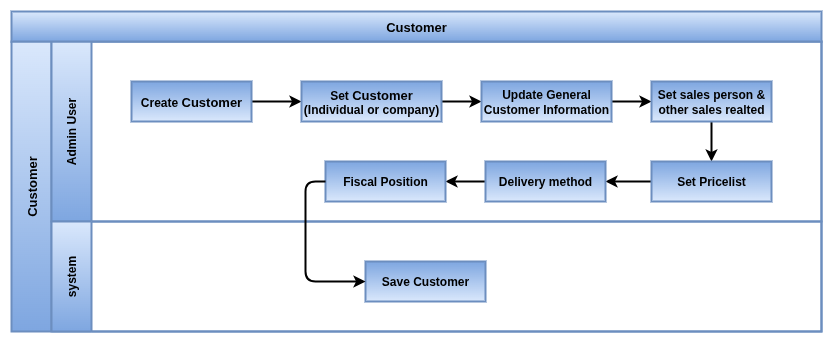

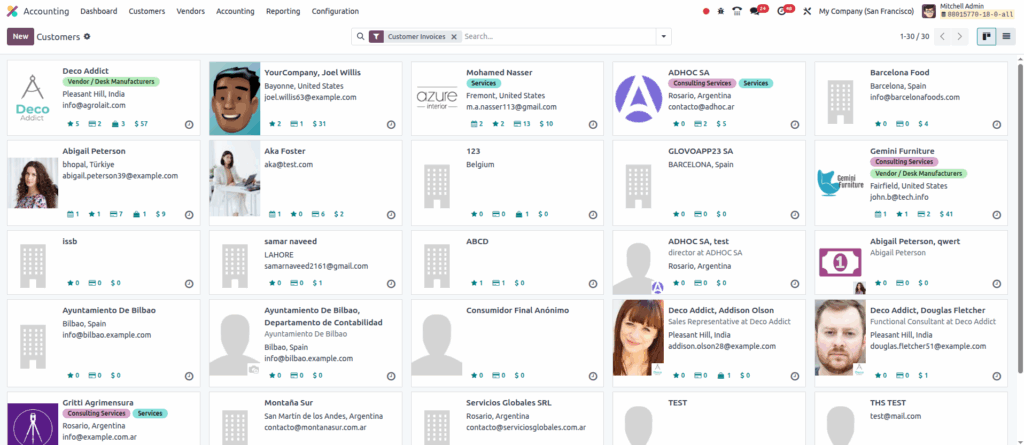

Customers

Overview

In Odoo, Customers are managed in a single place. A contact can act as a Customer. This unified approach makes it easy to manage all business relationships from one master record. It stores key details like address, tax info, payment terms, and communication history, which are then used across Sales, CRM, Purchase, Inventory, Accounting etc.,

Process Flow

Business Rules / Features

- Name of the Customer must be entered

- Address of the Customer such as street, city, zip, state and country

- Phone and Email of the Customer for the easy communication

- GSTN and PAN number of the Customer for the Taxability Purpose

- Customer can be identified using checkbox

- Company or Individual option to Supports both organisations and individual persons

- Agreed Payment terms mapping for each customer

- Agreed Pricelist mapping for each customer

- Default Payment method mapping for the Customer level

- Allow to Map the single or multiple bank accounts in the Customer for the payment processing purpose

- We can able to maintain the different sub address like shipping, invoice, others

- We can Able to maintain the Credit limits on customer level

- Smart buttons to Linked with CRM, Sales, Purchase, Accounting, Inventory

- Provision to Map the Tags in Customer Level for the reporting and easily Identification purpose

- Provision to add the Customer default Notes

- Invoice Follow-ups for due reminders, automatic and manual options are available

- Sales Person Mapping in Customer Level for the Follow-ups

- We can able to Map the default Fiscal Position in Customer level to auto apply taxes

- A Customer can be maintained as a single company level or across all companies

- Provision to maintain the Customer Images

- Sales team mapping in Customer level

Screenshot

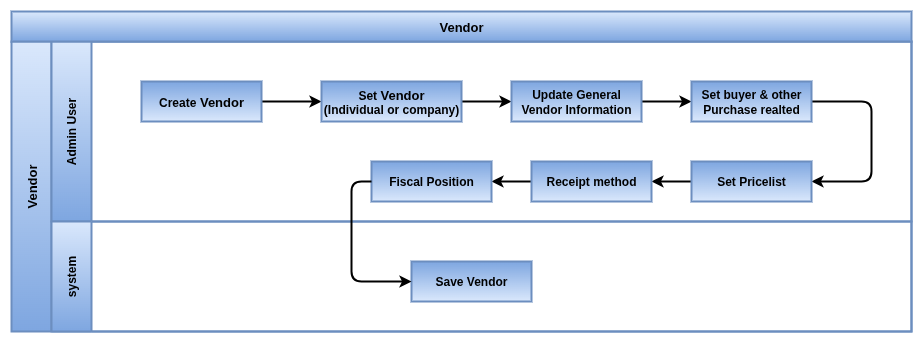

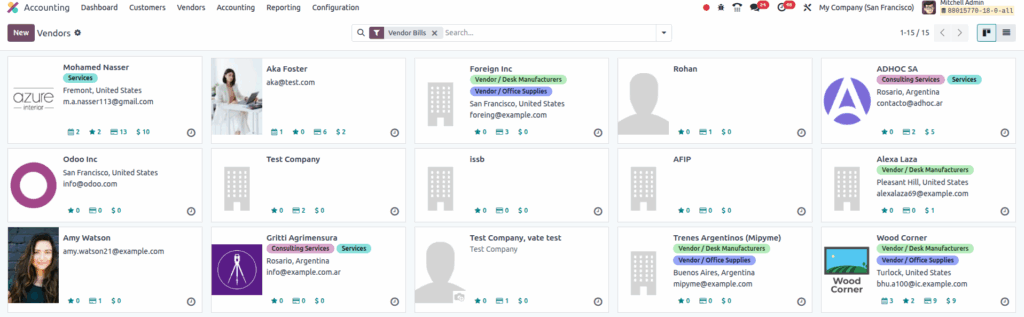

Vendors

Overview

In Odoo, Vendors are managed in a single place. A contact can act as a Vendor. This unified approach makes it easy to manage all business relationships from one master record. It stores key details like address, tax info, payment terms, and communication history, which are then used across Sales, CRM, Purchase, Inventory, Accounting etc.,

Process Flow

Business Rules / Features

- Name of the Vendor must be entered

- Address of the Vendor such as street, city, zip, state and country

- Phone and Email of the Vendor for the easy communication

- GSTN and PAN number of the Vendor for the Taxability Purpose

- Vendor can be identified using checkbox

- Company or Individual option to Supports both organisations and individual persons

- Agreed Payment terms mapping for each Vendor

- Agreed Pricelist mapping for each Vendor

- Default Payment method mapping for the Vendor level

- Allow to Map the single or multiple bank accounts in the Vendor for the payment processing purpose

- We can able to maintain the different sub address like shipping, invoice, others

- We can Able to maintain the Credit limits on Vendor level

- Smart buttons to Linked with Purchase, Accounting, Inventory

- Provision to Map the Tags in Vendor Level for the reporting and easily Identification purpose

- Provision to add the Vendor default Notes

- Invoice Follow-ups for due reminders, automatic and manual options are available

- Purchase Person Mapping in Vendor Level for the Follow-ups

- We can able to Map the default Fiscal Position in Vendor level to auto apply taxes

- A Vendor can be maintained as a single company level or across all companies

- Provision to maintain the Vendor Images

Screenshot

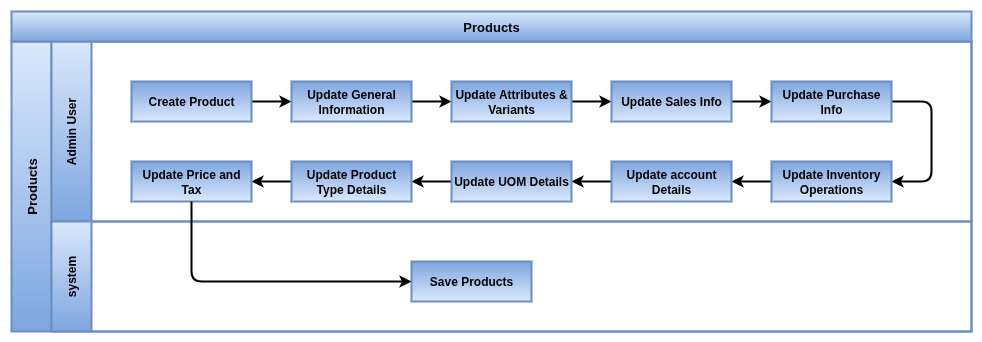

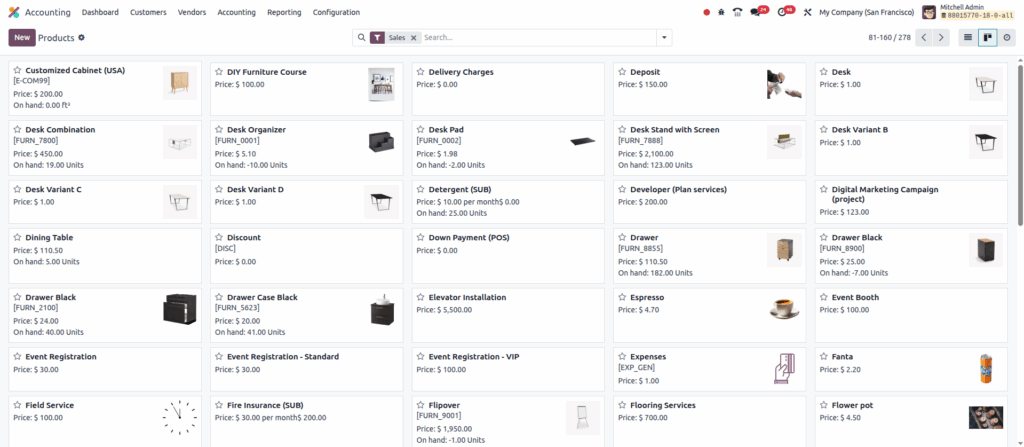

Products

Overview

In Odoo, a Product Template is the main record that holds the general details of a product such as name, type, category, pricing, etc. From this template, we can generate multiple Variants based on different attributes such as size, colour, material etc., In this way, businesses don’t need to create a separate product record for every variation manually. Templates keep things organised, while variants allow detailed control over stock, pricing and Sales, Purchase etc.,

Process Flow

Business Rules / Features

- Unique name and Internal Reference for product identification

- Different Product Type such as Goods, Combo or Service

- Category is Used for the Grouping the Similar Products and reporting Purpose

- Inventory Valuation is maintained under category level configuration

- Sales Invoice policy is two type Delivery quantity and Ordered quantity based

- Purchase billing policy is two type Received quantity and Ordered quantity based

- Inventory Tracking using Lot or By Unique Serial Number or quantity

- Product can be allowed in Sales and Purchase and subscription controls

- Default Units of measure mapping for Sales and Purchase flow transactions

- Default Taxes for Sales and Purchase mapping

- Income and Expenses Mapping for Accounting Posting purpose

- Able to Maintained Sales and Cost prices

- Different Type of Valuation based on costing methods such as First In First Out(FIFO), Average Cost(AVCO) and Standard Price

- Can able to map the HSC Code

- Single product can be allowed for single company or across all companies

- Can be mapped the Internal Note about the Product

- Routes Mapping to Make Automation (Buy, Manufacturing…etc)

- Different Type of Lead times, Customer, Manufacturing…etc to avoid the Deploys

- Provision to Add Expiration Dates and Pre-alert date for the stock level

- Easy to Map Vendor Info in product such as Vendor Name, Cost, Min Quantity…etc

- Product Can Be allowed in POS and Website Controls

- Separate POS category to Easy grouping

- Out of stock and Show Available stock in Ecommerce site controls

- Can Able to Add media in product Level

- Different Type of Price lists

- Barcode / Internal Code For scanning and warehouse operations

- Unique SKU / Code on Each variant has its own code and barcode

- Variants are created automatically from attributes such as Size, Colour, Brand etc.,

- Variant level Pricing to add Additional cost or sales price rules per attributes

- Different images can be set for each variant

Screenshot

Accounting Operations Management

- Customer Invoices

- Credit Notes

- Vendor Bills

- Vendor Refunds

- Payments Processing

- Receipts Processing

- Bank Statement Import & Reconciliation

- Journal Entries & Adjustments

Accounting Operations Management

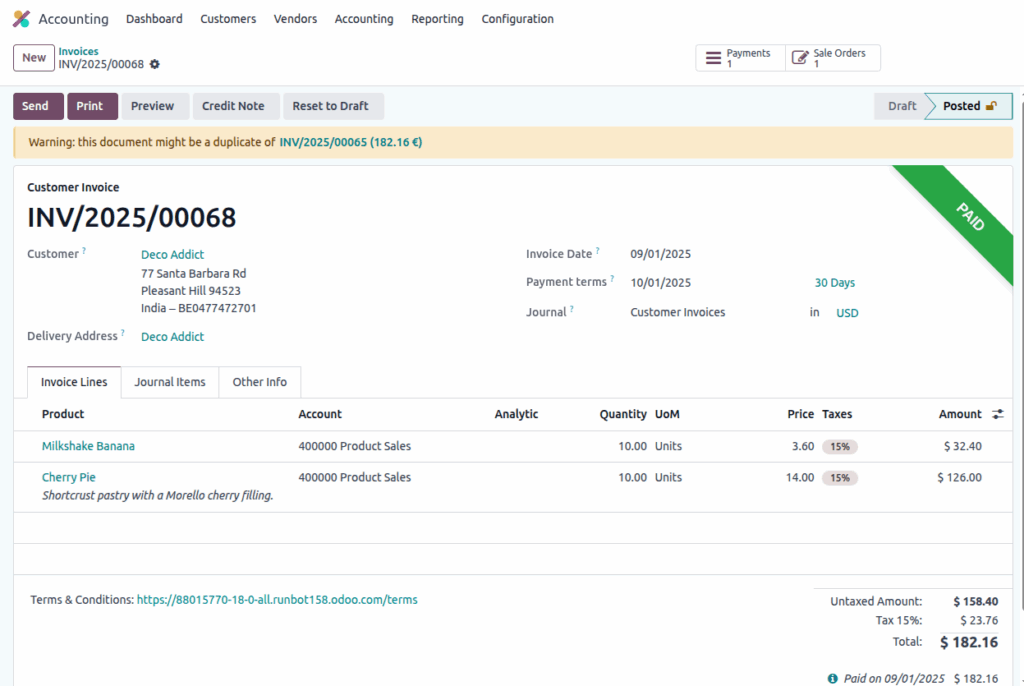

Customer Invoices

A Customer Invoice is the official financial document of a company issues to its customer for goods sold or services provided. In Odoo, invoices are directly linked to sales orders and payments. They ensure proper revenue recognition and customer account tracking. This integrates with E-Invoice Portal for the GST Submission as well as Eway Bill Integration for the Goods Transfers on Road.

Process Flow

Business Rules / Features

- Customer Invoice can able to create it from Sales order based on ordered or delivered Quantities

- Customer Invoice can also able to create directly without sales order

- Single Invoice is allowed create from Multiple Sales order

- Customer Information such as address, GSTIN, payment terms auto fetch from Master

- Invoice Date / Accounting Date to reflect the ledger balance in reports

- Due Date calculation is based on the mapped payment term in invoice

- By default all customer Invoices are mapped under Customer Invoice Journal

- Sales Person and team Mapping to make the payment follow-ups

- Fiscal Position mapping to Apply the required Taxes in line level

- Price List and Currency mapping in Invoice

- Based on the Company Currency and Invoice Currency the Journal Entry will pass

- If currency differs then Exchange rate will apply and convert it into Company Currency

- Due Amount calculation based on Payments done

- Maintained Payment Status for easy follow-up for dues

- Invoice Line with Product or Select a Note and Description is allowed

- Quantity and Units of Measure Defined in the Line Level

- Unit price and Discounts are defined in the Level for the Total calculation

- Based on Selected Product the Taxes will apply automatically in each line wise

- Analytical Account Mapping in Each Line wise to Track the project or Cost center Info

- Applied Taxes will show in header level with grouping of Taxes

- Invoice Cancellation control, EID and Normal

- Invoice Validation control

- E-Invoice submission automatic or manual option

- Manual EInvoice is two steps, confirm to check all validation and process

- Can Able to add Payments to Invoice and View Linked Payments

- Standard Invoice PDF Template to Download and shared to Customer

- Customer Invoice Linked with Sale orders smart button to easy view

Screenshot

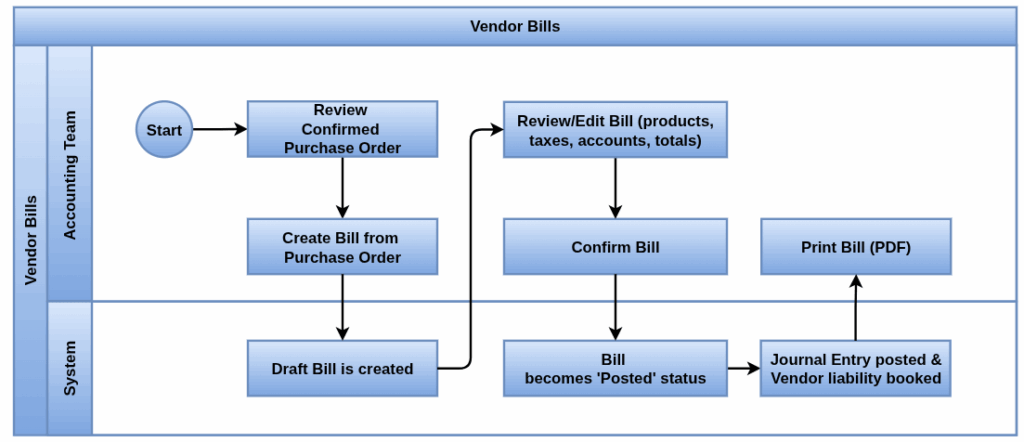

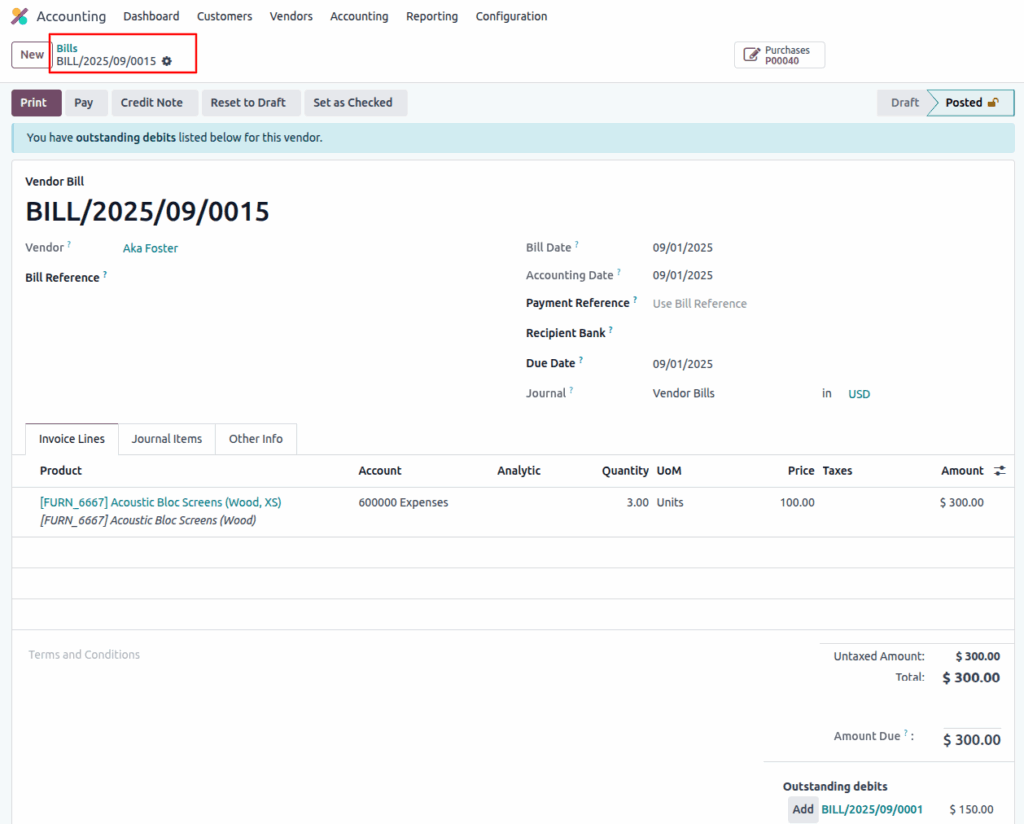

Vendor Bills

Overview

A Vendor Bill is the financial document received from a supplier for goods purchased or services received. In Odoo, vendor bills are directly linked to purchase orders and payments. This ensures proper expense booking, tax input credit tracking, and accurate supplier account balances. Vendor bills help in managing outstanding payables, monitoring supplier relations, and maintaining compliance with GST by capturing vendor GST details.

Process Flow

Business Rules / Features

- Vendor Bill can be created manually without a purchase order

- Vendor Bill can be created from a Purchase Order, based on ordered or received quantities

- A single Vendor Bill can be created from multiple Purchase Orders

- Vendor Information such as address, GSTIN, payment terms auto fetches from the Vendor Master

- Bill Date / Accounting Date will impact the supplier ledger balances in reports

- Due Date calculation is based on the mapped payment term in the vendor bill

- By default, all Vendor Bills are mapped under Vendor Bill Journal

- Purchase Representative and Team mapping available for follow-up and control

- Fiscal Position mapping to apply required taxes in line level

- Currency and Price List mapping in Vendor Bill

- If the bill currency differs from the company currency, exchange rates are applied to convert into company currency

- Due Amount calculation based on payments recorded

- Maintains Payment Status for easy follow-up of dues

- Vendor Bill Line can include Product, Service, Note, or Description

- Quantity and Units of Measure defined at line level

- Unit Price and Discounts defined at line level for total calculation

- Based on the selected product/service, applicable taxes auto-apply line wise

- Analytical Account mapping at line level to track expenses against projects or cost centers

- Applied Taxes are displayed at header level with grouping of taxes

- Vendor Bill cancellation control with proper access rights

- Bill Validation control for accounting accuracy

- Payments can be added to Vendor Bill and linked payments can be viewed

- Standard Vendor Bill PDF Template available to download and share with vendors

- Vendor Bill is linked with Purchase Orders via smart button for quick navigation

Screenshot

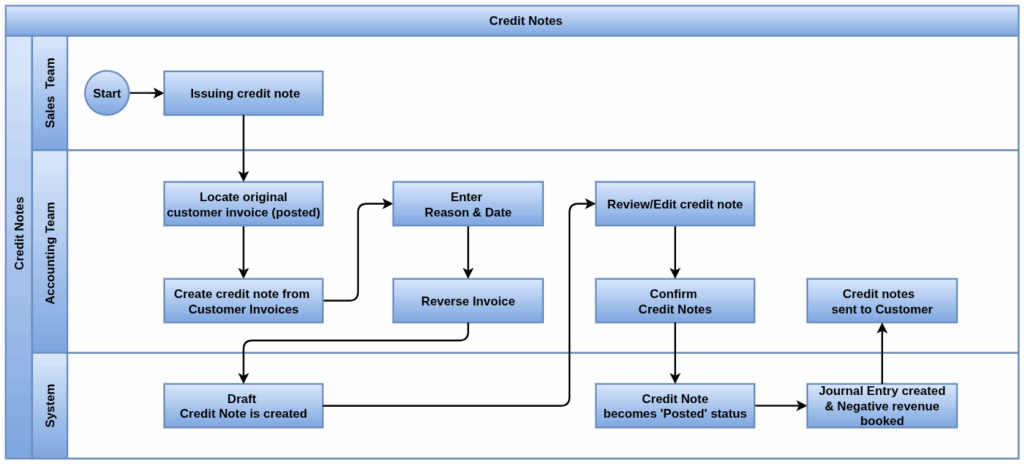

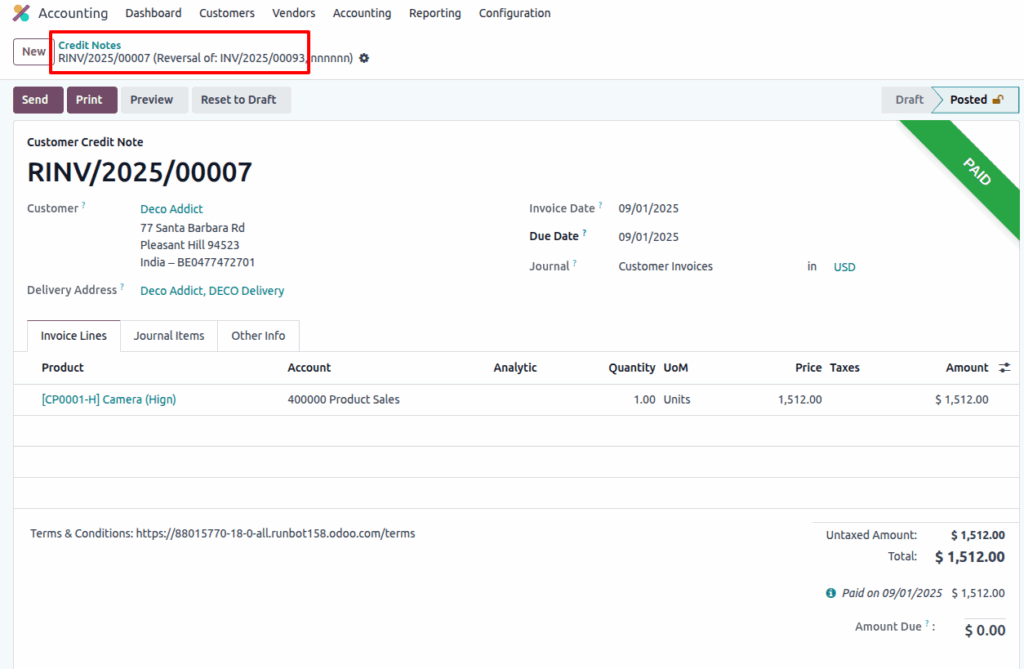

Credit Notes

Overview

A Credit Note is an official financial document issued to adjust or cancel part or all of a previously issued invoice or vendor bill. In Odoo, credit notes are linked to Customer Invoices. They are typically used for sales returns, discounts, corrections or cancellations. Credit Notes ensure proper adjustment in accounting, customer/vendor balances and GST reporting.

Process Flow

Business Rules / Features

- Credit Notes can be created manually without linking to an existing invoice or bill

- Credit Notes can also be created with reference to an existing Customer Invoice or Vendor Bill

- A single Credit Note can be created against multiple invoices/bills if required

- Customer/Vendor information such as address, GSTIN, payment terms auto-fetch from the master

- Credit Note Date / Accounting Date affects the customer/vendor ledger balance in reports

- By default, all Customer Credit Notes are mapped under the Credit Note Journal

- Currency and Exchange Rate handling is applied if the credit note is in a foreign currency

- Maintains Status for tracking (Draft, Posted, Cancelled)

- Return products or services can be selected at line level

- Quantity and Unit of Measure defined for each line

- Unit price and discount adjustments allowed at line level

- Based on selected products, applicable taxes auto-apply line wise

- Analytical Account mapping available at line level to track adjustments against projects or cost centers

- Applied Taxes grouped and displayed at the header level

- Credit Notes can be used to refund customers or adjust payments

- Reconciliation of Credit Notes with invoices/bills possible through payments and journal entries

- Cancellation control available with user access rights

- Validation control ensures accuracy before posting to ledger

- Standard Credit Note PDF Template available to download and share

Screenshot

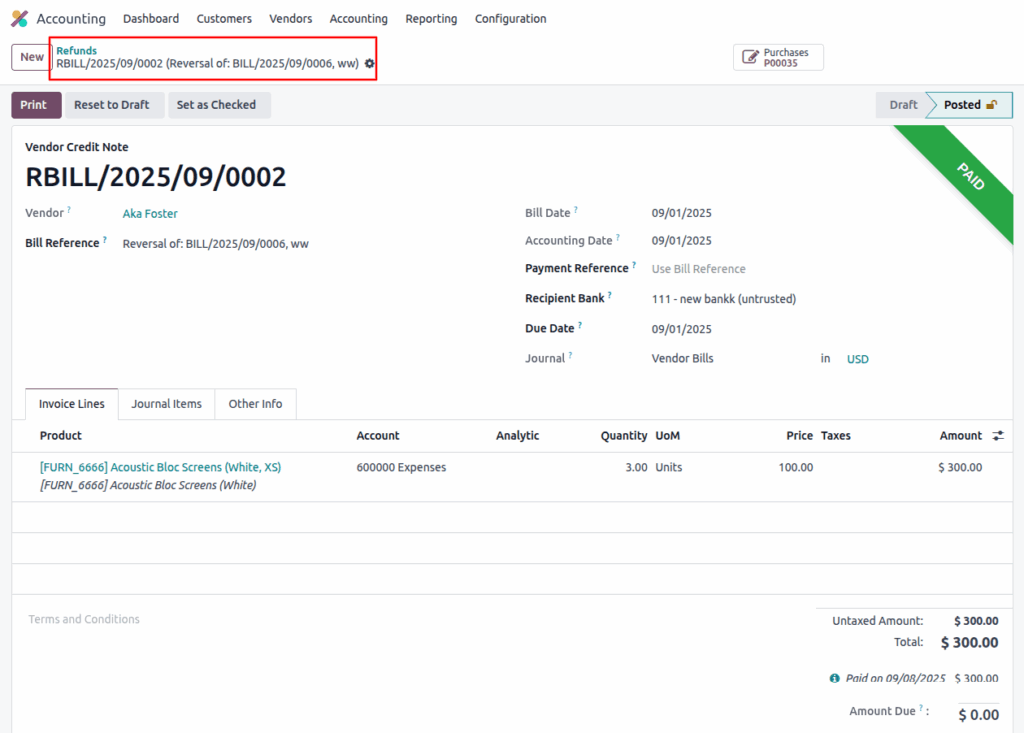

Vendor Refunds

Overview

A Vendor Refund, also referred to as a Vendor Debit Note, is a financial document created by a company and sent to a supplier to formally request a reduction in the amount payable. It is usually issued when goods are returned, services are not rendered, over billing occurs or pricing discrepancies are found. In Odoo, Vendor Debit Notes are directly linked to Vendor Bills and Accounts Payable, ensuring correct adjustment of supplier balances and payment obligations.

Process Flow

Business Rules / Features

- Vendor Debit Note can be created without reference to an existing Vendor Bill

- Vendor Debit Note can also be created with reference to one or multiple Vendor Bills

- Vendor information such as address, GSTIN, and payment terms auto-fetch from the master record

- Debit Note Date / Accounting Date impacts vendor ledgers and financial reports

- By default, all Vendor Debit Notes are mapped under the Vendor Debit Note Journal

- Currency and Exchange Rate handling applied if the debit note is in a foreign currency

- Maintains Status for tracking (Draft, Posted, Cancelled)

- Debit Note lines can include returned products, price corrections, or discount adjustments

- Quantity and Units of Measure specified at line level

- Unit price and discounts defined in the line level for accurate total calculation

- Applicable taxes auto-apply at line level based on product or fiscal position

- Analytic Account mapping available in each line for project or cost center tracking

- Taxes grouped and displayed at the header level

- Vendor Debit Note can be reconciled with Vendor Bills and Payments to settle outstanding balances

- Cancellation control available with proper authorization

- Validation control ensures accounting accuracy before posting

- Standard Vendor Debit Note PDF Template available to download and share with vendors

- Smart Buttons provide quick access to linked Bills, Payments, and Vendor records

Screenshot

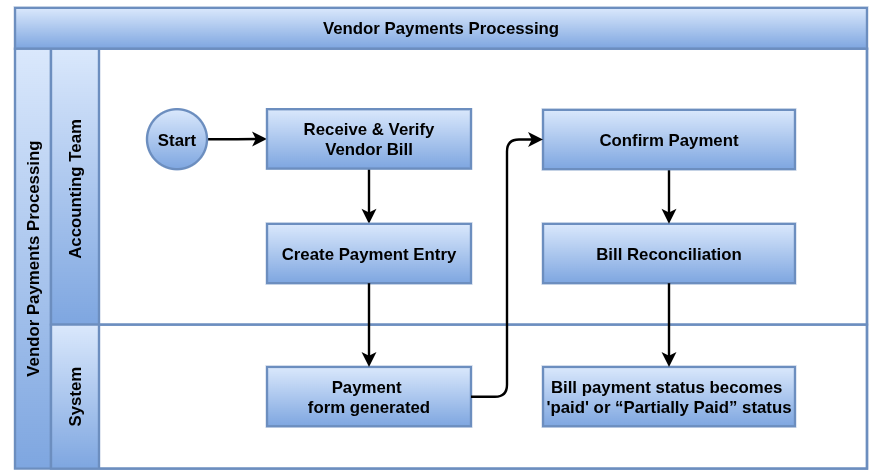

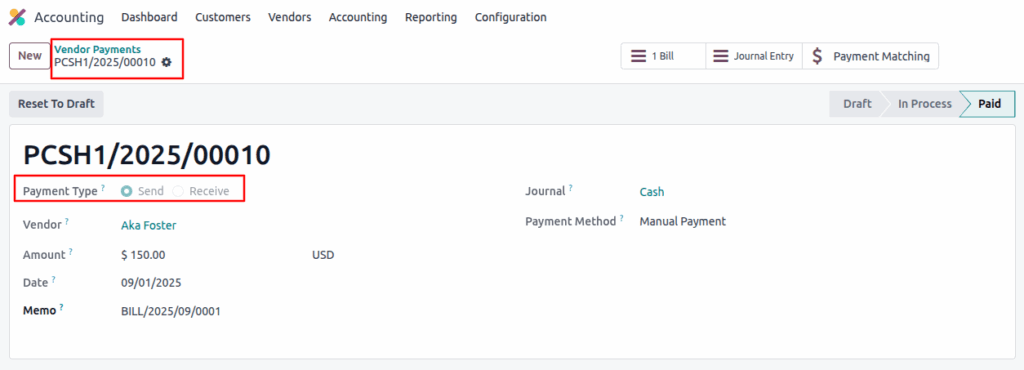

Payments Processing

Overview

A Vendor Payment represents the actual settlement of outstanding Vendor Bills made by the company to its suppliers. In Odoo, Vendor Payments ensure proper tracking of Accounts Payable, cash flow, and reconciliation with bank or cash accounts. Payments can be executed through multiple modes like Bank Transfer, Cheque, NEFT/RTGS and Cash and are fully integrated with journals, currencies, and reconciliation features.

Process Flow

Business Rules / Features

- Vendor Payments can be created with reference to one or multiple Vendor Bills

- Vendor Payments can also be created without reference to a bill (advance payment)

- Vendor details such as address, GSTIN, and bank account information are auto-fetched from the Vendor Master

- By default, all Vendor Payments are recorded under the Selected Journal (Bank or Cash).

- Payment Methods supported: Bank Transfer, Cheque, Cash, NEFT/RTGS, etc.

- Currency handling: If payment currency differs from company currency, exchange rates apply and entries are adjusted accordingly

- Supports Advance Payments, which can later be reconciled against Vendor Bills

- Maintains Payment Status (Draft, Posted, Cancelled, Reconciled)

- Reconciliation available between Vendor Bills, Debit Notes and Bank Statement

- Partial and Full payments supported at invoice level

- Payment Reference and Memo fields available for clear identification of payment purpose

- Automatic journal entry posting happens upon payment confirmation

- Multi-company support ensures payments are linked to the correct entity

- Check printing & numbering supported if payments are made via cheque

- Payment Cancellation control allowed with appropriate rights

- Standard Vendor Payment PDF Receipt available for documentation

- Smart Buttons link Vendor Payments with related Bills, Debit Notes

Screenshots

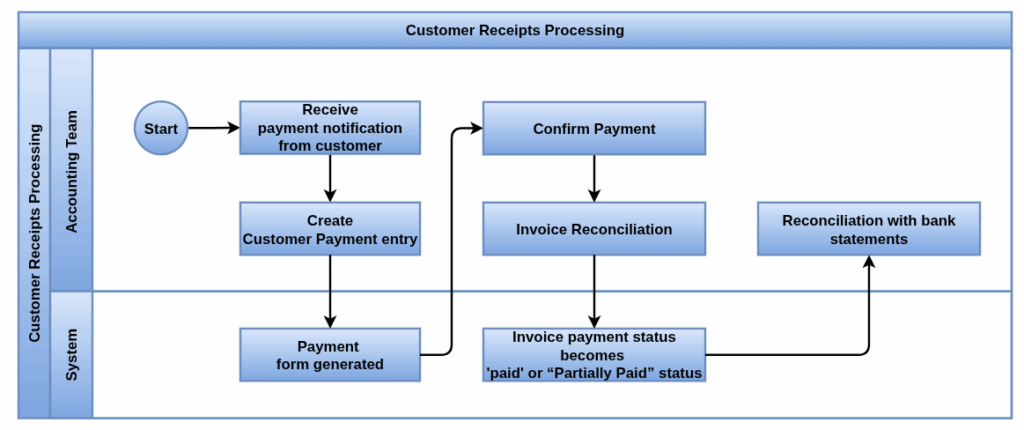

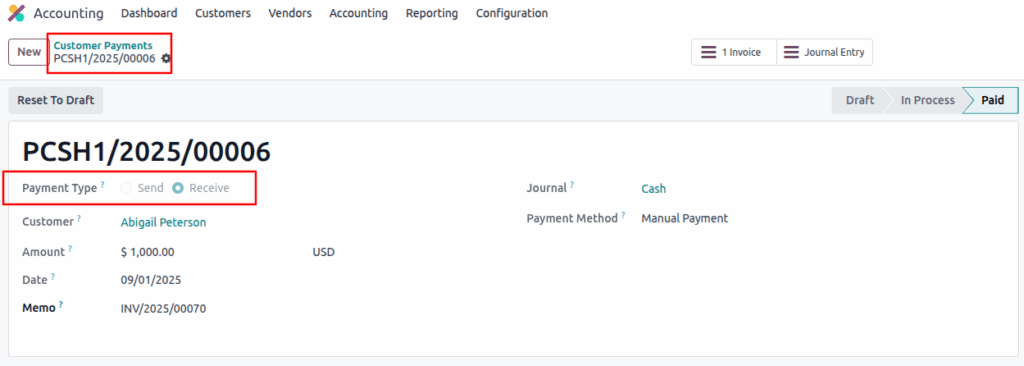

Receipts Processing

Overview

A Customer Receipt represents the actual collection of money from a customer towards outstanding invoices, advance payments or direct settlements. In Odoo, Customer Receipts are essential for tracking Accounts Receivable, customer balance management and cash flow. They integrate directly with invoices, journals, and reconciliation processes, ensuring accurate financial reporting.

Process Flow

Business Rules / Features

- Customer Receipts can be created against one or multiple Customer Invoices

- Receipts can also be recorded without an invoice (advance receipt)

- Customer details such as address, GSTIN, and payment terms are auto-fetched from the Customer Master

- By default, all Customer Receipts are recorded under the Selected Journal (Bank or Cash)

- Payment Methods supported: Bank Transfer, Cheque, Cash, NEFT/RTGS, etc.

- Currency handling: If receipt currency differs from company currency, exchange rate is applied and adjusted in journal entries

- Maintains Payment Status (Draft, Posted, Cancelled, Reconciled)

- Supports Advance Receipts, which can later be reconciled with future Customer Invoices

- Reconciliation between Customer Invoices, Credit Notes and Bank Statement

- Partial and Full receipts supported at invoice level

- Reference and Memo fields available for identifying receipt purpose

- Automatic journal entry posting happens upon receipt confirmation

- Multi-company support ensures receipts are linked to the correct entity

- Check deposit & clearance tracking supported if payments are received via cheque

- Receipt Cancellation control allowed with appropriate user rights

- Standard Customer Receipt PDF Acknowledgment available for sharing with customers

- Smart Buttons link Receipts with Invoices, Credit Notes

- Direct Integration with HDFC Bank option available

Screenshot

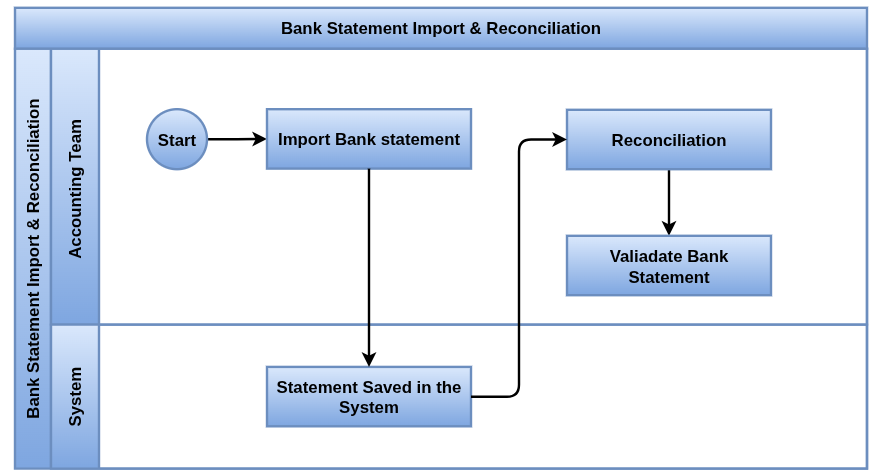

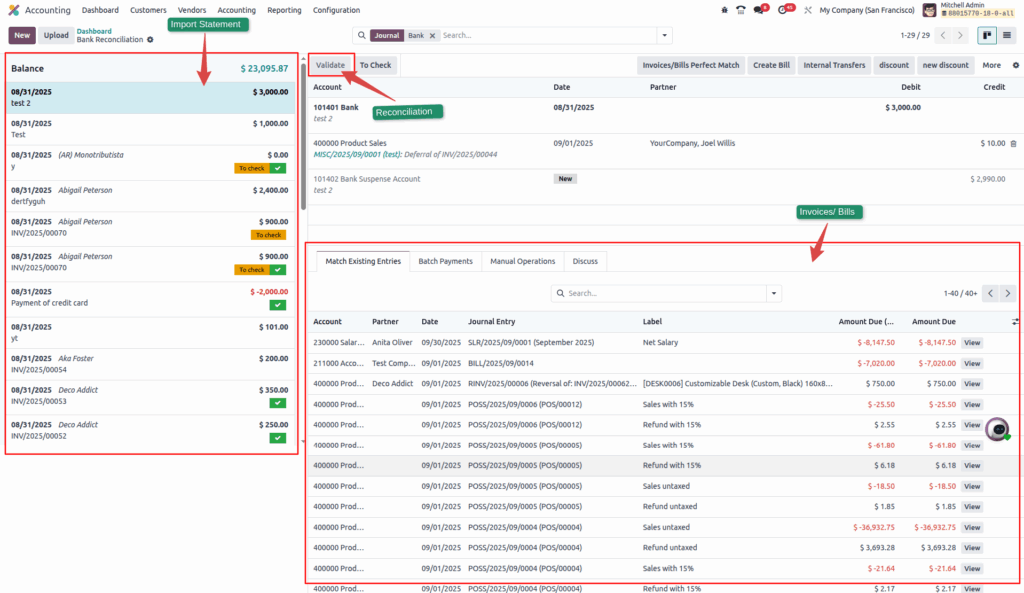

Bank Statement Import & Reconciliation

Overview

The Bank Statement Import & Reconciliation feature in Odoo allows companies to keep their books fully aligned with the bank’s records. By importing bank statements from supported formats or connecting directly through bank feeds, accountants can quickly match incoming and outgoing transactions against customer receipts, vendor payments, and other financial entries. This process ensures accurate cash management, reduces reconciliation errors and provides a clear picture of the company’s liquidity.

Process Flow

Business Rules / Features

- Support for multiple bank statement formats (Excel, CSV)

- Auto-matching rules based on amounts, references, and dates

- Manual reconciliation tools for unmatched transactions

- Handling of fees, charges, and foreign currency differences

- Audit trail and user approvals for reconciliations

- Integration with payment processing and cash flow forecasting

- Each imported statement is linked to a specific bank journal in Odoo, ensuring proper posting

- The system provides automatic reconciliation suggestions by matching statement lines with open invoices, vendor bills, or existing journal entries

- Partial reconciliation is supported where only a portion of the transaction amount matches

- Write-offs can be applied for small differences such as bank charges, rounding adjustments or exchange differences

- Odoo maintains a complete audit trail of reconciliations, tracking the user and date of each action

- The ending balance on the statement must match the calculated balance in Odoo to confirm reconciliation

- Fully supports multi-company operations, where each company can reconcile its own bank accounts independently.

- Built-in validation prevents duplicate transactions from being imported

- Smart navigation through bank journal dashboards allows quick access to statements, unreconciled items and reconciliation history

Screenshot

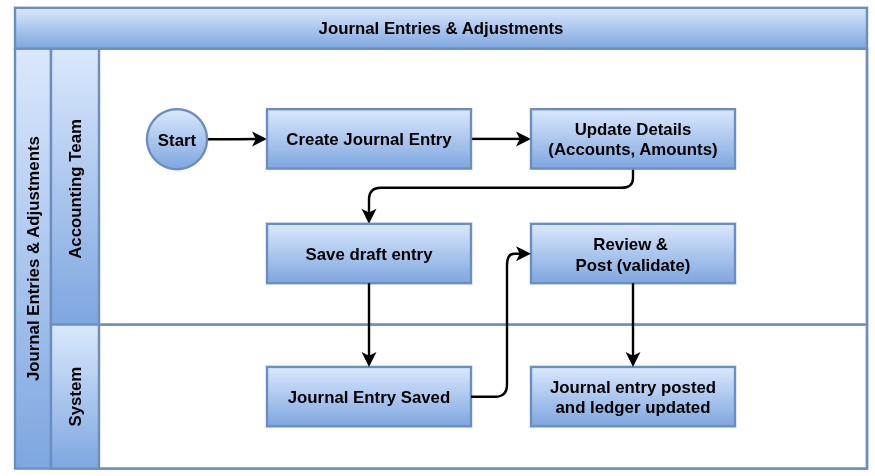

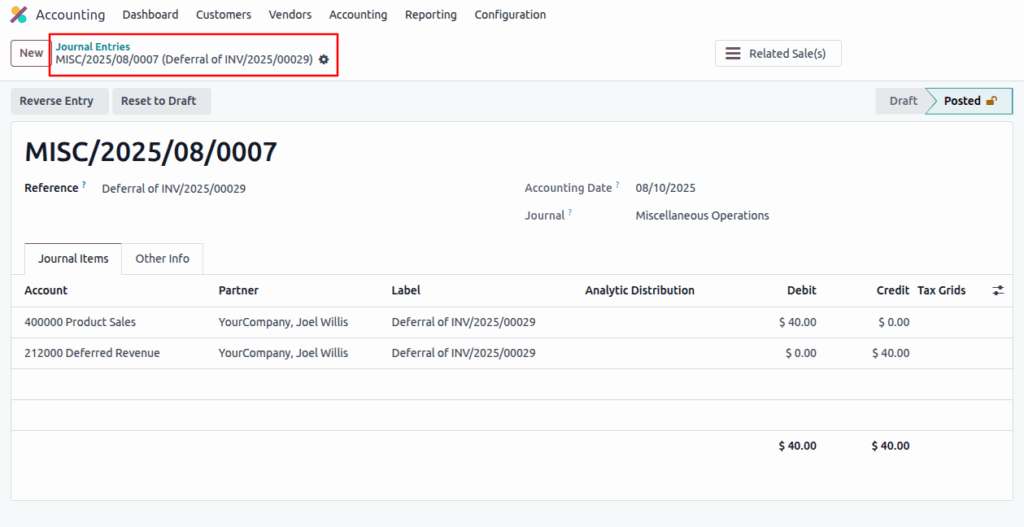

Journal Entries & Adjustments

Overview

Manual and automated recording of accounting transactions to ensure accurate financial statements. Journal Entries & Adjustments in Odoo record all financial transactions in compliance with double-entry bookkeeping, ensuring accuracy, transparency and proper financial reporting.

Process Flow

Business Rules / Features

- Creation of general journal entries with multi-currency and tax support

- Recurring and reversing journal entry templates

- Adjustment entries for accruals, deferrals, corrections, and allocations

- Real-time validation of balanced entries before posting

- Audit logging and access controls for traceability

- Manual journal entries can be created for adjustments or corrections

- Each journal entry must have at least one debit and one credit line

- Journal entries are always linked to a Respective journal (Cash, Miscellaneous..etc)

- Key fields include Date, Journal, Reference, Partner, Currency and description

- Journal entries are first created in Draft state and must be validated to post

- Multi-currency support with exchange rate gain/loss adjustments

- Analytic accounts and tags can be applied at line level for cost/project tracking

- Inter-company journal entries supported for consolidated accounting

- System ensures sequence numbering for audit compliance

- Supporting documents can be attached to journal entries

- User access rights control who can create, validate or reverse entries

Screenshot

Accounting Reporting & Analytics

- General Ledger

- Trial Balance

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Partner Ledger

- Aged Receivables

- Aged Payables

- Invoice Analysis

- Analytic report

- Executive Summary

- Audit Logs & Compliance Reports

- Tax Reports & Filings

Accounting Reporting & Analytics

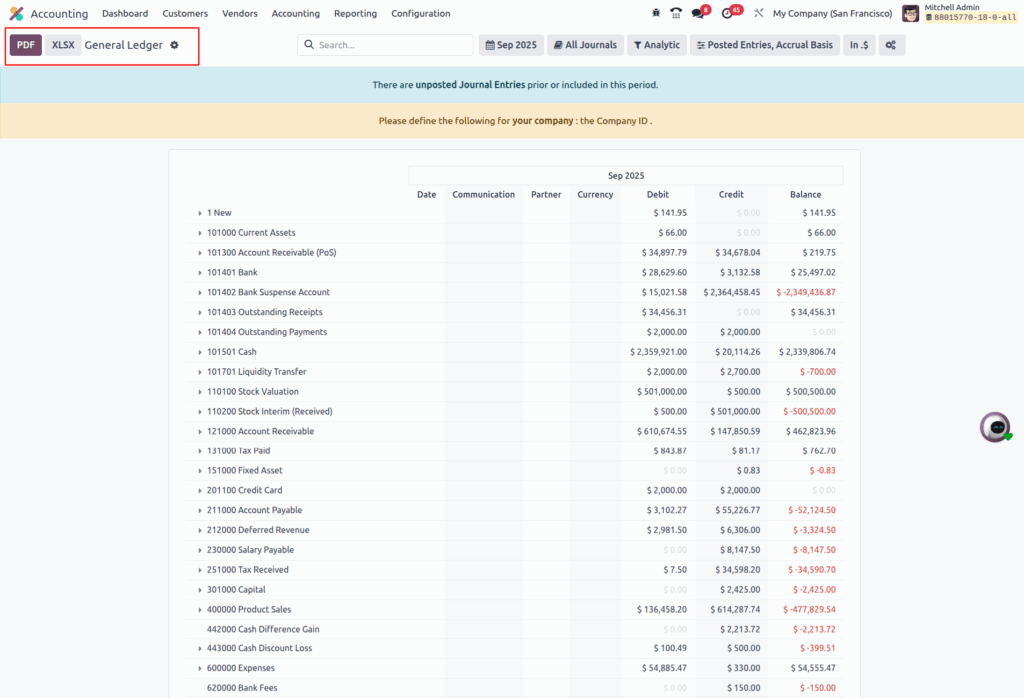

General Ledger

Overview

The General Ledger in Odoo provides a detailed record of all financial transactions, summarizing entries from all journals. It serves as the backbone of accounting, ensuring accuracy, transparency, and compliance in financial reporting.

Business Rules / Features

- Shows all posted journal entries across all journals

- Each line includes date, journal, reference, partner, debit, credit and balance

- Can be filtered by company, journal, account, partner or date range

- Supports real-time reporting with drill-down to original transactions

- Opening balances carried forward automatically from previous fiscal year

- Balances update instantly when new entries are posted

- Trial Balance and Balance Sheet are derived from the General Ledger

- Includes multi-currency tracking with both company currency and transaction currency

- Analytic accounts and tags are visible for cost and project-based reporting

- Export available in PDF and Excel formats

- Can generate consolidated ledger for multi-company setup

- Provides running balances for each account

- Shows account-wise summaries and line-level transaction details

- Report Can be viewed in detailed or summary wise

- Supports grouped reporting by partner, account, or journal.

Screenshot

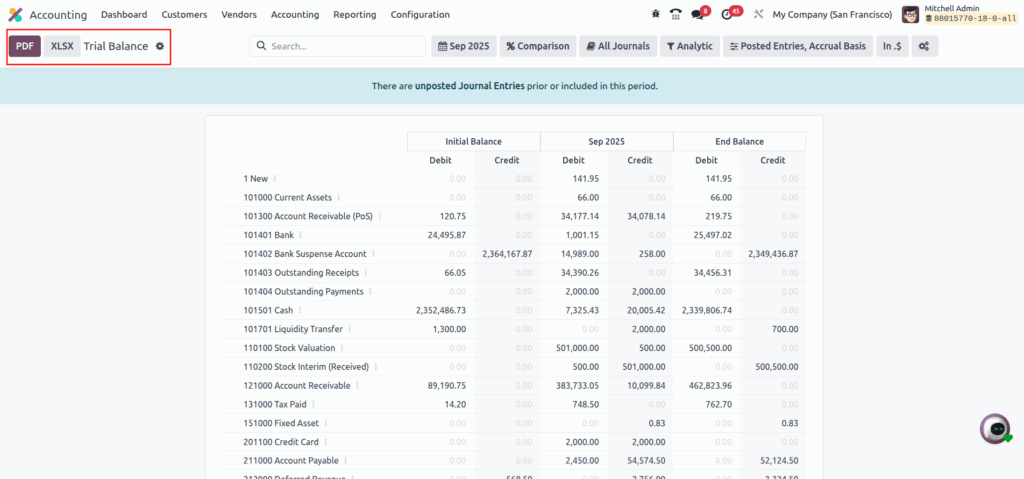

Trial Balance

Overview

The Trial Balance in Odoo is a key financial report that lists all ledger accounts with their debit and credit balances. It ensures that total debits equal total credits, helping validate the accuracy of accounting entries before preparing financial statements.

Business Rules / Features

- Displays all accounts with debit, credit, and balance amounts

- Can be filtered by date range, fiscal year, or specific period

- Opening and closing balances included for each account

- Allows drill-down to General Ledger entries

- Supports company-wise reporting in multi-company setup

- Provides group view and detailed account-level view

- Includes analytic accounts and tags for deeper analysis

- Multi-currency support with balances shown in company currency

- Export available in PDF and Excel formats

- Supports comparison between different periods

- Adjustment entries reflect immediately in the trial balance

- Unbalanced entries highlighted for quick error detection

- Helps in finalization of Balance Sheet and Profit & Loss reports

- Opening balances auto-fetched from previous fiscal year

- Supports consolidated trial balance for group companies

- Can show only active accounts with non-zero balance

Screenshot

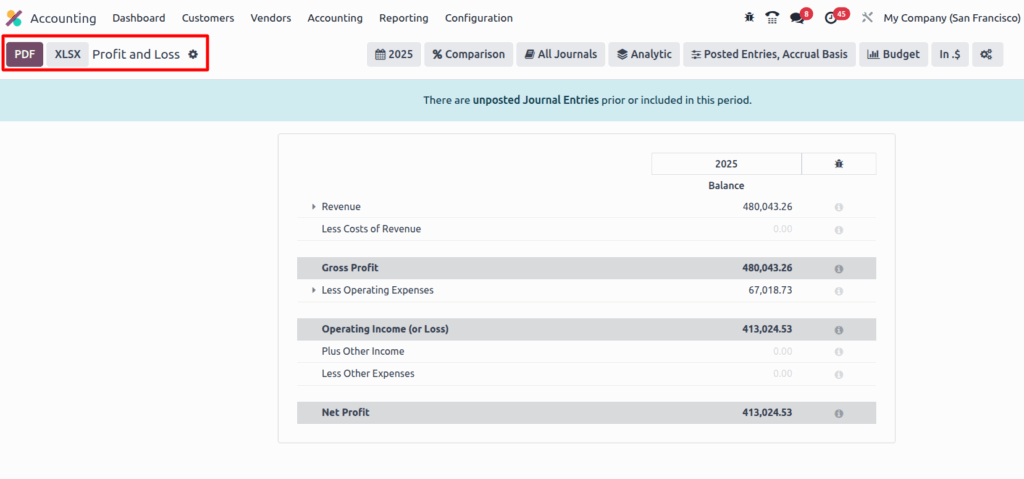

Profit & Loss Statement

Overview

The Profit and Loss (P&L) statement in Odoo shows the company’s financial performance over a selected period. It summarizes revenues, direct costs, and expenses to calculate the net profit or loss, helping management analyse business profitability.

Business Rules / Features

- Displays Income, Expenses and Net Profit/Loss for a selected period

- Filter by date range, fiscal year or custom period

- Drill down to individual journal entries and source documents

- Supports comparison between periods (monthly, quarterly, yearly)

- Includes both posted and draft entries (based on filter)

- Multi-company support with consolidated view

- Supports analytic accounts and cost centers for detailed analysis

- Can apply analytic tags for project or department wise tracking

- Expenses and revenues grouped by account type.

- Supports hierarchy view (grouping by parent accounts)

- Exportable to Excel and PDF formats

- Negative balances shown clearly for easy interpretation

Screenshot

Balance Sheet

Overview

The Balance Sheet in Odoo presents the financial position of the company at a specific period. It shows assets, liabilities and equity, ensuring that the accounting equation (Assets = Liabilities + Equity) is always balanced. It helps management, auditors and stakeholders understand the company’s financial strength and stability.

Business Rules / Features

- Displays Assets, Liabilities and Equity as on a given period or Date

- Fully aligned with the accounting equation (Assets = Liabilities + Equity)

- Supports multiple date filters (as of today, fiscal year-end, or custom date)

- Drill down to journal entries, invoices, bills and source transactions

- Multi-company support with consolidated or individual company balance sheets

- Currency conversion for multi-currency companies

- Grouping by account type and hierarchy

- Configurable report sections based on account groups

- Analytic account and cost center filters available for deeper insights

- Real-time calculation: updates automatically with posted entries

- Ability to include or exclude unposted journal entries

- Comparative view with previous year(s) or periods

- Exportable to Excel and PDF formats

- Negative balances highlighted for easy identification

Screenshot

Cash Flow Statement

Overview

The Cash Flow Statement in Odoo tracks the movement of cash and cash equivalents during a specific period. It helps businesses understand how operating, investing and financing activities impact liquidity. This report is crucial for monitoring cash availability, planning future payments and ensuring financial stability. The report works based on the Tags mapped in Account Master.

Business Rules / Features

- Presents inflows and outflows of cash over a defined period

- Auto-generated from journal entries linked to cash/bank accounts

- Filters available for company, fiscal year, and custom date ranges

- Drill down to the underlying journal entries and source documents

- Multiple company support with consolidated or individual cash flows

- Includes both posted and (optional) draft entries

- Real time updates as transactions are posted

- Comparative view across periods for trend analysis

- Shows opening and closing bank balances clearly

- Negative balances highlighted for early warning signals

- Analytic filters (cost centers/projects) for detailed analysis

- Exportable to PDF and Excel for board review or audits

Screenshot

Partner Ledger

Overview

The Partner Ledger in Odoo provides a detailed view of all transactions linked to each customer and vendor. It shows outstanding balances, payments and invoices, enabling businesses to track receivables and payables partner wise. This report is essential for credit control, vendor reconciliations and financial audits.

Business Rules / Features

- Displays all accounting entries grouped by partner

- Shows both customers and vendors in a single report

- Includes Invoices, Bills, payments, refunds and Journal Entries.

- Real-time balance updates as soon as entries are posted

- Filters by date range, partner, company, or journal

- Option to include/exclude draft or unposted entries

- Drill-down to journal items and source documents

- Handles multi-company and multi-currency transactions

- Automatic currency conversion to company currency

- Option to show aged balances per partner for follow-up

- Separate columns for debit, credit, and running balance

- Export to Excel/PDF format

- Can be sent to partners as account statements.

- Fully integrated with other Odoo reports like Trial Balance and General Ledger

Screenshot

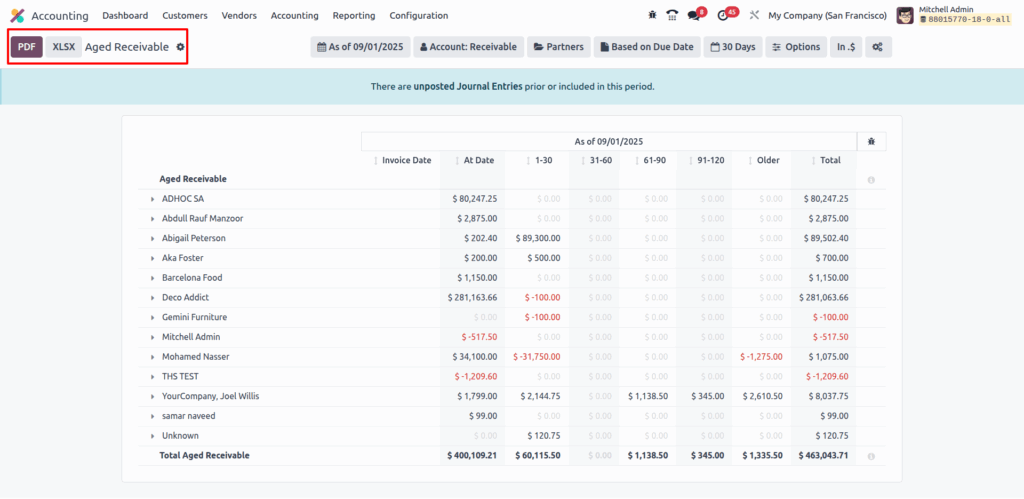

Aged Receivables

Overview

The Aged Receivables report in Odoo provides a breakdown of outstanding customer invoices according to their due dates. It helps businesses monitor overdue amounts, track customer credit risk and manage collection activities effectively. This report is critical for cash flow management and credit control.

Business Rules / Features

- Shows customer outstanding invoices split into aging periods

- Default buckets: 0–30, 31–60, 61–90, and 90+ days. Bucket days can be configurable

- Provides partner-wise and invoice-wise due amounts

- Displays both due date and invoice date references

- Includes not due and overdue balances separately

- Real-time calculation based on posted entries only

- Drill-down to each invoice and payment entry

- Supports multi-currency, with conversion to company currency

- Option to filter by Customer, Sales team, Company, Account,

- Export to PDF for external reporting.

- Helps in payment follow-up letters and customer reminders

- Integrated with Customer Statements for communication

- Useful for auditors to verify outstanding customer balances

- Supports multi-company reporting

- Enhances credit control by identifying overdue partners quickly

Screenshot

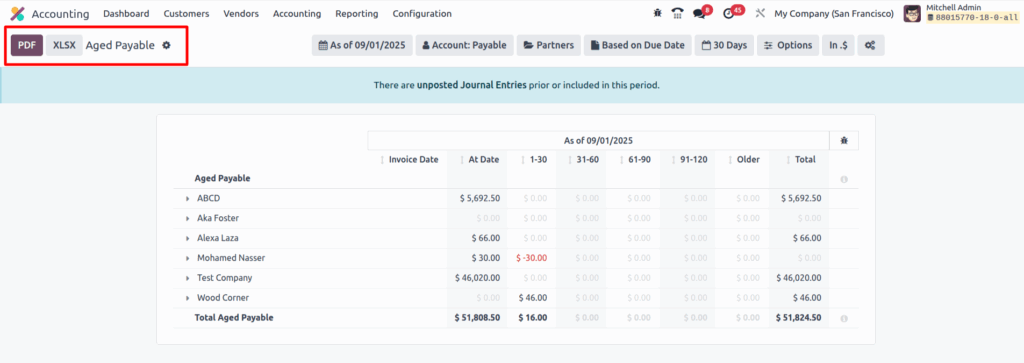

Aged Payable

Overview

The Aged Payables report in Odoo provides a detailed view of outstanding vendor bills and credit obligations, classified by their due dates. It helps businesses manage supplier payments, track overdue liabilities and plan cash outflows efficiently. This report is essential for maintaining good vendor relationships and effective working capital management.

Business Rules / Features

- Shows vendor outstanding bills split into aging periods

- Default buckets: 0–30, 31–60, 61–90, and 90+ days (configurable)

- Provides vendor-wise and bill-wise pending amounts

- Displays both bill date and due date references

- Separates not due and overdue balances clearly

- Based on posted entries only to ensure accuracy

- Drill-down to each bill, refund, and payment entry

- Supports multi-currency, converting amounts to company currency

- Filters available by vendor, purchase team, or company

- Export as PDF for reporting and analysis.

- Useful for payment scheduling and vendor negotiations

- Supports multi-company reporting in consolidated view

- Critical for auditors to verify accounts payable balances

Screenshot

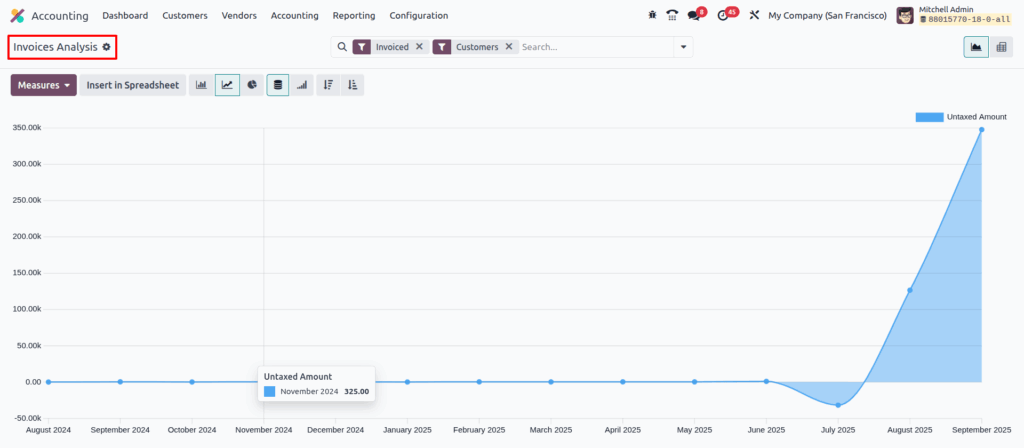

Invoice Analysis

Overview

Invoice Analysis in Odoo provides a detailed reporting view of all customer invoices and vendor bills. It helps businesses track revenue, expenses, payment status and tax implications. With powerful filters, groupings and pivot views, users can analyze invoicing trends, customer performance, vendor obligations and profitability across different dimensions.

Business Rules / Features

- Customer Invoices, Vendor Bills, Credit Notes and Refunds, MISC Entries

- Tracks invoiced amount, residual amount and payment status

- Drill down by customer, vendor, salesperson or purchase representative

- Supports grouping by product, category, journal and period

- Provision to filters for posted/draft/cancelled invoices

- Allows analysis based on invoice date, due date or accounting date

- Supports multi-company and multi-currency reporting

- Pivot and graph views for trend analysis

- Helps identify top customers, vendors and products

- Exportable to Excel for external reporting.

- Useful for management reviews, financial planning

Screenshot

Analytic Reports

Overview

The Analytical Account Report in Odoo provides a detailed breakdown of revenues and expenses recorded against each analytical account. It enables management to track project profitability, cost center performance and budget utilization. This report is primarily used for internal management accounting and does not affect statutory financial statements.

Business Rules / Features

- Shows detailed transactions linked to analytical accounts

- Provides balance per analytical account

- Supports filters by Department, Project and Tasks…etc

- Can be grouped by projects, cost centers, departments..etc

- Includes drill-down capability to view original source documents

- Can be exported to Excel for management review

- Works with pivot and different graph views for analytical insights

- Enables hierarchical reporting when linked to analytical plans

Executive Summary Reports

Overview

The Executive Summary Report in Odoo provides a high-level snapshot of a company’s financial health, designed for top management and decision-makers. It consolidates key financial indicators like income, expenses, profitability, cash position and outstanding balances. The report helps management to quickly assess overall performance without going into transaction level details.

Business Rules / Features

- Summarises key financial indicators (Income, Expenses, Profit/Loss)

- Displays Cash Balance, Bank Balance and Receivables/Payables

- Highlights Outstanding Customer Invoices and Vendor Bills

- Provides Net Profit or Loss for the selected period

- Supports period-wise comparison (monthly, quarterly, yearly)

- Available for multi-company consolidation

- Drill-down option to view supporting financial reports

- Can be generated in PDF format

Screenshot

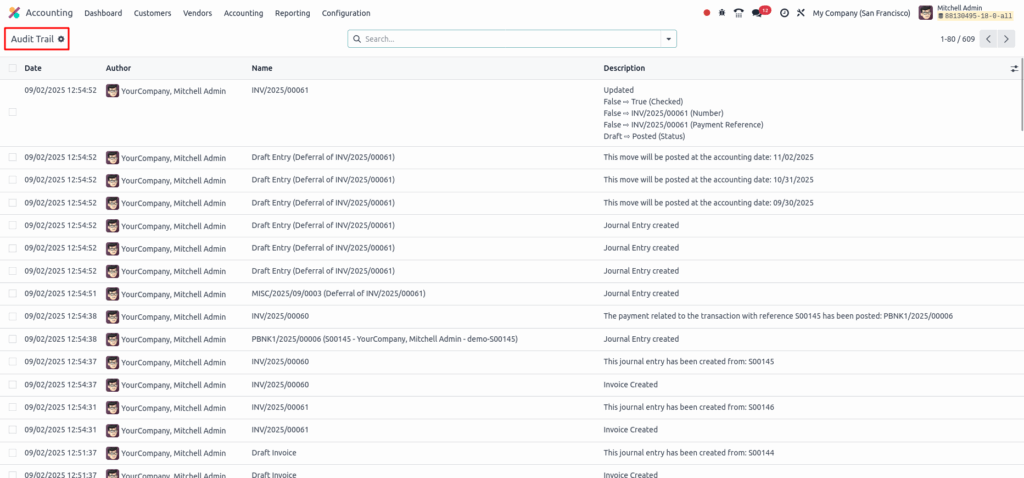

Audit Logs & Compliance Reports

Overview

Audit Logs & Compliance Reports in Odoo ensure financial transparency, accountability, and adherence to statutory regulations. These reports track all critical accounting activities, record user actions, and provide compliance-related summaries for audits, tax authorities, and management reviews. They form the backbone of internal controls and regulatory compliance.

Business Rules / Features

- Maintains a complete audit trail of financial transactions

- Detailed logs of user actions, including creation, modification, and deletion of transactions

- Time-stamped audit trails with user identification

- Logs date, time, and user details for every financial action

- Reports tailored for internal audits and external regulatory bodies

- Segregation of duties and role-based access controls

- Automatic flagging of suspicious activities or anomalies

- Exportable logs for forensic analysis

- Supports compliance with Indian GST regulations (tax reports, returns)

- Allows configuration of access rights for audit and compliance teams

- Ensures period closure control to avoid post-closing changes

- Export as Excel format for external audits.

- Integrated with Odoo Journal Entries for cross-verification

Screenshot

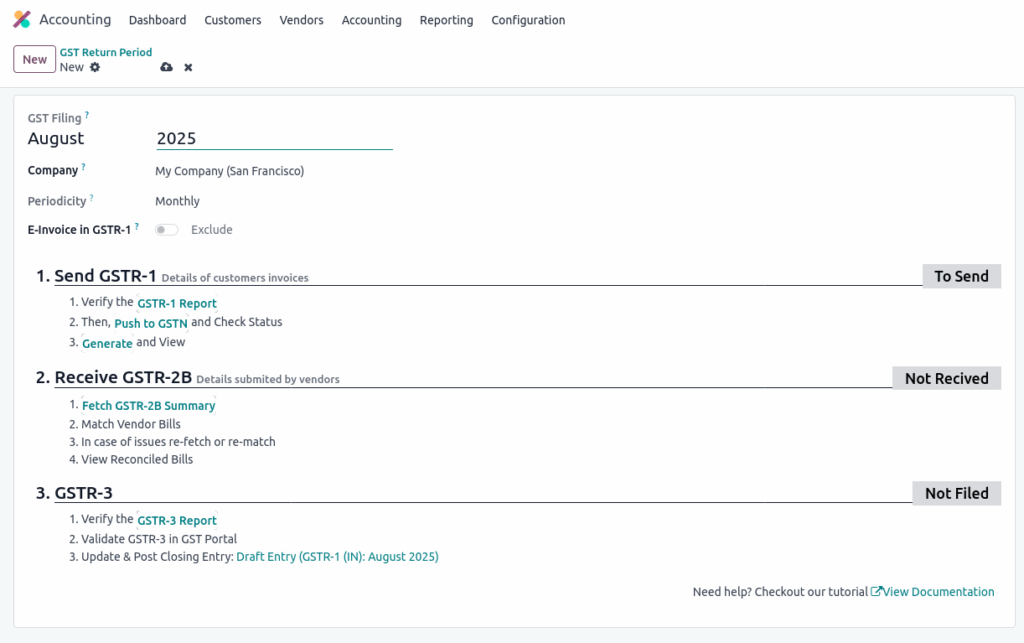

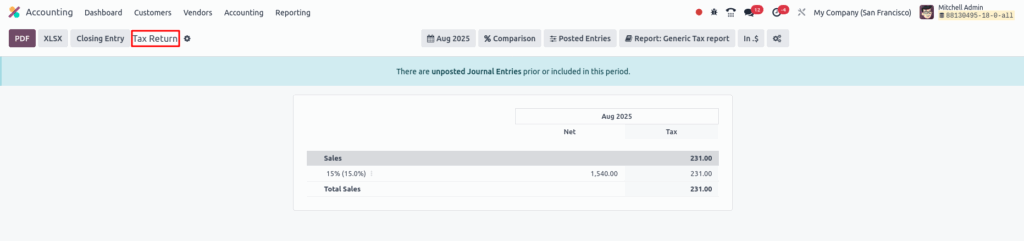

Tax Reports & Filings

Overview

Tax Reports & Filings in Odoo provide organizations with a centralized, automated and compliant way to calculate and file taxes. They ensure correct application of GST, TDS, TCS and other statutory taxes while generating government-ready reports. Integrated with e-Filing portals, these reports help businesses remain compliant, reduce manual effort and avoid penalties.

Business Rules / Features

- Generates statutory tax reports such as GST, TDS, TCS

- Supports GST computation for sales and purchase transactions

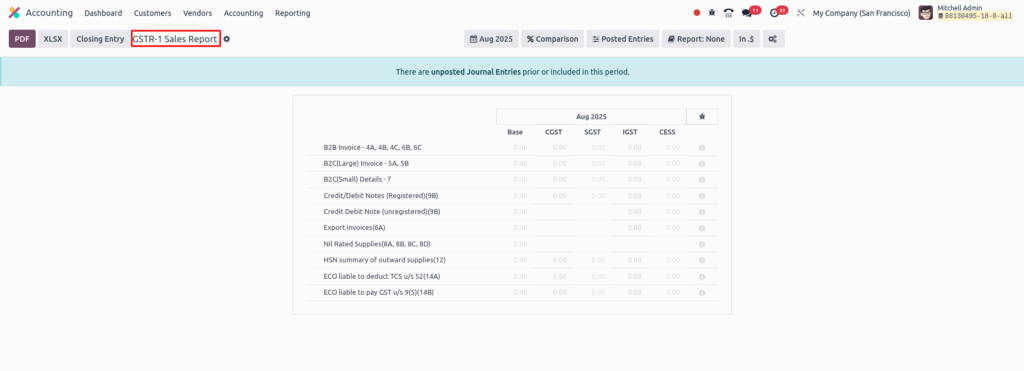

- Prepares GSTR-1, GSTR-2B, GSTR-3B for GST compliance

- Provides input tax credit (ITC) tracking against purchases

- Handles reverse charge mechanism (RCM) for applicable vendors

- Tax reports can be generated in summary or detailed formats

- Filing-ready reports available in Excel/PDF/JSON format

- Period closure ensures tax filings cannot be altered post-submission

- Supports multi-company tax compliance in consolidated reporting

- Facilitates manual adjustments for reconciliation with portal data

Screenshot

Accounting Dashboard

Overview

The Accounting Dashboard in Odoo provides a real-time, visual overview of financial health for the company. It consolidates key performance indicators, pending actions, and shortcuts into one interface, enabling accountants and managers to make faster, data-driven decisions.

Business Rules / Features

- Displays real-time financial KPIs such as revenue, expenses and cash position

- Shows open customer invoices and pending vendor bills

- Quick view of overdue receivables and payables for immediate action

- Provides bank and cash balances with reconciliation status

- Includes shortcuts for creating invoices, bills and payments directly

- Displays pending reconciliations from bank statements

- Shows recent journal entries and adjustments for quick validation

- Drill-down option to transaction-level details from dashboard metrics

- Supports graphical widgets like bar, pie, and line charts for trend analysis

- Provides role-based visibility ensuring sensitive data is secure

Screenshot