Assets Management in Odoo 18

The Asset Management module in Odoo helps companies keep proper track of their fixed assets like buildings, machines, vehicles, computers, or furniture. It covers the full journey of an asset from the time you buy it, use it, calculate its value going down (depreciation), spend on its repair or maintenance, and finally when you sell or scrap it. This makes sure the accounts are correct and also gives better financial control.

It works smoothly with other Odoo modules like Accounting, Maintenance, Purchase, and Inventory. For example, when you buy an item that should be treated as an asset, the system can directly add it as an asset, post depreciation automatically, and even remind you about service or maintenance.

The system also supports companies working in multiple locations or with different currencies, making it easier to manage assets across branches or countries. With features like grouping assets into categories, flexible depreciation methods, and ready-made reports, it helps businesses increase asset value, reduce risks, and stay prepared for audits without extra manual work

Key Features

- Create and manage fixed assets and other long-term assets easily

- Define your own Asset Models with flexible depreciation methods and schedules

- Multiple depreciation options are available: Straight Line, Declining and Declining then Straight Line

- Assets can be created automatically from vendor bills or purchase invoices

- Depreciation entries are generated automatically in draft and posted periodically

- Maintains detailed asset records like purchase date, original cost, book value, salvage value and current status

- Prorata Temporis option ensures depreciation is calculated in the most accurate way, even if the asset was not used for the full period

- Allows asset revaluation, disposal, or pausing of depreciation when required

- Handles disposal and sale of assets with automatic profit/loss entries in accounts

- Each asset can be linked to its purchase journal entry for clear traceability

- Supports automated asset creation through asset account settings (draft or validated)

- Comes with depreciation schedules and board view for better planning and visibility

- Allows both manual asset creation and automated workflows

- Confirmed assets can be saved as templates (asset models) for reuse

- Integrates tightly with Accounting and Inventory modules for complete lifecycle tracking

- Tracks gross value increases or adjustments using smart buttons for quick updates

Key Benefits

- Automates depreciation and asset accounting processes

- Simplifies management of asset lifecycle from acquisition to disposal

- Supports flexible depreciation methods and prorated calculations

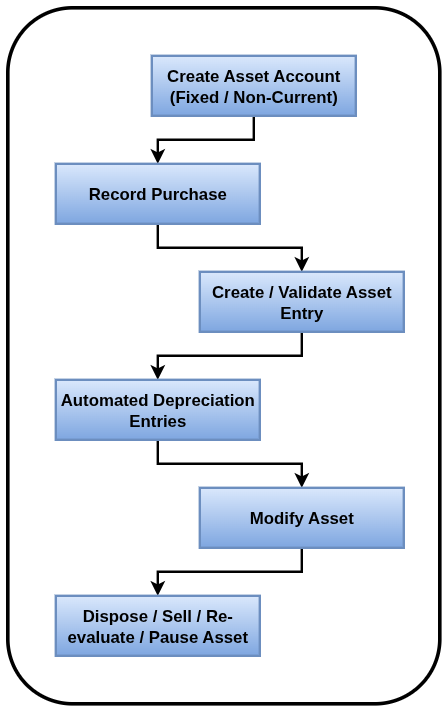

Asset Management Workflow

Assets Master Management

- Assets Models

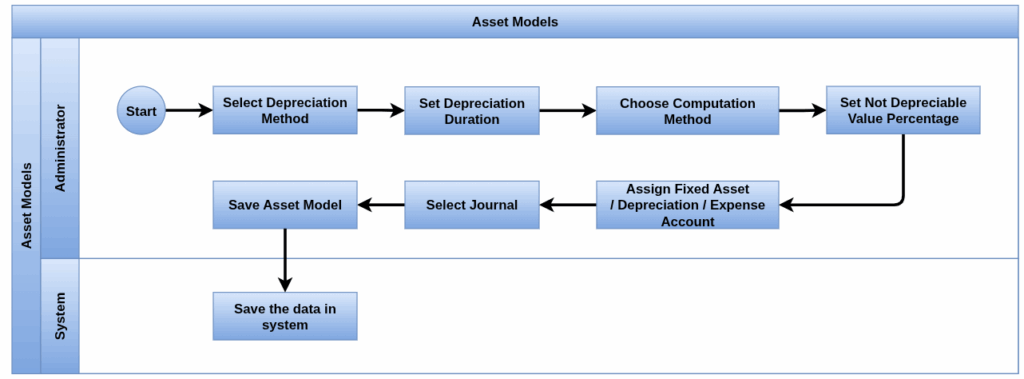

Asset Models

Overview

Asset Models in Odoo are templates used to automate and standardize the depreciation settings for similar types of assets. Each model defines the depreciation method, duration, accounts, and journal entries, making asset creation faster and more consistent. They are especially useful for recurring asset purchases like computers, furniture, or vehicles.

Process Flow

Business Rules

- The Asset Model name is mandatory

- The asset model must be linked to a Fixed Asset Account to track the acquisition cost.

- It must also include a Depreciation Account to record accumulated depreciation.

- An Expense Account should be selected to post periodic depreciation expenses.

- A specific Journal (usually of type Miscellaneous) is required to post depreciation entries.

- A depreciation method must be selected, which can be Straight Line, Declining Balance, or Declining then Straight Line.

- The duration of the asset must be defined, either in months or years, based on its useful life.

- A computation policy must be chosen: No Prorata, Constant Periods, or Based on Days per Period.

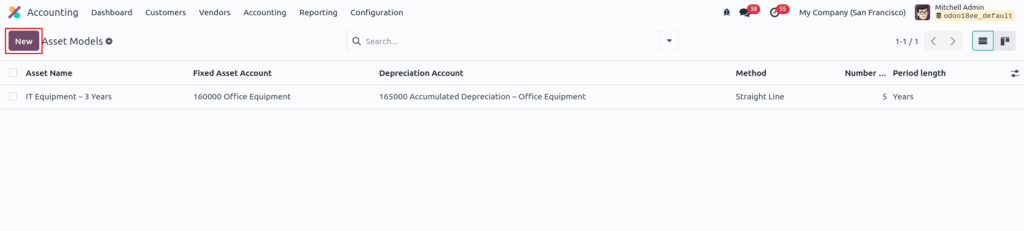

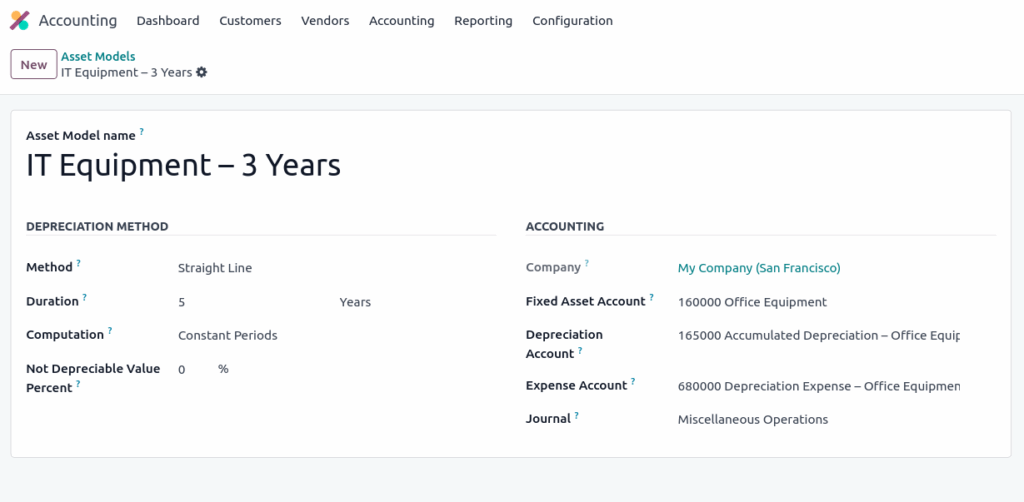

Screenshot

Asset Models Tree View

Asset Models Form View

Assets Management

- Configure an Assets Account

- Post an expense to the right account

- Assets creation

- Automate the Assets

- Modification of an Asset

Configure an Assets Account

Overview

When recording transactions related to fixed assets, these must be posted to an Assets Account instead of the default expense account. This ensures proper tracking of asset values and depreciation over time

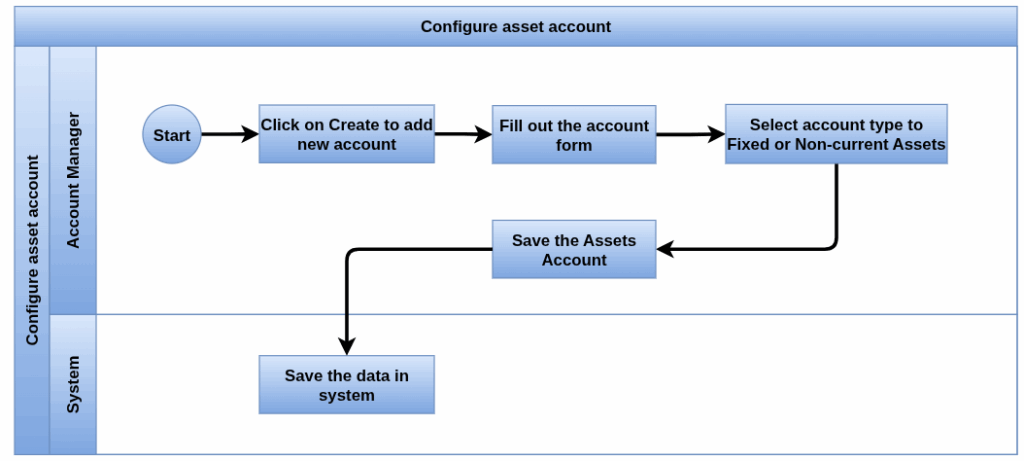

Process Flow

Business Rules

- The Account name must be mandatory

- The code must be set for every company to which this account belongs

- The account must be classified as Non-Current Asset or Fixed Asset in the chart of accounts

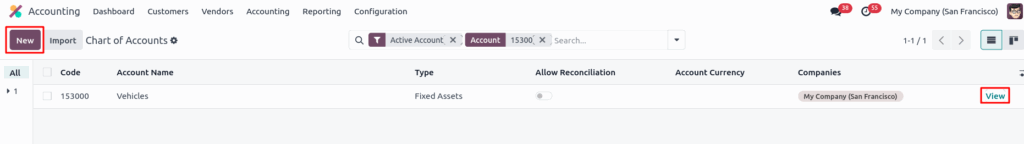

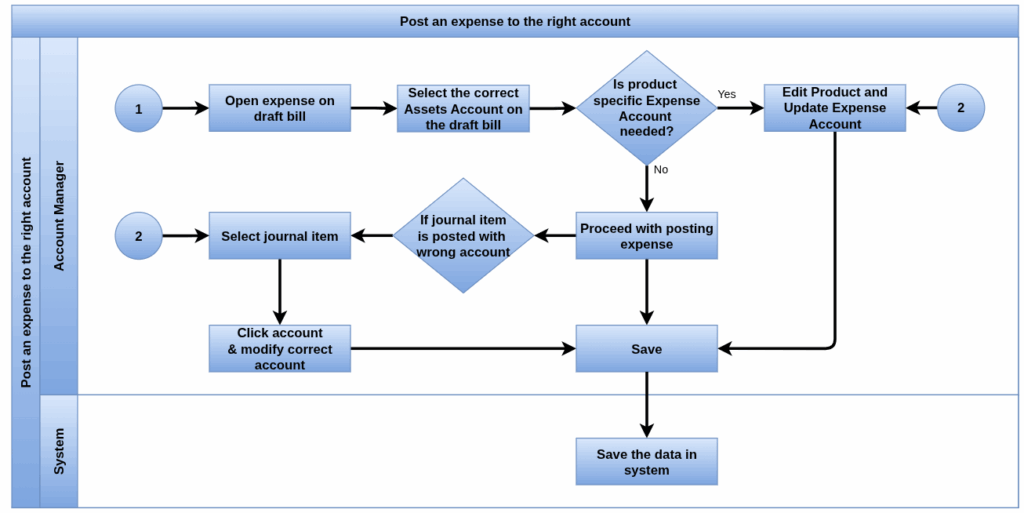

Screenshots

Configure an Asset Account tree View

Configure an Asset Account form View

Post an expense to the right account

Overview

Purchasing fixed assets like furniture, machinery, or IT equipment requires posting the expense to an Assets Account instead of a regular expense account. This allows Odoo to properly track the asset, automate depreciation, and maintain accurate financial statements.

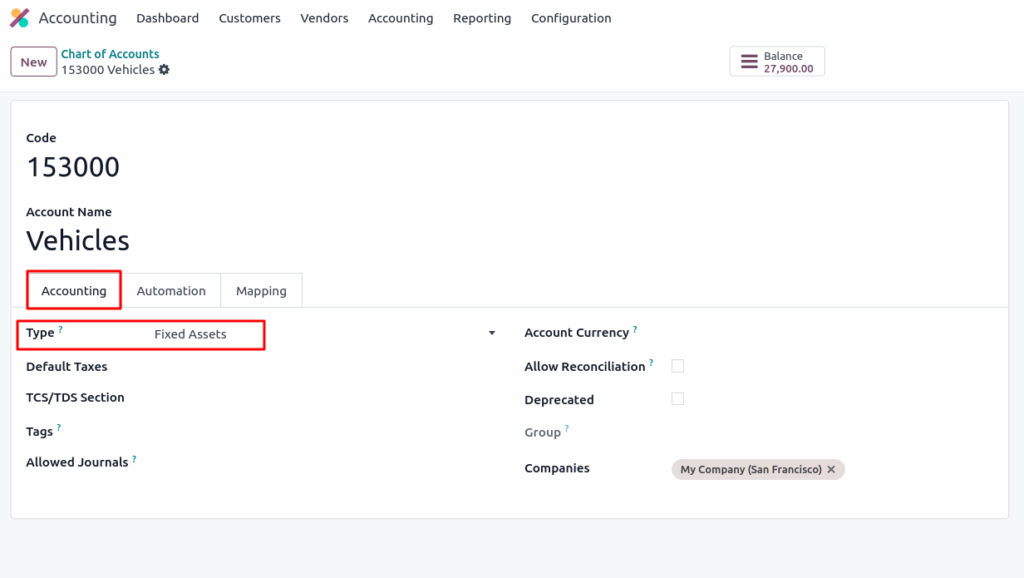

Process Flow

Business Rules

- Always use a Fixed Asset Account when recording asset purchases on vendor bills

- Set the correct account manually on draft bills, or predefine it in the product’s accounting settings

- To automate asset creation, link the fixed asset account to an Asset Model

- If the bill is already posted with the wrong account, update it via the Purchases Journal

- Posting to an asset account enables automated depreciation schedules and accurate asset reporting

Screenshots

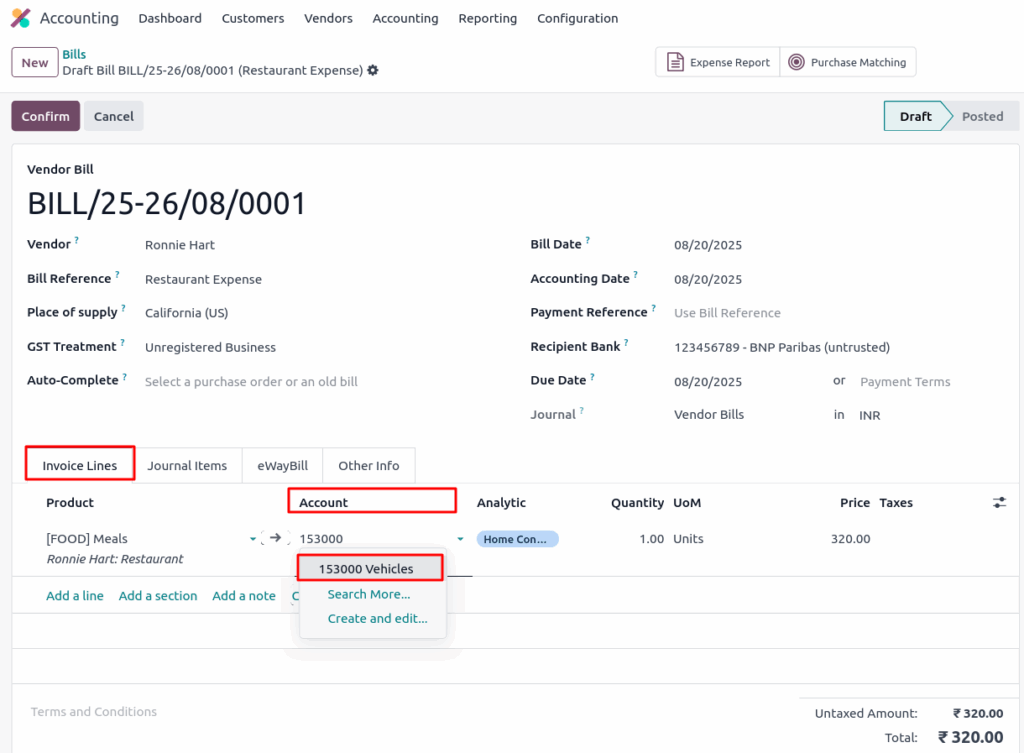

Correct Account on a Draft Bill View

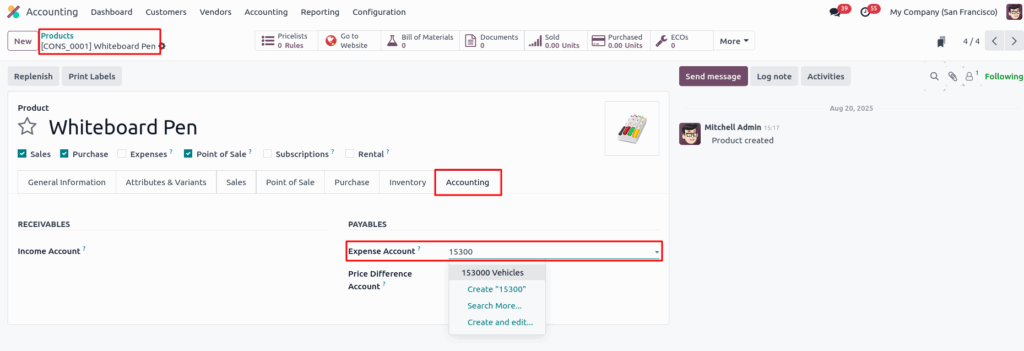

Assign a Expense Account to Products View

Change the Account of a Posted Journal Item View

Assets creation

Overview

Odoo allows you to create and manage fixed asset entries, which automatically generate depreciation journal entries over time. Assets can be created manually or directly from purchase journal items. The depreciation schedule is calculated based on the selected depreciation method and prorata settings, ensuring accurate accounting over the asset’s useful life

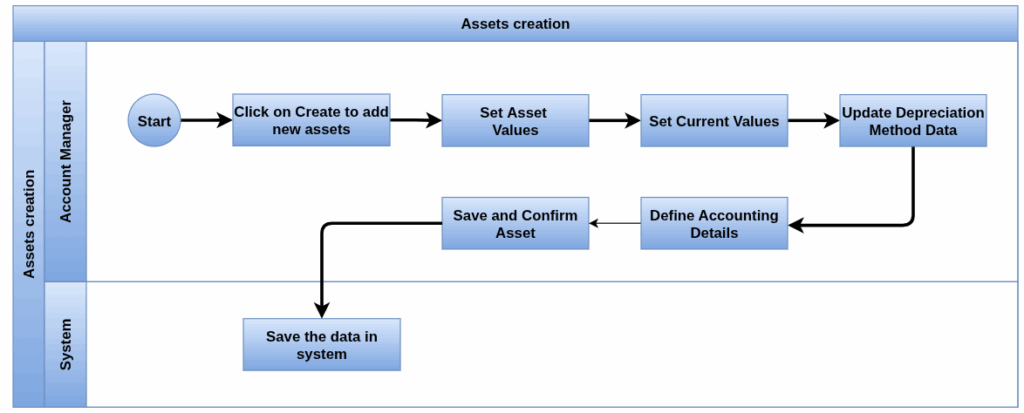

Process Flow

Business Rules

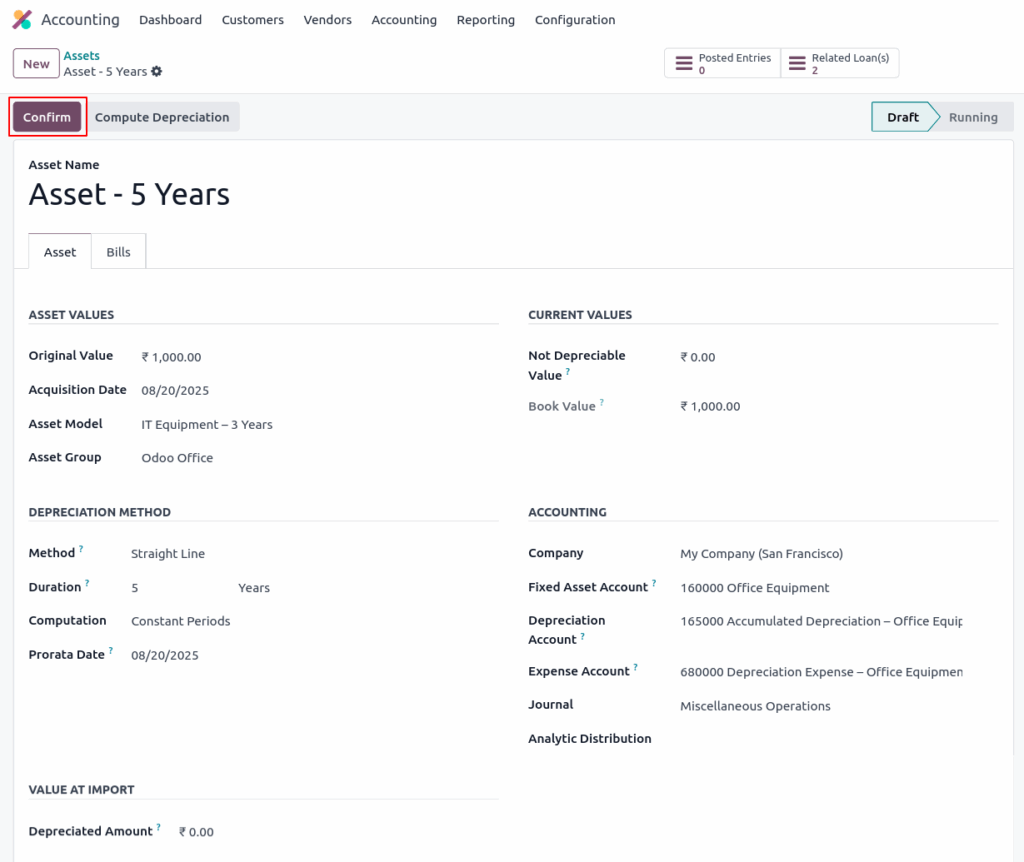

- Assets must have a unique name and be linked to a valid Asset Model

- Original Value and Acquisition Date are mandatory to create an asset

- Depreciation Method and Duration must be defined (e.g., Straight Line over 5 years)

- Assets must be linked to the correct Fixed Asset, Depreciation, and Expense accounts

- If Prorata Temporis is enabled, the Prorata Date must be set to calculate partial first-period depreciation

- Asset must be Confirmed before depreciation entries can be posted

- Depreciation Board must be computed to generate scheduled depreciation entries

- Depreciation entries are auto-generated and posted based on the selected Depreciation Method and frequency

- Assets can be created directly or linked from posted purchase journal items using Create Asset action

- Only journal items posted in appropriate asset-related accounts can be converted into asset entries

Screenshots

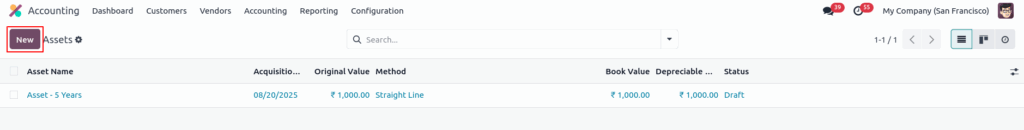

Assets tree view

Assets form view

Assets Depreciation board view

Automate the Assets

Overview

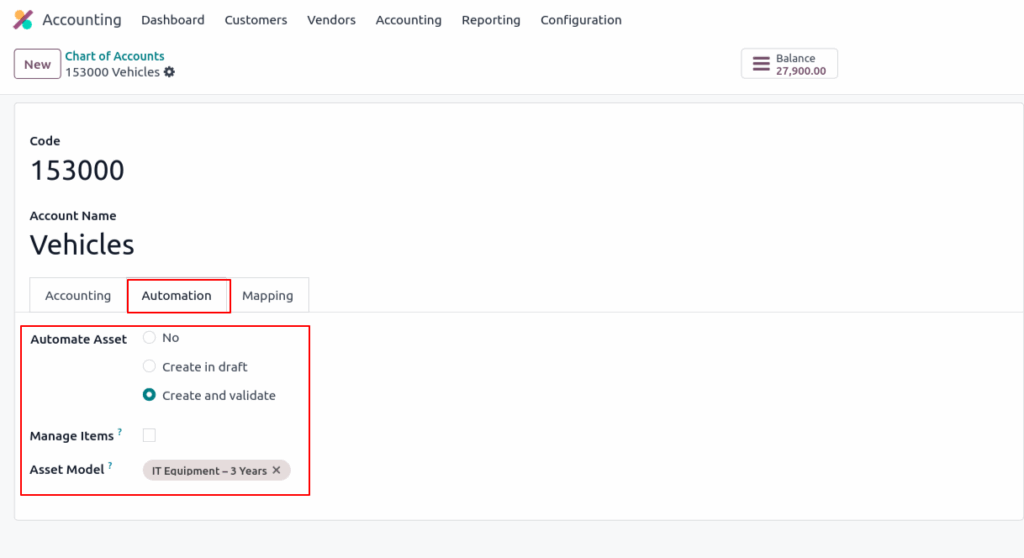

In Odoo, the Automate Assets feature lets you automatically create asset entries when posting to fixed asset accounts. You can choose to create no asset, create a draft, or create and validate using an asset model, making asset tracking faster and more consistent.

Process Flow

Business Rules

- When an account type is set as Non-current Assets or Fixed Assets, you can enable automatic asset creation

- The Automate Assets field controls the automation behavior with three options:

- No: (Default) No asset is created automatically

- Create in draft: A draft asset entry is created when a transaction is posted; you must review and validate it manually

- Create and validate: An asset is created and validated automatically upon posting, but you must assign an Asset Model in advance

- To use “Create and validate,” the linked Asset Model defines the depreciation method, duration, and accounting rules

- This automation helps streamline asset tracking and ensures consistency in asset creation from purchase transactions

Screenshots

Automate assets form view

Modification of an Asset

Overview

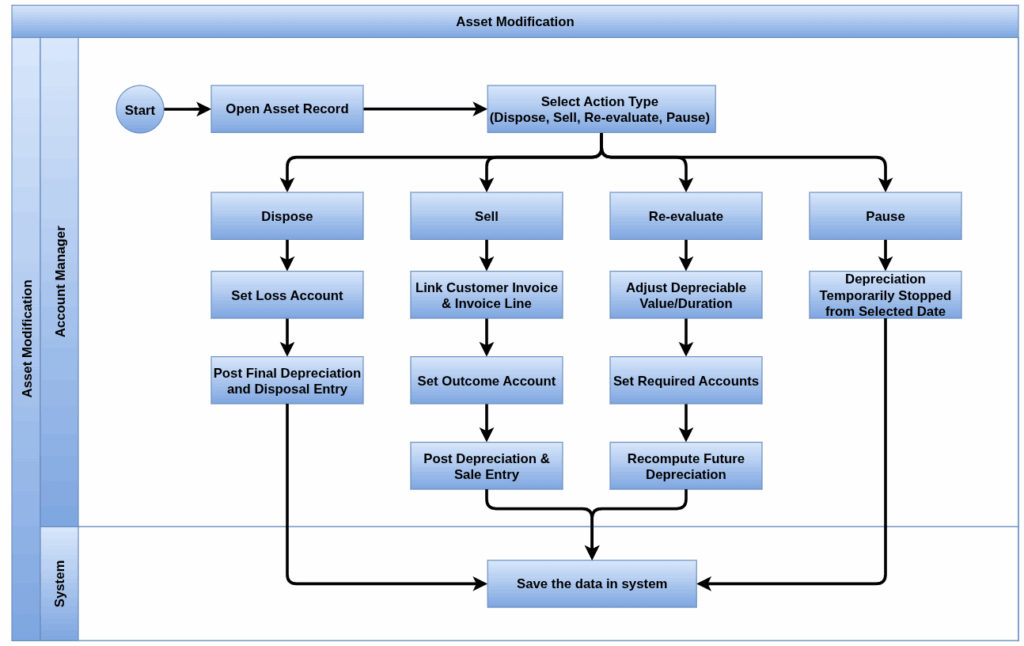

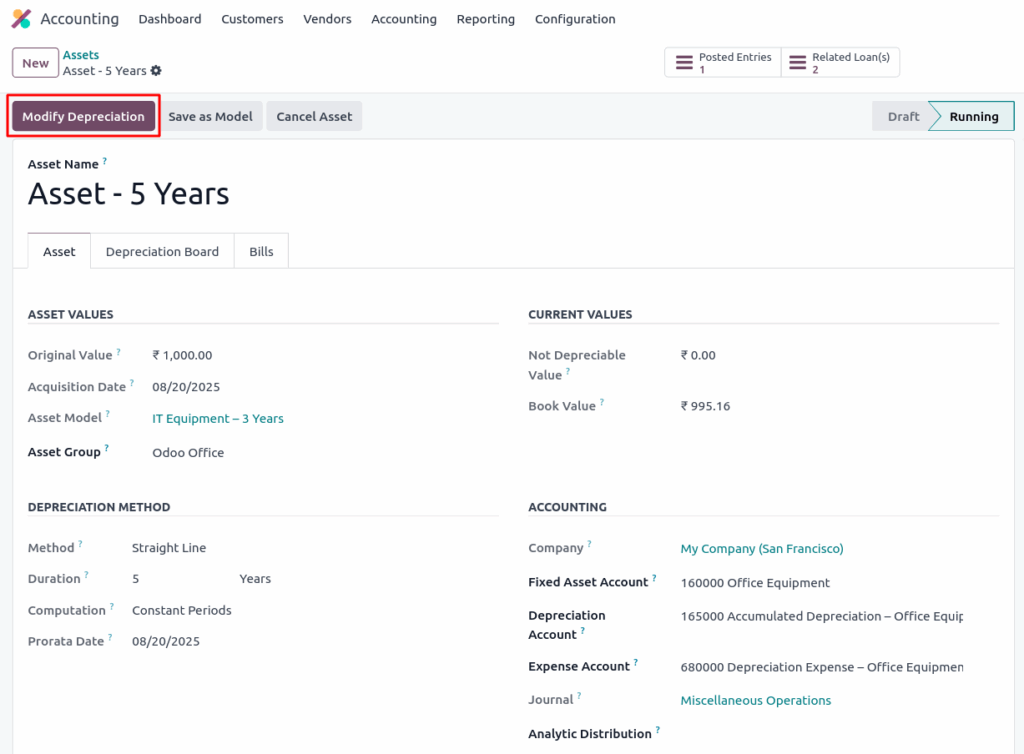

In Odoo, assets can be modified by disposing, selling, pausing, re-evaluating, or adjusting depreciation values. These actions update the asset’s value and depreciation schedule, post necessary journal entries, and take effect from the specified date. Increases create a new asset entry, while decreases update future depreciation.

Process flow

Business rules

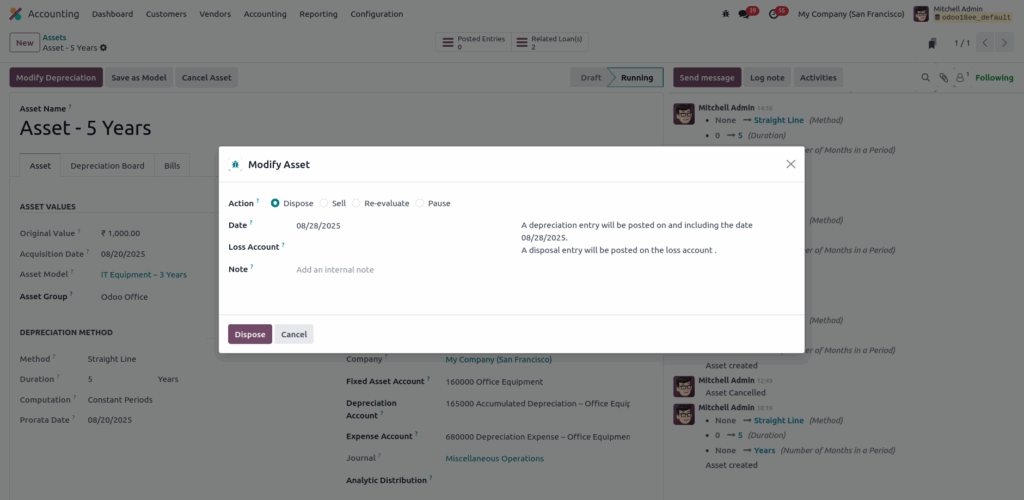

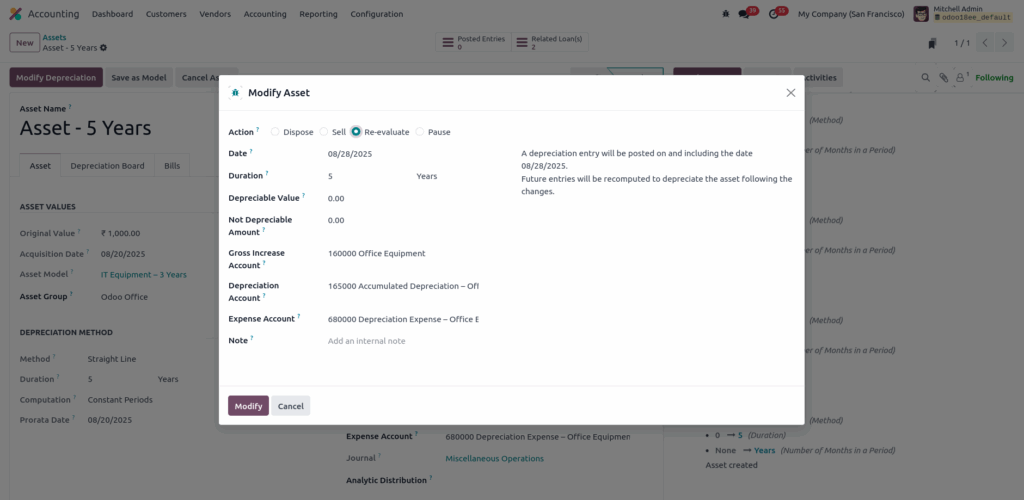

- One must choose one of the following actions to modify an asset

- Dispose: Ends the asset’s life; posts a final depreciation and a disposal entry to the Loss Account

- Sell: Requires linking a Customer Invoice and Invoice Line; reverses revenue and records the outcome in the appropriate account

- Re-evaluate: Adjusts the asset’s Depreciable Value, Duration, or Not Depreciable Amount; future depreciation is recalculated based on the new values

- Pause: Temporarily stops depreciation from the selected date onward

- Date Field: The effective date must be set for the action; a depreciation entry is posted on or including this date

- Accounts For Dispose or Sell, you must assign a Loss Account or Outcome Account.

- Accounts For Re-evaluate, you must configure the Gross Increase Account, Depreciation Account, and Expense Account if increasing the asset value

- Future Depreciation: Only unposted depreciation entries are updated when asset values are changed

Screenshots

Asset Modification Button View

Asset Modification Dispose View

Asset Modification Sell View

Asset Modification Re-evaluate View

Asset Modification Pause View