Odoo 18 Expenses

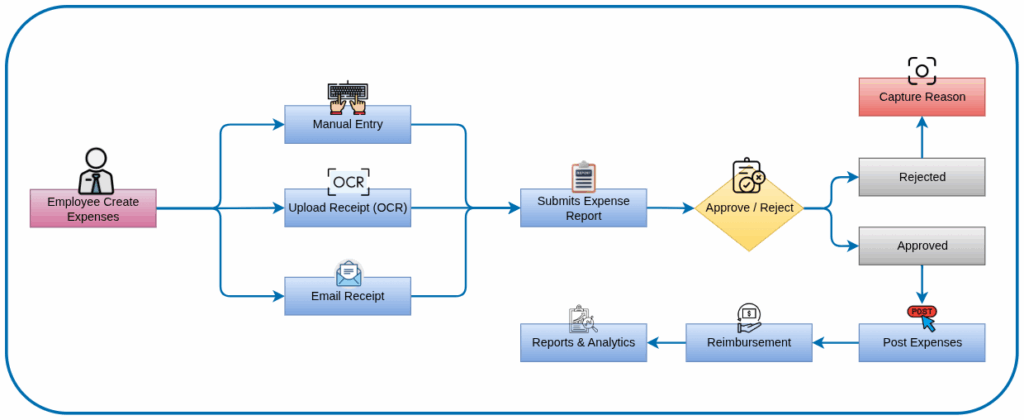

Employees can record their expenses and easily attach scanned copies of their bills for the manager’s approval. Managers can access all receipts and expense reports, and approve or reject them with just one click. If the manager rejects an expense, they need to provide a reason. After approval, accountants will check the records, enter them into the books and process the invoices and payments.

Odoo 18 Expenses Feature

- Attach scanned copies of bills, receipts and tickets

- Upload expenses individually or in bulk

- Submit expenses via email

- Split a single expense across multiple categories or projects

- Add notes for reviewers to provide context

- Submit expense reports to managers for approval

- Track the status of each expense submission

- Review submitted expenses before approval

- Approve or reject expense submissions

- Notify employees upon approval or rejection

- Generate and manage detailed expense reports

- Post approved expenses to the accounting module

- Reimburse employees after expense approval

- Create invoices and process payments for approved expenses

- Configure master data for expense categories

- Expenses can be categorized by type (travel, meals, office supplies, etc.)

- Configure master data for activity types

- Multi-currency support for international expense claims with auto conversion

- Expenses can be linked to Analytical Accounts/Projects for cost tracking

- Approval workflows is configurable in employee master

- Expenses create vendor bills or journal entries

- employees can submit expenses via mobile app

Key Benefits

- Odoo Expenses makes logging expenses easy through manual entry, receipt uploads, or email submissions

- It features automated multi-level approval workflows to ensure efficient expense validation

- The module integrates seamlessly with accounting and payroll for smooth financial management

- It provides clear reporting and insights to help monitor and control business spending

Expenses Management Workflow

Expenses Master Management

- Expense Categories

- Activity Types

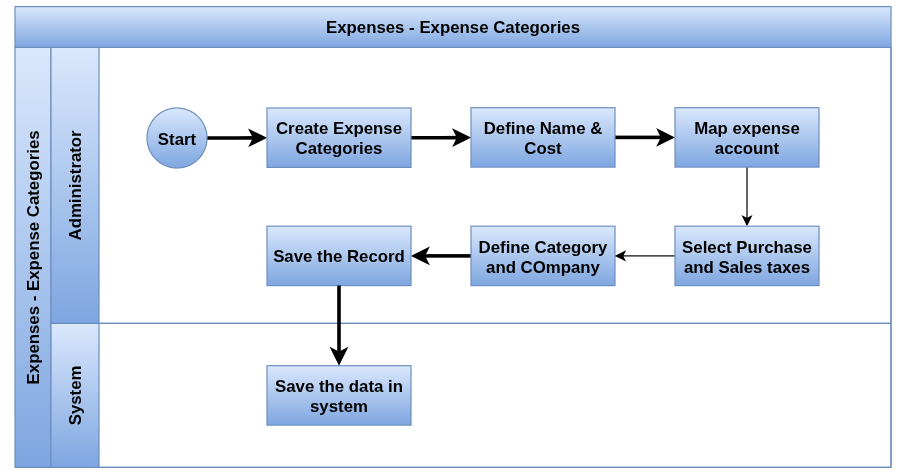

Expenses Categories

Overview

Expense Categories allow businesses to categorize different types of expenses (e.g., office supplies, travel expenses, utilities, etc.). This ensures that the expenses are easily tracked and grouped for both reporting and accounting purposes.

Process Flow

Business Rules

- Each expense must be tagged under an Expense Category

- Administrator group user access to visible expanses categories menu otherwise not

- Administrator group access user only create expanses categories

- The ‘Product Name’ field is mandatory. If you do not enter a value, the record will not be saved

- Enforces policy rules like limits, daily allowances rates

- Easy classification of expenses in reports and dashboards

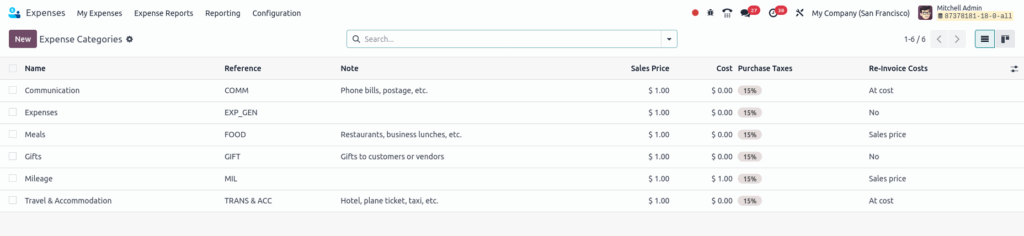

Screenshot

Expenses Categories Tree View

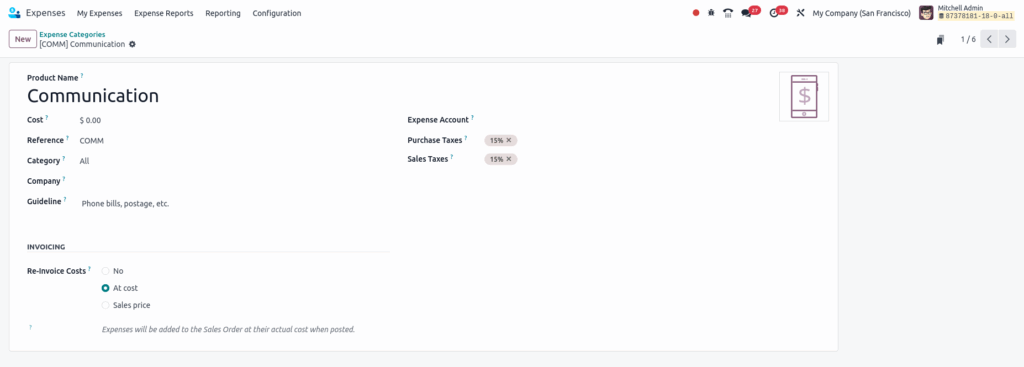

Expenses Categories Form View

Activity Types

Overview

In Odoo Expenses, Activity Types are used to define different kinds of tasks or actions that employees need to perform related to their expenses. These activities can be assigned to specific expense records to ensure proper follow-up, tracking, and management of expenses.

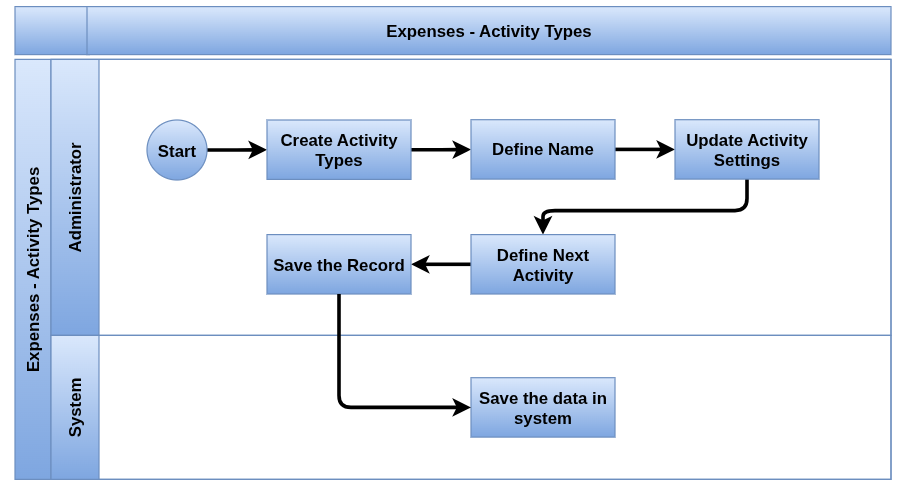

Process Flow

Business Rules

- Enable debug mode to make the ‘Activity Type’ menu visible to the logged-in user on the screen.

- Debug mode enable in user screen and create the activity type

Screenshots

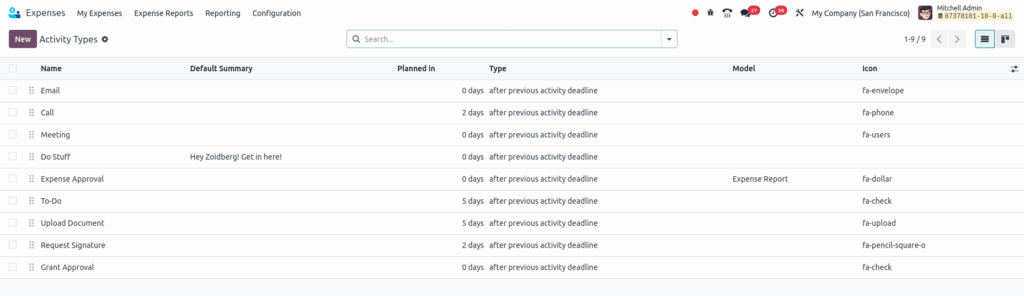

Activity Types Tree View

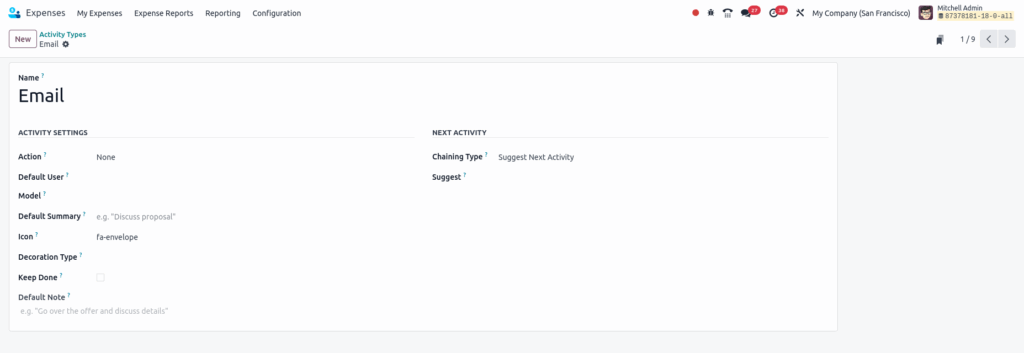

Activity Types Form View

Odoo 18 Expenses Management

Expenses features

- Log Expenses Manually

- Attach Receipts

- Upload Expenses

- Email Expense Entries

- Split Expense

- Generate Expense Reports

- Approve / Refuse Expenses

- Post Expenses

- Reimburse Employees

Log Expenses Manually

Overview

Logging expenses manually in Odoo is used for recording individual employee expenses by entering details such as description, category, amount, and date directly into the system. This method is useful when uploading or emailing receipts isn’t possible, ensuring all business expenses are accurately captured and ready for approval and reimbursement.

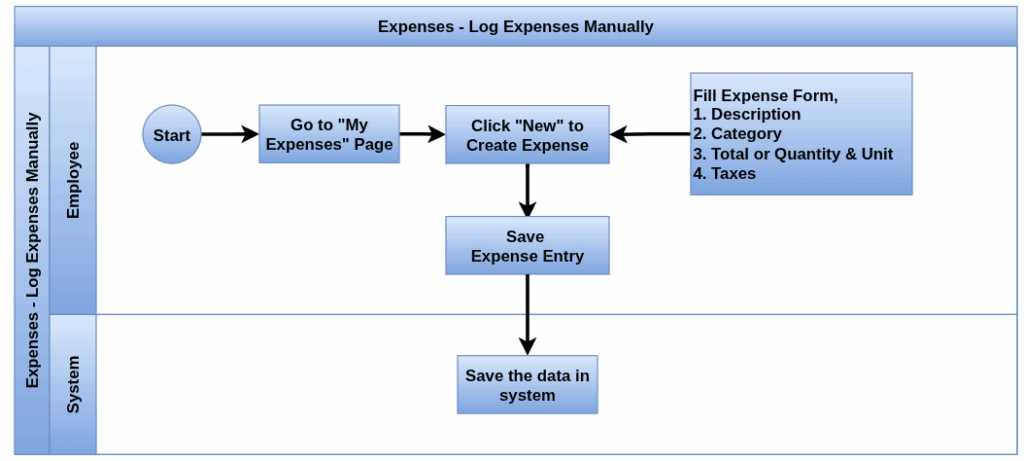

Process Flow

Business Rules

- The user must be linked to an employee record with appropriate access rights

- Fields like Description, Category, Amount, and Expense Date are mandatory before saving

- The selected category controls tax rates, analytic accounts, and expense accounts

- Users must indicate if the expense was paid by the Employee (to be reimbursed) or by the Company

- If company policy enforces it, a receipt must be attached for an expense to be eligible for approval or payment

- Expenses stay in “Draft” until submitted; no accounting or reimbursement happens until approval

Screenshots

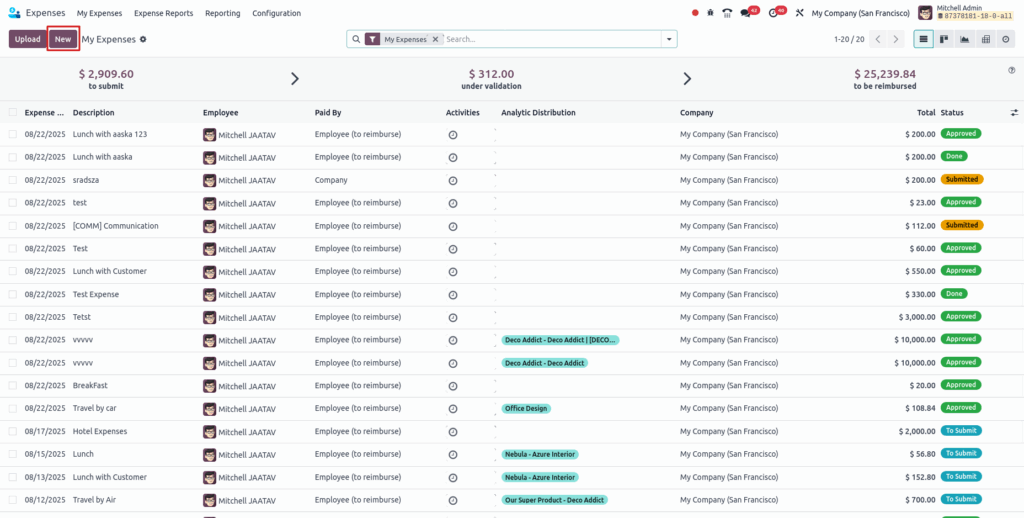

Manual Expenses Tree View

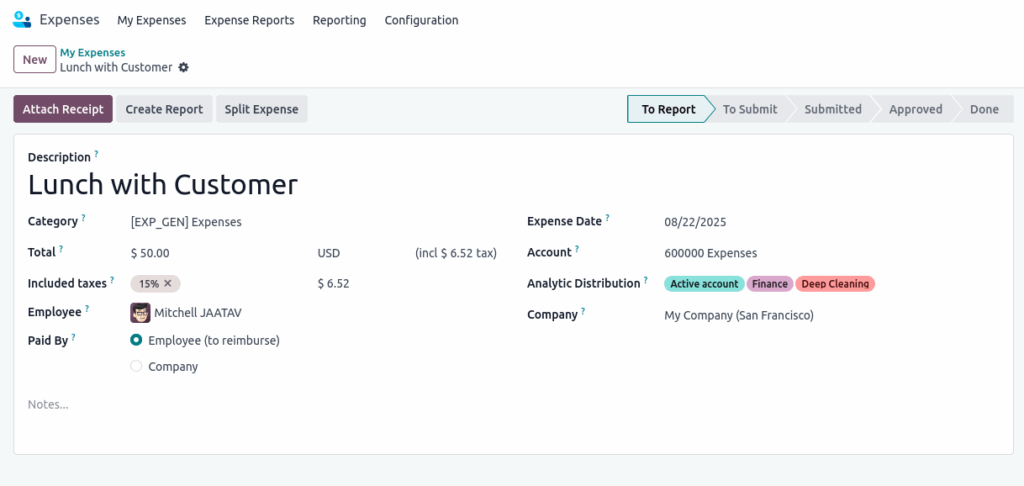

Manual Expenses form View

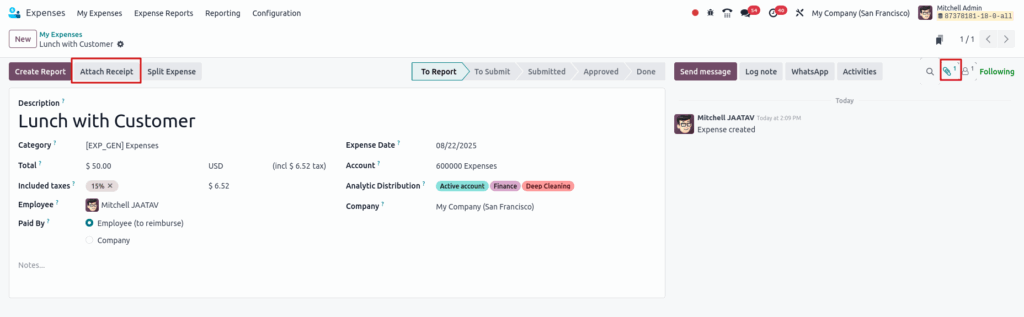

Attach Receipts

Overview

Attaching receipts is a crucial step in validating expense claims. Users can upload digital copies (PDF, image) of their receipts directly to individual expense records. This ensures transparency and supports audits, making it easier for managers and finance teams to verify the authenticity of expenses. The uploaded receipts appear in the chatter section of each expense, and multiple files can be attached if necessary.

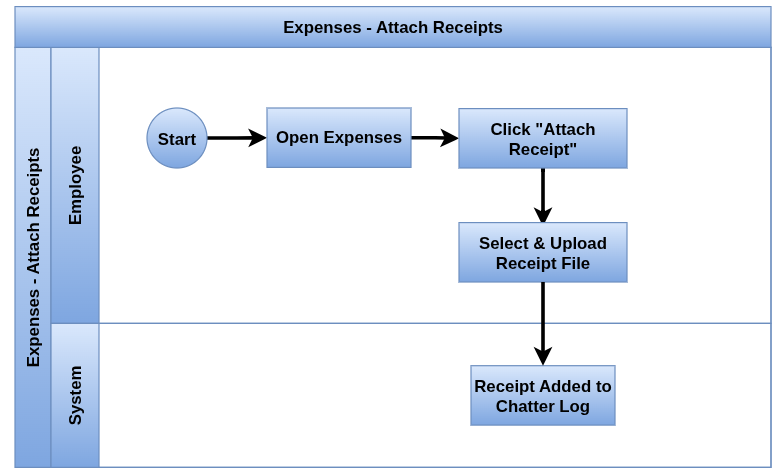

Process Flow

Business Rules

- Receipts must be clearly legible and relevant to the logged expense

- Receipts can be attached at any time before approval

- Multiple receipts can be added to a single expense if applicable

- Required for reimbursement if enforced by company policy

Screenshots

Attach Receipts Create Button View

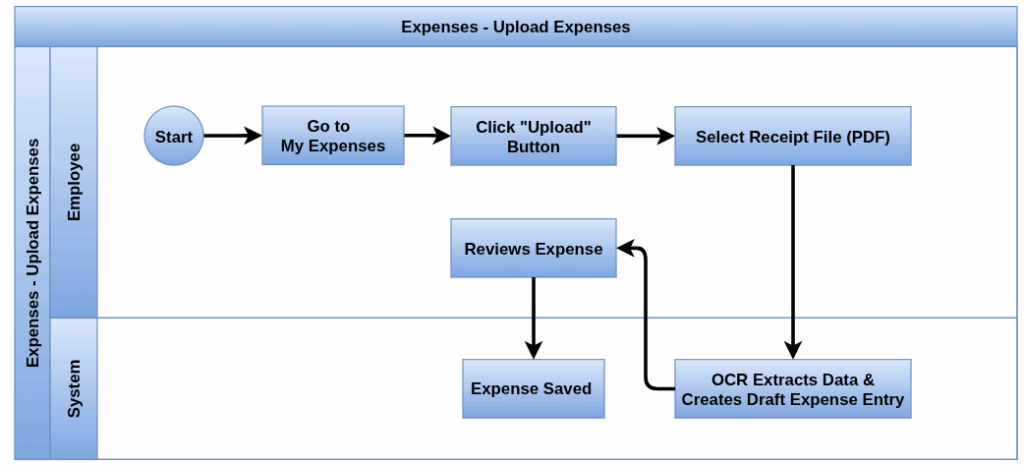

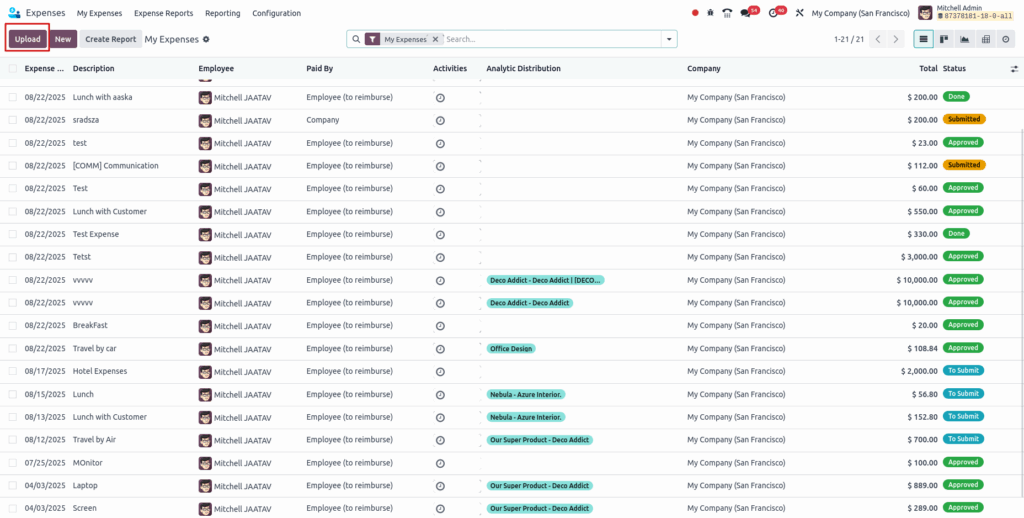

Upload Expenses

Overview

Odoo allows users to upload scanned receipts which are automatically processed using OCR (Optical Character Recognition). This digitization extracts key data like amount, date, and vendor, and creates a draft expense record. This method speeds up data entry, reduces manual effort, and helps employees quickly log expenses, especially when handling many receipts. It is ideal for mobile users and frequent travelers who need to submit expenses on the go.

Process Flow

Business Rules

- OCR must be enabled in settings and sufficient IAP credits must be available

- Only supported file types (PDF, image) are allowed

- Uploaded receipts must match company expense formats to avoid rejections

- Users must review and confirm auto-created entries before submission

- Uploaded receipts should not exceed a maximum file size (e.g., 5MB) to ensure smooth processing.

Screenshots

Upload Expenses Button View

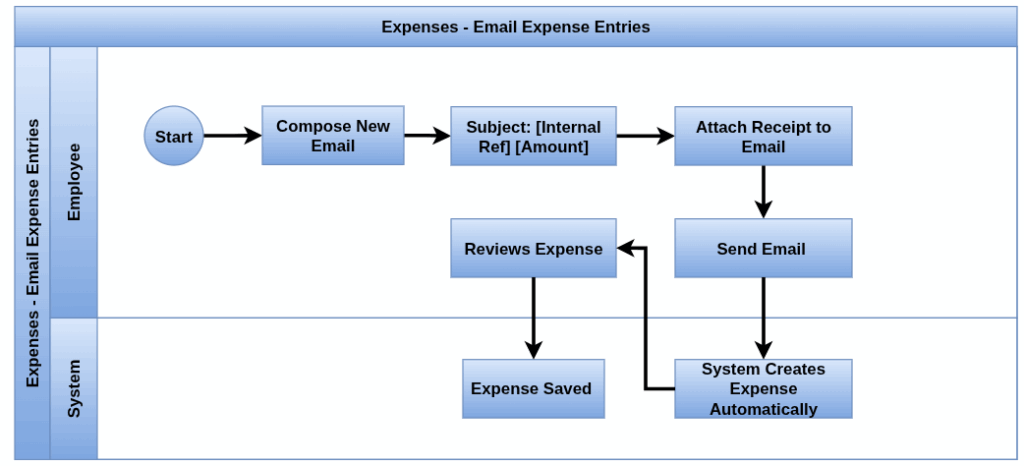

Email Expense Entries

Overview

Odoo supports expense submission via email, allowing employees to forward receipts directly to a predefined email alias (e.g., expense@company.com). The system reads the subject line (formatted with an internal reference and amount) and uses the attachment to auto-create an expense. This is especially helpful for field staff or mobile users who may not access the Odoo interface regularly but need to submit expenses promptly.

Process Flow

Business Rules

- Sender must be an authenticated employee (Work Email in employee record)

- Subject line must follow format: [Internal Reference] [Amount] (e.g., FOOD $25.00)

- Receipt must be attached to the email

- Category reference must match an existing expense category

- Expense entries created via email must be reviewed by the employee or manager before approval to ensure data accuracy.

Screenshots

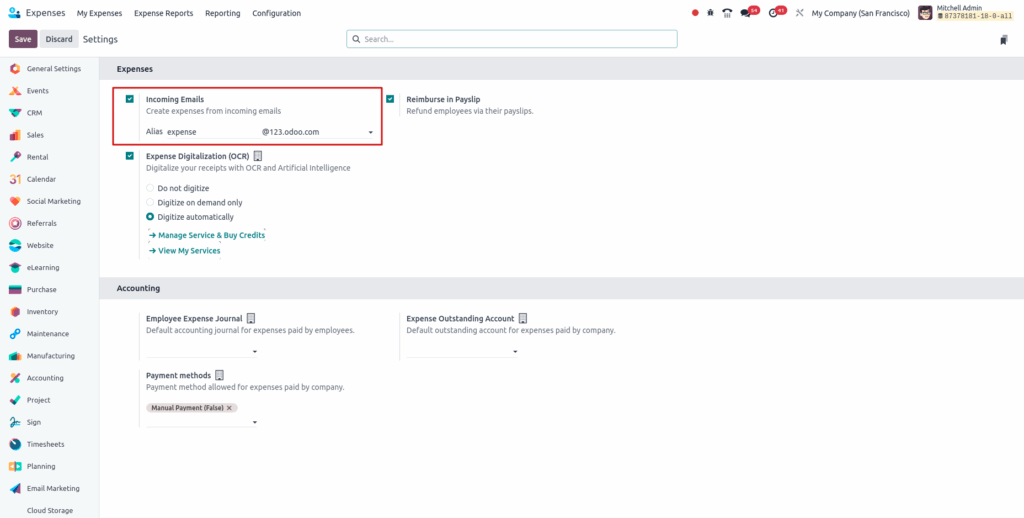

Email Expenses Configuration View

Split Expense

Overview

The Split Expense feature in Odoo is used when a single expense needs to be divided across multiple accounts, departments, projects, or analytic tags. This is useful when costs are shared between different cost centers or should be allocated to multiple budgets. It ensures accurate tracking, reporting, and accountability of shared expenses.

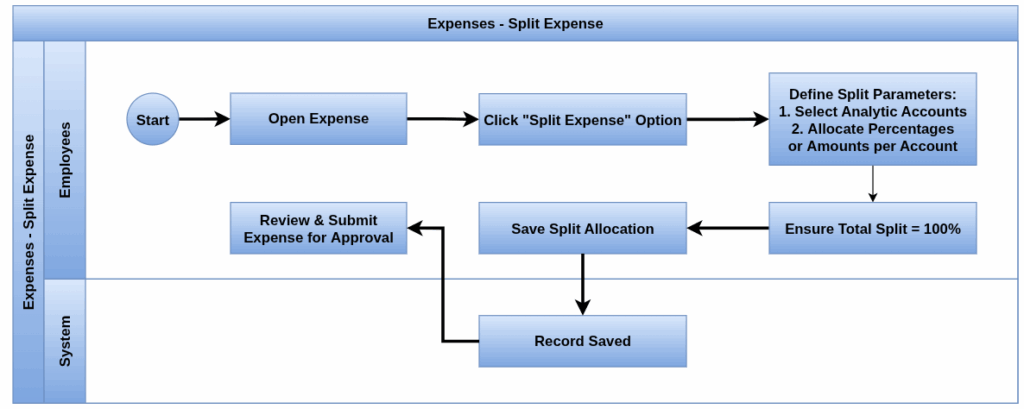

Process Flow

Business Rules

- Splits must total 100% of the original expense amount

- Users can split by analytic accounts, projects, departments, or a combination

- Only users with the right access can apply or edit splits

- Each split line must have a valid distribution percentage or amount

- Split entries must be reviewed and approved along with the main expense

- The system automatically validates that there is no over- or under-allocation before saving

- Split expenses reflect proportionally in expense reports and accounting entries

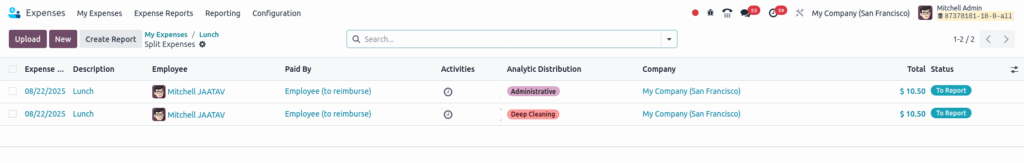

Screenshots

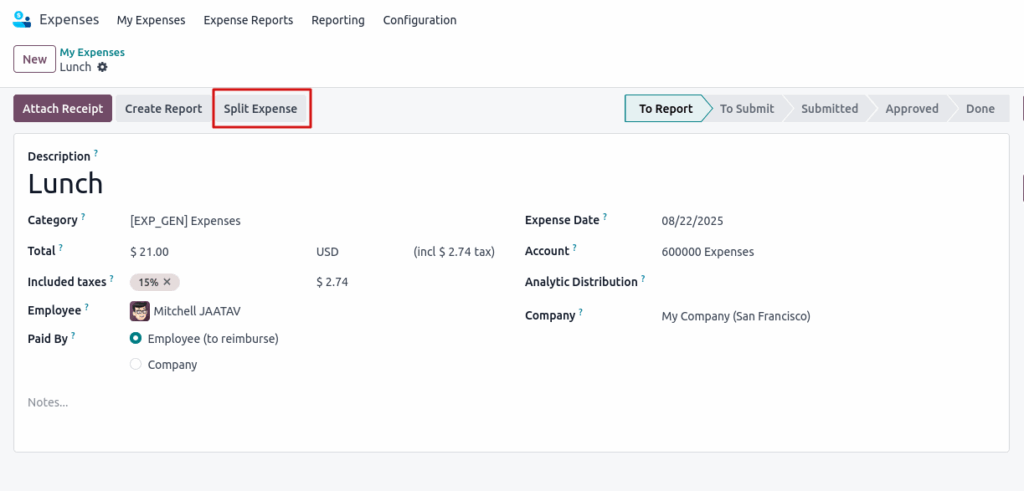

Split Expense Button View

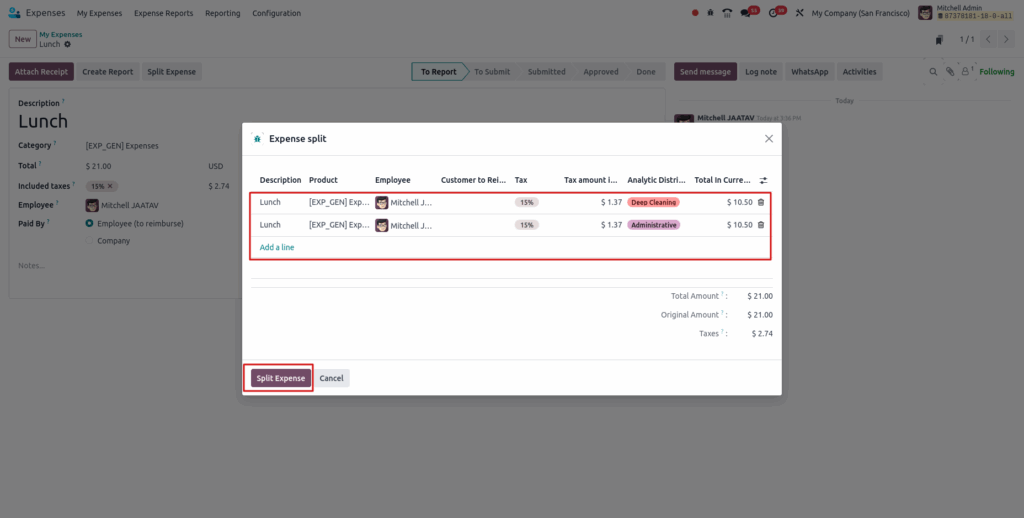

Split Expense Creation View

Splitted Expense View

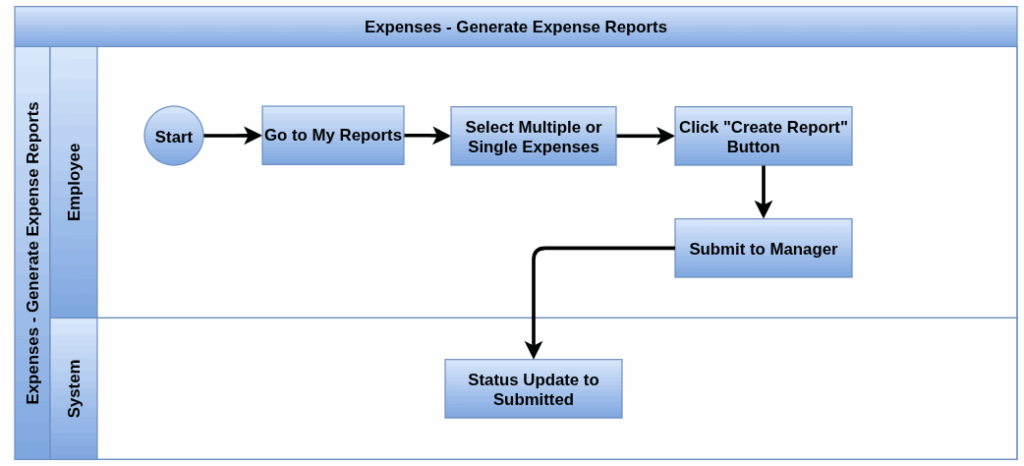

Generate Expense Reports

Overview

In Odoo, when employees are ready to submit expenses—such as after a business trip or monthly they must create an expense report. From the Expenses app, users can access the My Expenses dashboard to manage and track their entries.

Process Flow

Business Rules

- An expense report must be created when expenses are ready to be submitted (e.g., after a business trip or monthly)

- Expense reports can be created from the Expenses app dashboard, My Expenses ‣ My Expenses, My Reports, or Expense Reports views.

- Only expenses with status To Report or To Submit can be added to an expense report

- Expense reports must be created before submitting expenses for approval

- Expenses already included in another report cannot be added again

- A manager must be assigned to review and approve each expense report

- Expense reports must be submitted individually; batch submission is not allowed

- The status of expense reports determines whether they need submission (To Submit in blue text) or are already processed (Submitted/Approved in black)

- Additional expenses can be added to a report before submission if they have a To Submit status and aren’t already on a report

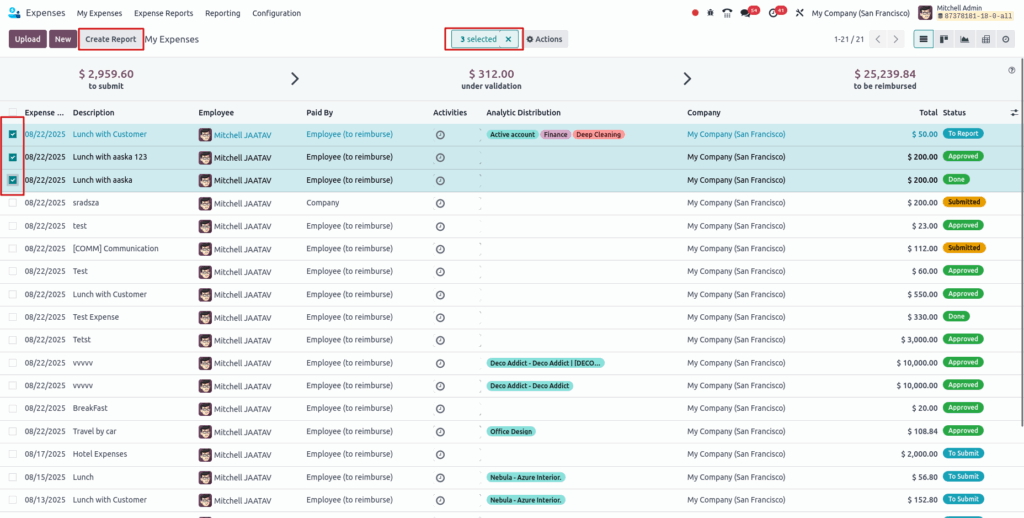

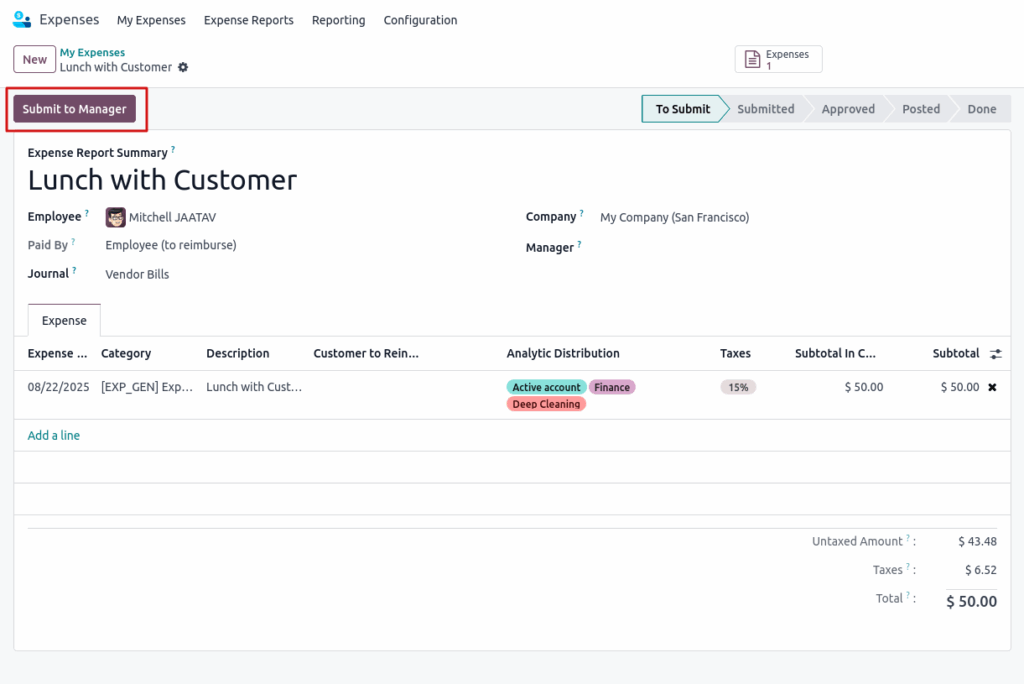

Screenshots

Expenses report create View

Expenses report Submit View

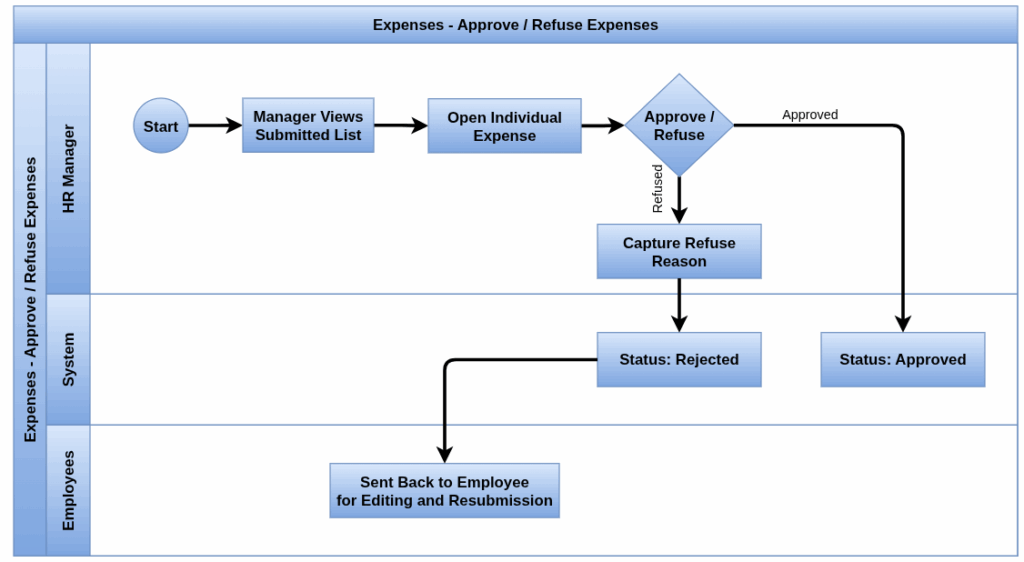

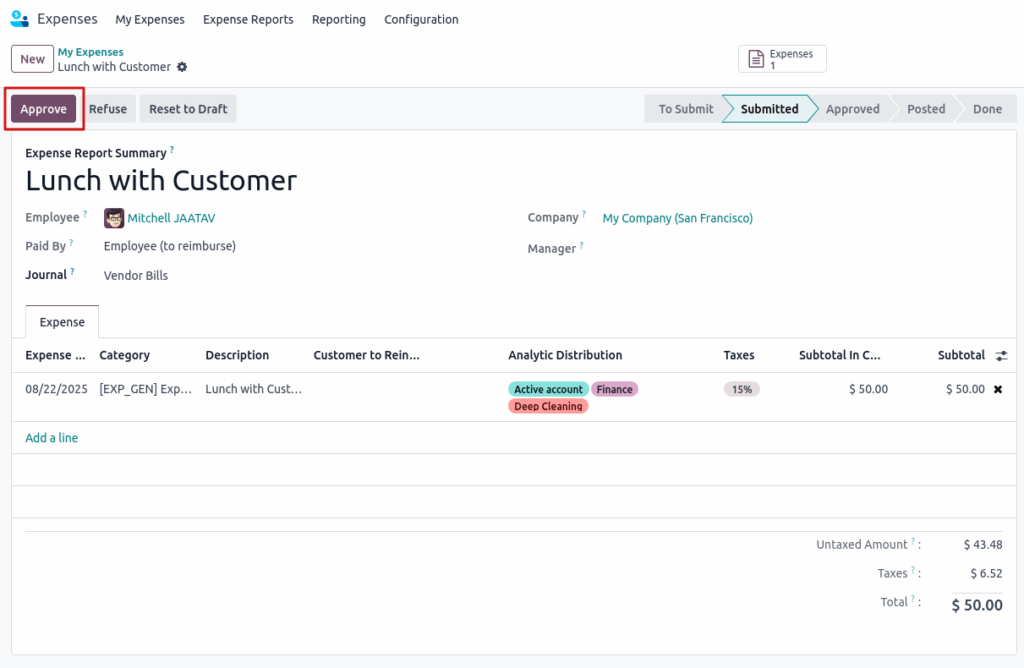

Approve / Refuse Expenses

Overview

Once expenses are submitted, they enter the approval workflow. Managers or designated approvers can review, approve, or reject each claim based on company policy. The system supports single or multi-level approvals, with notifications and audit trails. Rejected expenses are returned to the employee with comments for correction. This process ensures that only legitimate, policy-compliant expenses are reimbursed.

Process Flow

Business Rules

- Only users with approval rights can take action

- Rejected expenses must include a reason for refusal

- Approval routes can be single or multi-level based on amount or role

- Expenses with missing mandatory fields or receipts cannot be approved

Screenshots

Approve Expenses View

Refuse Expenses View

Refuse Reason Capture View

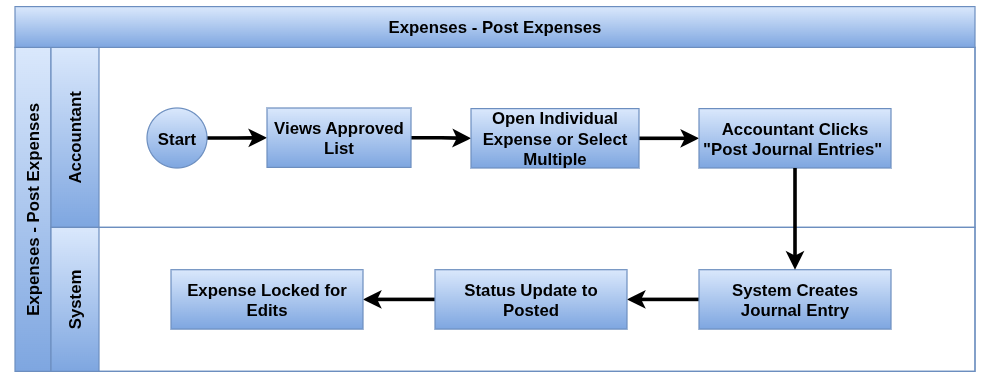

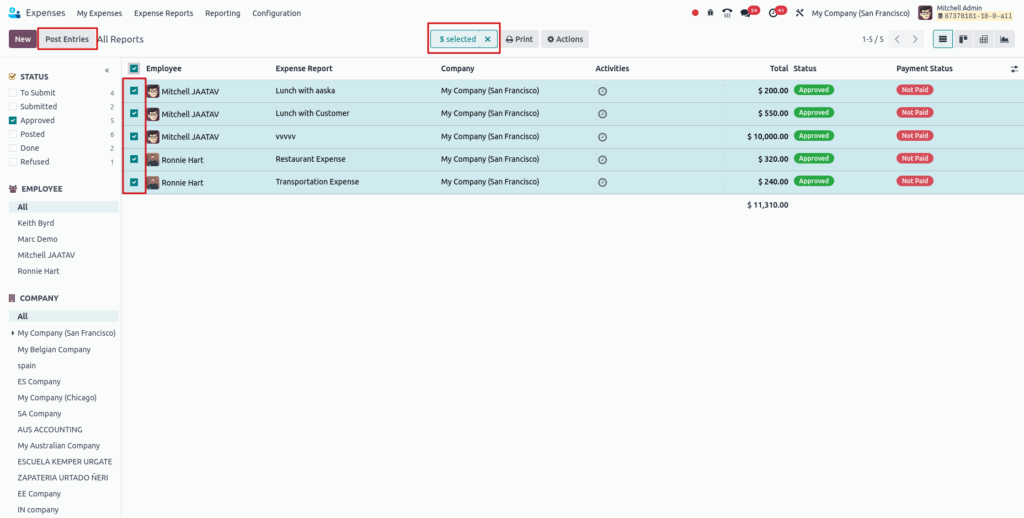

Post Expenses

Overview

Posting expenses means finalizing them in the accounting system. Once an expense is approved, it can be posted to create corresponding journal entries. These entries record the expense in the general ledger, aligning with configured accounts and tax rules. Posting is essential for accurate financial reporting and ensures expenses are included in the company’s accounting books.

Process Flow

Business Rules

- Only users with approval rights can take action

- Expense categories must have proper accounting setup (expense accounts, taxes)

- Posted entries appear in the journal in draft or posted status depending on configuration

- Posting locks the expense for editing

Screenshots

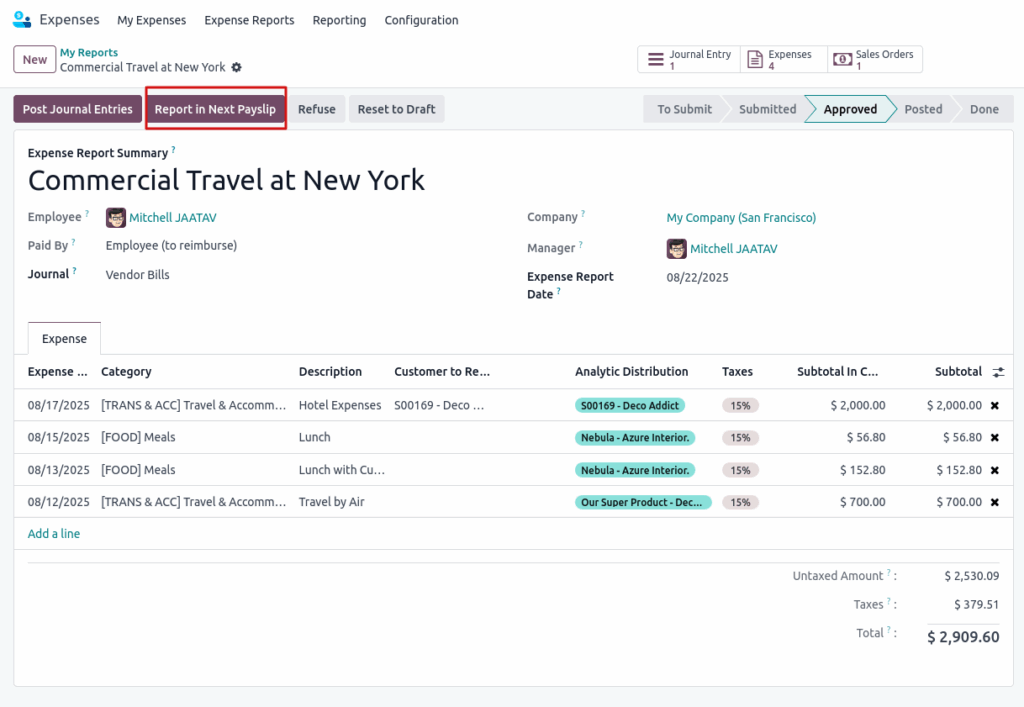

Post Entries View

Entries Posted View

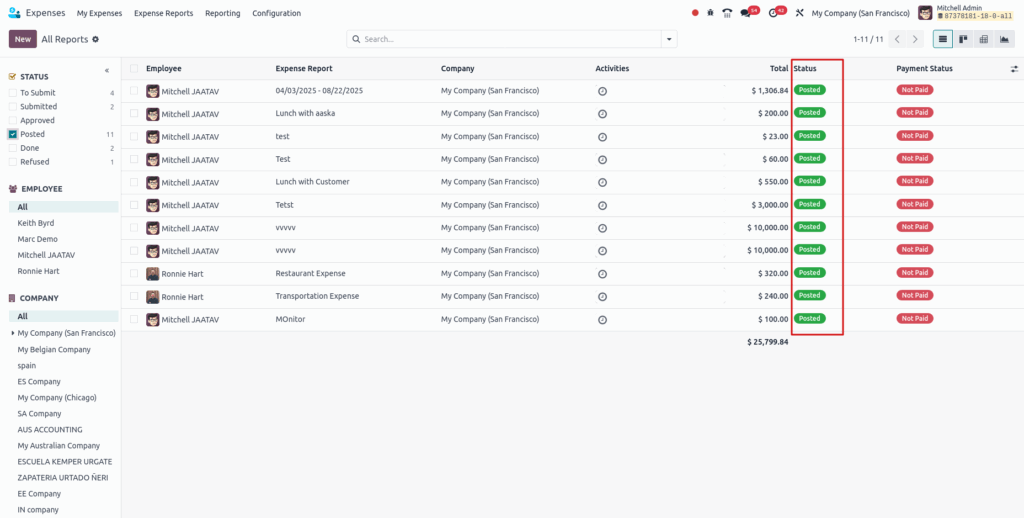

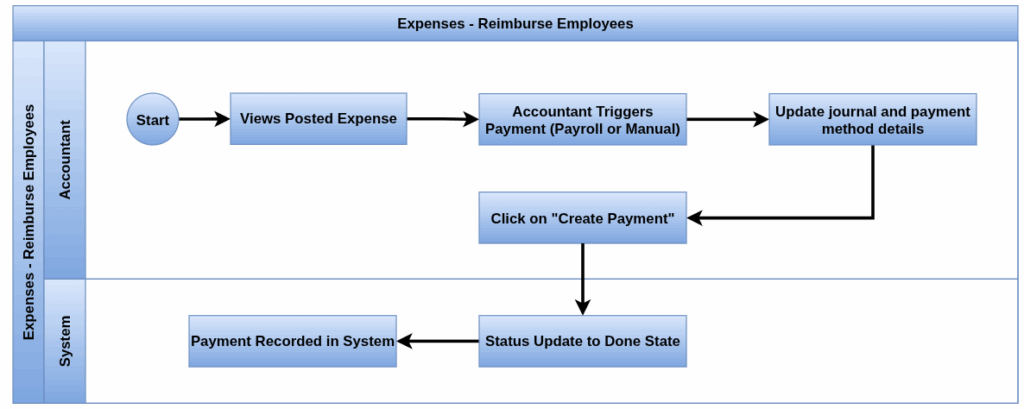

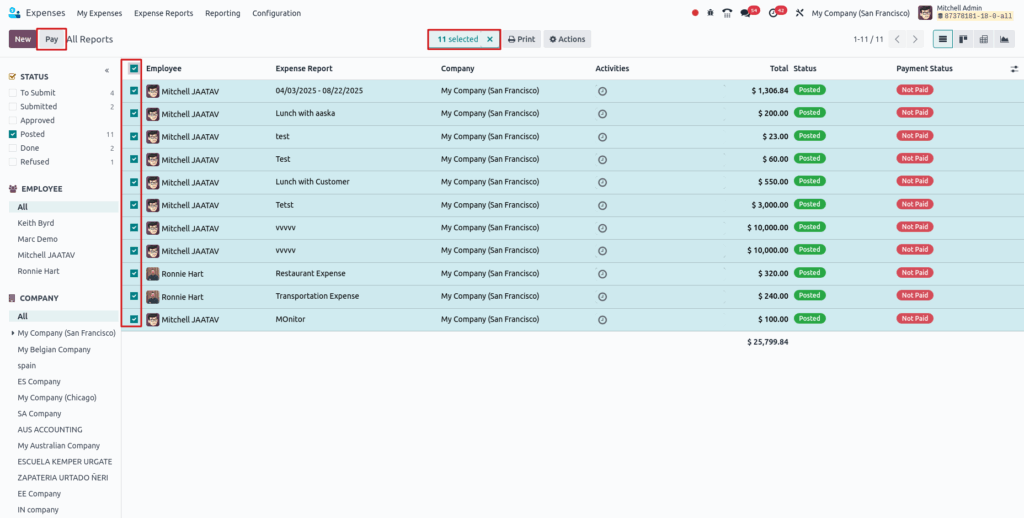

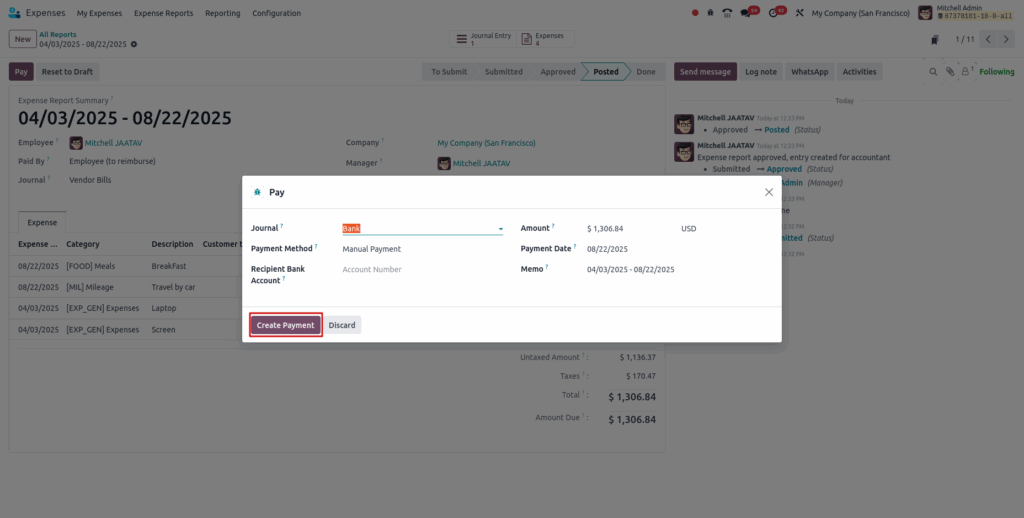

Reimburse Employees

Overview

After expenses are approved and posted, employees who paid out-of-pocket can be reimbursed. Odoo supports different methods: reimbursements via payroll integration or manual payments through the accounting system. Reimbursing ensures that employees are compensated in a timely manner and that financial data reflects accurate liabilities. For expenses paid by the company directly, no reimbursement is required, but the cost is still recorded.

Process Flow

Business Rules

- Only expenses marked as “Paid by Employee” are reimbursable

- Reimbursement is triggered after posting and approval

- Payroll integration allows reimbursement through payslips

- Payments must be matched with posted accounting entries for reconciliation

Screenshots

Reimburse in bulk View

Reimburse in Individual View

Reimburse in payment details View

Reimburse in Payslip option View

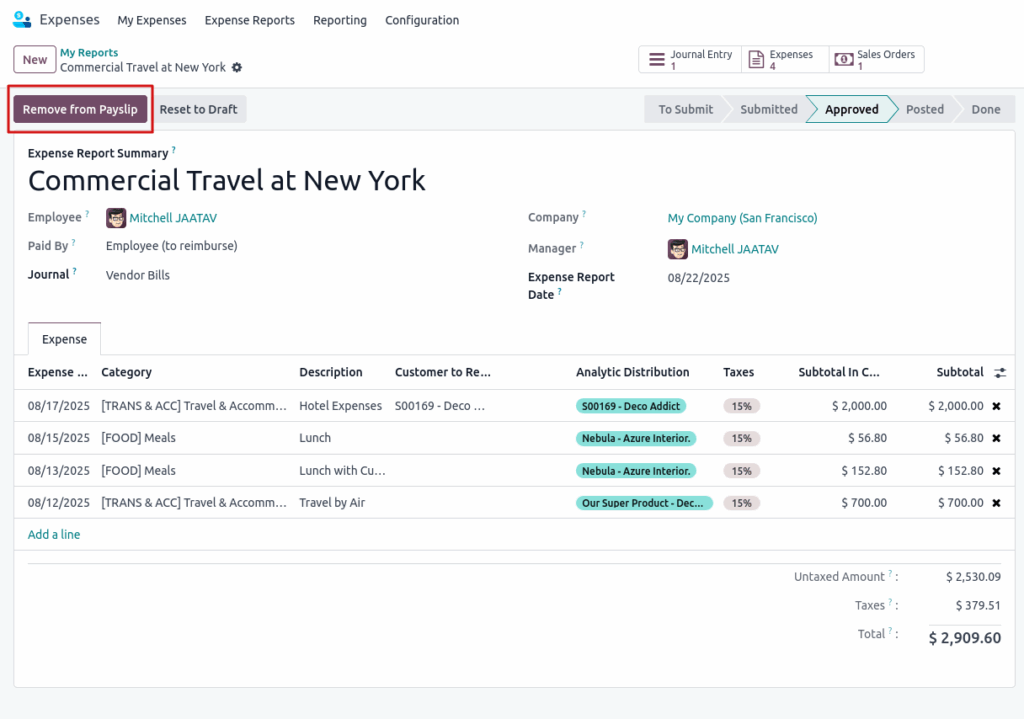

Remove Reimburse in Payslip option View

Expenses Report Management

- Expenses Analysis

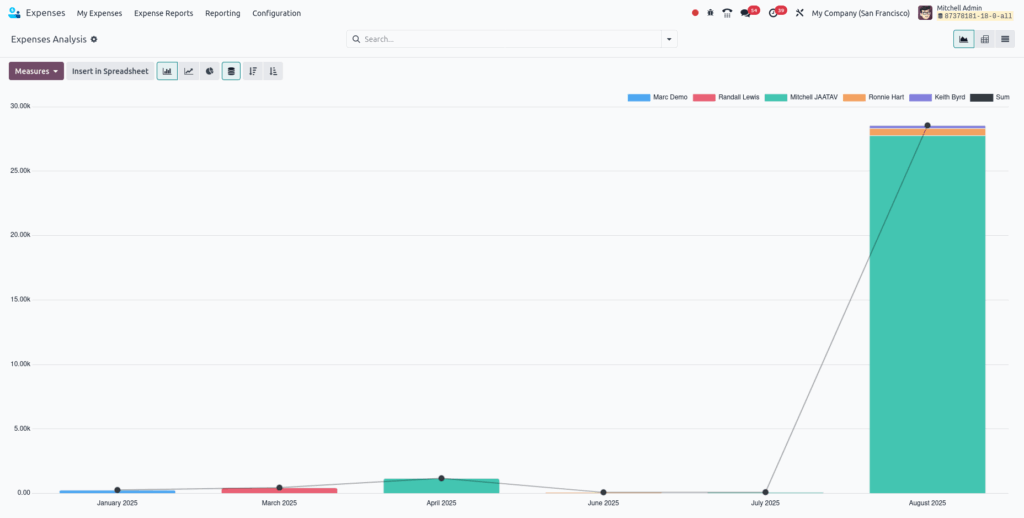

Expenses Analysis

Overview

Expenses Analysis in Odoo provides real-time insights into employee and departmental spending. It helps businesses monitor, control, and optimize expense-related costs through dynamic reports and dashboards.

Features available in Expenses Analysis

- Customizable Reports: Filter by employee, department, date, category, or status

- Graph & Pivot Views: Analyze expenses visually using bar, line, or pie charts

- Export to Excel/PDF: Generate and share professional reports easily

- Real-Time Data: View updated expense data as entries are submitted and approved

- Analytic Accounting Integration: Track expenses by project, cost center, or department

- KPI Monitoring: Identify top spenders, high-cost categories, or delayed approvals

Screenshots

Graph View