How to Create a Taxes in Odoo

The seller collects sales tax from the buyer and pays it to the government. Purchase tax (input tax) is the tax a business pays on goods or services it buys.

To access a tax, go to Invoicing -> Configuration -> Tax , and click New to create a new tax.

Create a new tax

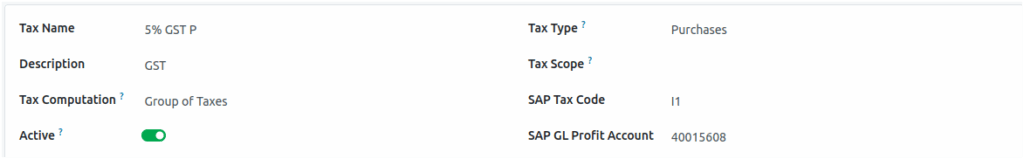

When creating a tax, the Tax Name field is mandatory and must be filled in. You can also provide additional details in the Description field to explain the purpose or specifics of the tax.

Tax Computation : In the dropdown, select:

- Group of taxes : Refers to the Normal Tax.

- Percentage of the price: Calculated as a CESS and IGST Tax.

The Active checkbox is used to activate the tax. Tax Type allows you to select whether the tax applies to purchases or sales. Tax Scope defines the type of product the tax is used for. The SAP Tax Code links each tax to a specific tax rate and type.

while the SAP GL Profit Account specifies the account related to that tax, such as an asset, liability, equity, income, or expense account.

Adding the Children tax

In the Description field, click Add a Line.

when setting up taxes, you can click “Add a line” to display a list of child taxes. If the Tax Computation Type is set to Group of Taxes, you need to select both SGST and CGST. For taxes with the Percentage of Price computation type, you only need to add IGST.

Viewing the Existing Taxes

To view the existing taxes, go to Invoicing → Configuration → Taxes. The Taxes list is grouped by default, and the Tax Name column displays the name of each tax. The Description column shows the tax description, and the Tax Type indicates whether the tax is for Sales or Purchases.

On invoices, the Label on Invoices field displays the tax percentage along with the description. The company name is also shown. A checkbox indicates whether the tax is active or inactive, and the color highlights its status.