How to Calculate Product Pricing Fields in a Purchase Order in Odoo

Purchase Order (PO) process to calculate product pricing with proper cost visibility, margin control, and profitability insights and apply target margin or markup. By applying the outlined formulas and principles, companies can achieve precise cost control and stronger profitability management.

It provides the clarity needed to support data-driven, margin-focused pricing strategies.

Creating a Purchase Order

- Open the Purchase module and click the ‘New’ button to create a new RFQ.

- Select the vendor, and then choose the product based on the selected vendor from the respective field.

Product name and MRP

For example

Product : [7979] WHISKAS ADULT OCEAN FISH FLV 50G

MRP=₹955 How to Calculate MRP (Tax Excl.)

The Maximum Retail Price (MRP) (TaxExcl). shown does not include any tax.

Formula

MRP (Tax Excl.) = MRP / (1 + Tax Percentage)For Example

• MRP = ₹955

• Tax Rate = 12% (i.e., 1.12), MRP(Tax Excl.) =955 / 1.12= 852.68MRP excluding tax is ₹852.68.

Unit Value when Discount is Not Applied

When no discount is applied, the unit value displayed will be the basic cost.

Formula

Unit Value= Basic Cost- Discount PercentageNote: If the Discount is 0, the total discount amount will show be 0.

How to Calculate Tax Exclusive Value

Formula

Tax Excl.=Unit Value * QuantityFor Example

• Unit Value= 609.3360

• Quantity =10

• Tax Excl.= 609.3360 *10 = 6093.36Tax excluding is ₹ 6093.36

How to Calculate Net Cost

Formula

Net Cost = Unit Value+Tax PercentageFor Example

• Unit Value = ₹609.3360

• Tax =12 %

• Net Cost =609.3360+12%=682.45632Net Cost is ₹ 682.45632

How to Calculate Tax Inclusive Value

Formula

Tax Incl. = (Unit Value + Tax Percentage) × QuantityFor Example

Unit Value = 609.3360

Tax Rate = 12%

Quantity = 10

Tax Incl.= (609.3360+12%)*10=6824.5632Tax Inclusive is ₹ 6824.56

How to Calculate Total Basic Cost

The Total Basic cost calculated based on basic of the unit price of the product multiplied by the purchase quantity.

Formula

Total Basic Cost = SUM(Basic Cost * Quantity)For Example

• Line 1: Basic Cost = 609.3360, Quantity = 10

• Line 2: Basic Cost = 533.89, Quantity = 15

• Total Basic Cost=(609.3360×10) + (533.89×15) = 14101.71Total Basic Cost is ₹14101.71

How to Calculate Total Discount

Formula

Total Discount = SUM(Total Discount)For Example

• Line 1: Total Discount = 0

• Line 2: Total Discount =0

• TotalBasic Cost = 0 + 0 = 0Total Discount is ₹0

How to Calculate Taxable Amount

Formula

TaxableAmount=TotalBasicCost−Total DiscountFor Example

• Total Basic Cost = 14101.71

• Total Discount = 0

• TaxableAmount=14101.71 − 0 = 1410Taxable amount is ₹14101.71

How to Calculate Total

Formula

Total=TaxableAmount+TaxAmountFor Example

• Taxable Amount = 14101.71

• SGST = 846.10

• CGST = 846.10

• Total = 14101.71 + (846.10 + 846.10) = 15793.91Total is ₹15793.91

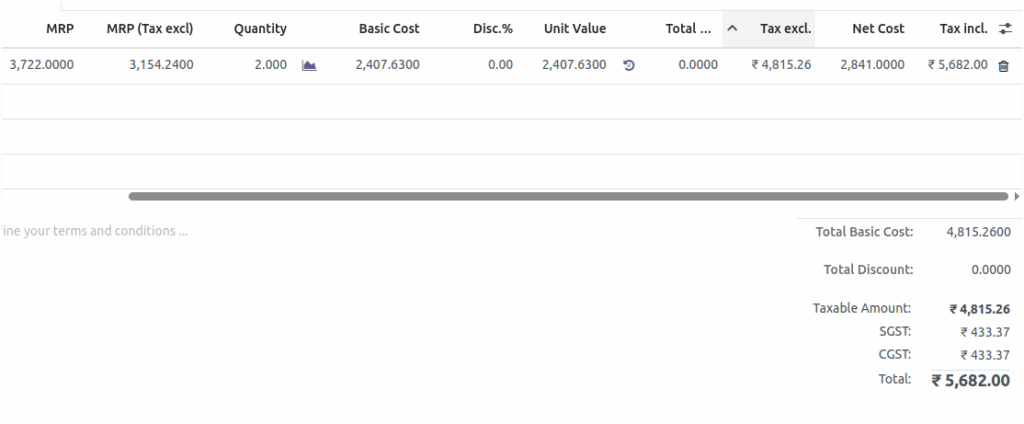

How Mark Down % and Mark Up % are Calculated in Purchase Orders in Odoo

Mark Down% Calculation

Formula

Mark Down% = ((MRP (Taxable) - Unit Value) / MRP (Taxable)) * 100For Example

• MRP (Taxable) = ₹3,154.2400

• Unit Value = ₹2407.6300

• Mark Down % = ((3154.2400-2407.6300) / 3154.2400) * 100 = 23.67Mard Down% is 23.67

Mark Up % Calculation

Formula

Mark Up% = ((MRP (Taxable) - Unit Value) / Unit Value) * 100For Example

• MRP (Taxable) = ₹3,154.2400

• Unit Value = ₹2407.6300

• Mark Up % = ((3154.24-2407.6300) / 2407.6300) * 100 =31.01Mark Up% is 31.01

Change in Margin%

Check the previous Purchase Order Mark Up % or Mark Down %.

Note: When the current Purchase Order Mark Up % or Mark Down % has increased, the change in margin % is shown as positive. Otherwise, if the Mark Up % or Mark Down % has decreased, the change in margin % is shown as negative.