How to Add Freight Charges in a GR Bill in Odoo

In Odoo, when receive goods from a vendor, sometimes it need to include extra costs like

freight charges in the Goods Receipt (GR) Bill. Adding freight charges helps make sure that the total purchase cost is correct and that all expenses are properly recorded for accounting and reports.

Create a GR Bill in Odoo

To create a GR bill in Odoo, first open the Purchase module and click the + New button on the RFQ screen. Choose the vendor, add the required products, and confirm the Purchase Order. After confirming, complete the Goods Receipt (GR).

Once the GR is finished, click Create GR Bill. All the received products will automatically appear in the Invoice Lines tab.

Add Freight Charges in a GR Bill

To add freight charges in a GR bill, go to the Invoice Lines tab and click Add a line. Choose the Freight Charges product from the list, which will automatically appear with a quantity of 1.

Make sure this product set up correctly in the system as a Service Product. In its Purchase tab VENDOR BILLS Section, enable the Is a Landed Cost option, set the Default Split Method to By Current Cost, and choose On ordered quantities as the Control Policy.

Next in GR Bill, enter the freight amount in the line and check that it is added to the total shown at the bottom of the GR bill. Once the amount is updated, review and fill in the Vendor Bill details such as the Total, Taxable Amount, and Tax Amount.

Finally, after confirming all the values are correct, click Confirm to complete and post the GR bill with the added freight charges.

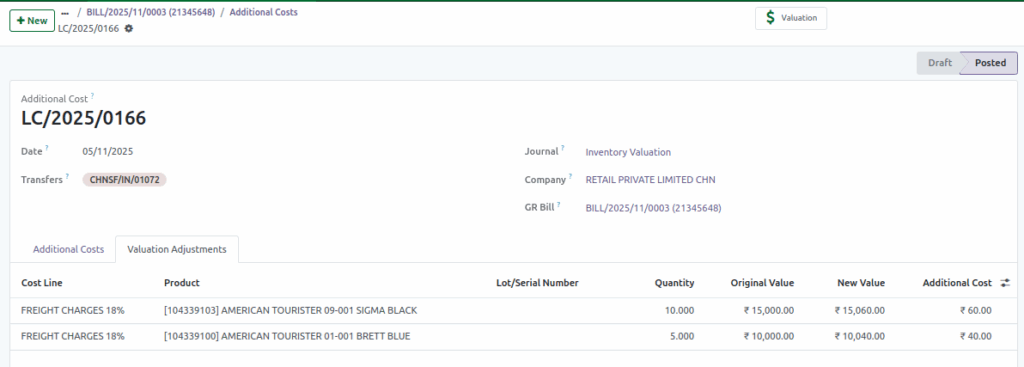

Freight Charges Split up into Products

Odoo automatically divides the freight charges among all received products based on their cost since the splitting method is By Current Cost. This ensures each product’s landed cost is updated correctly.

After confirming the GR Bill, the Additional Cost smart button appears at the top. Clicking it opens a landed cost document where the Valuation Adjustment tab shows the freight charge split for each product.

Example

Suppose I receive two products in a GR:

- Total Cost of Product A – ₹15,000 for 10 quantities

- Total Cost of Product B – ₹10,000 for 5 quantities

- Freight Charge – ₹100

Odoo splits the ₹100 freight based on cost proportion:

- Product A: (15,000 ÷ 25,000) × 100 = ₹60

- Product B: (10,000 ÷ 25,000) × 100 = ₹40

So, Product A gets ₹60 extra cost, and Product B gets ₹40 extra cost.

In GR Bill it shows for each qty Product A gets ₹6 additional cost, and Product B gets ₹8 additional cost in the Add cost field.

Freight Charges Without Tax

If the added freight charge product has 0% tax, the freight amount is added after tax, directly to the total amount.

Example: Start with the taxable amount of ₹25,000, add the total tax of ₹2,550, and then the freight charge of ₹100. This gives a final total of ₹27,650.

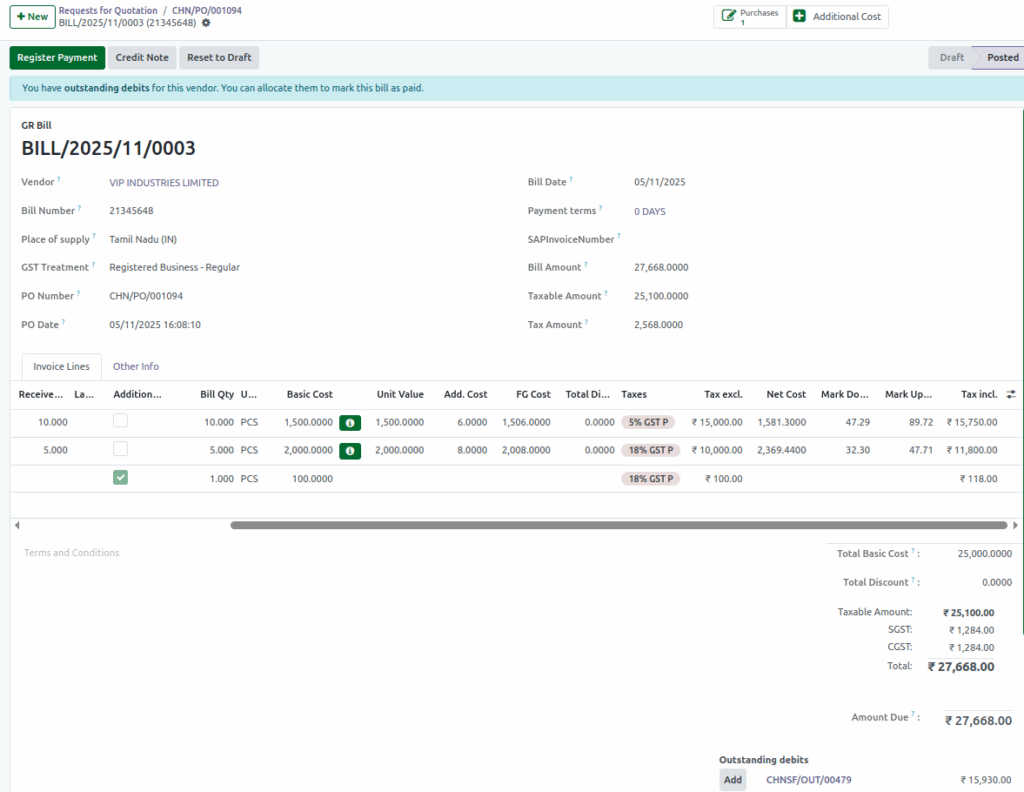

Freight Charges With Tax

If the added freight charge product has a tax percentage (like 5% or 18%), the freight amount is added to the taxable amount, and tax is calculated automatically and added to the total bill value.

Example: The original taxable amount is ₹25,000. When you add ₹100 as freight, the new taxable amount becomes ₹25,100. After applying tax for both products and freight charges, the total tax becomes ₹2,568. So, the final bill amount is ₹27,668.